Video Statement: I’m a Normal Person Dealing with 2.5 Years of Retaliation

Watch: Patrick Stoica - “Why have people been doing this for 2.5 years?”

Published December 21, 2025. Brief video statement showing restraining order, asking why this retaliation has continued for 2.5 years. Normal person dealing with documented abuse.

⚠️ Critical Warnings

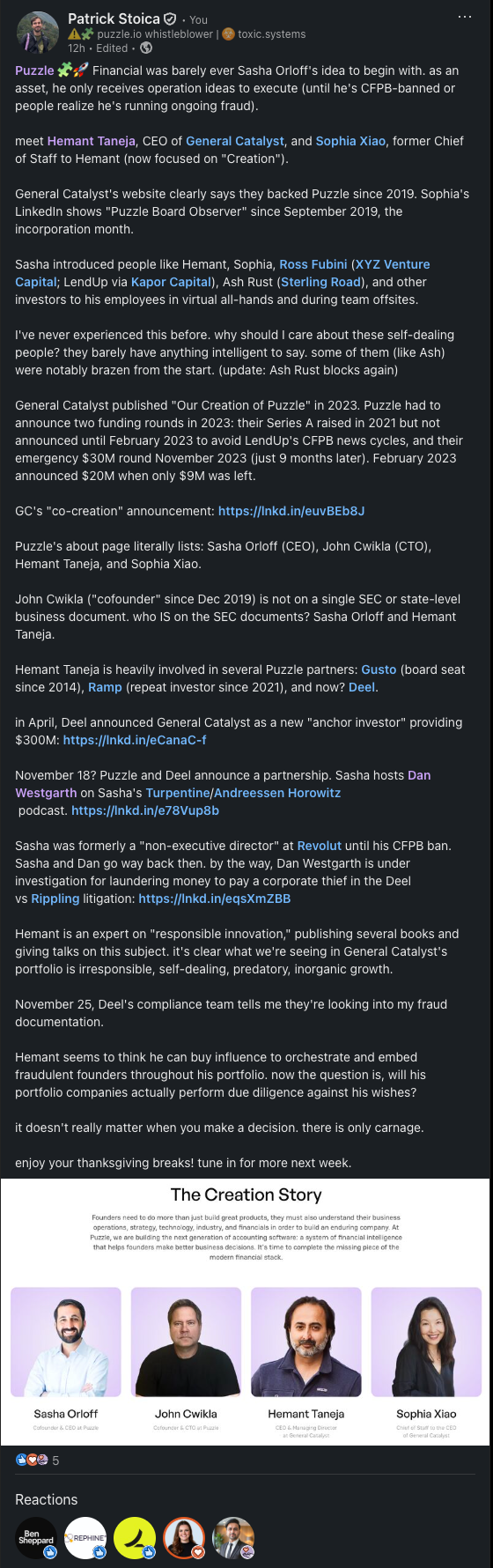

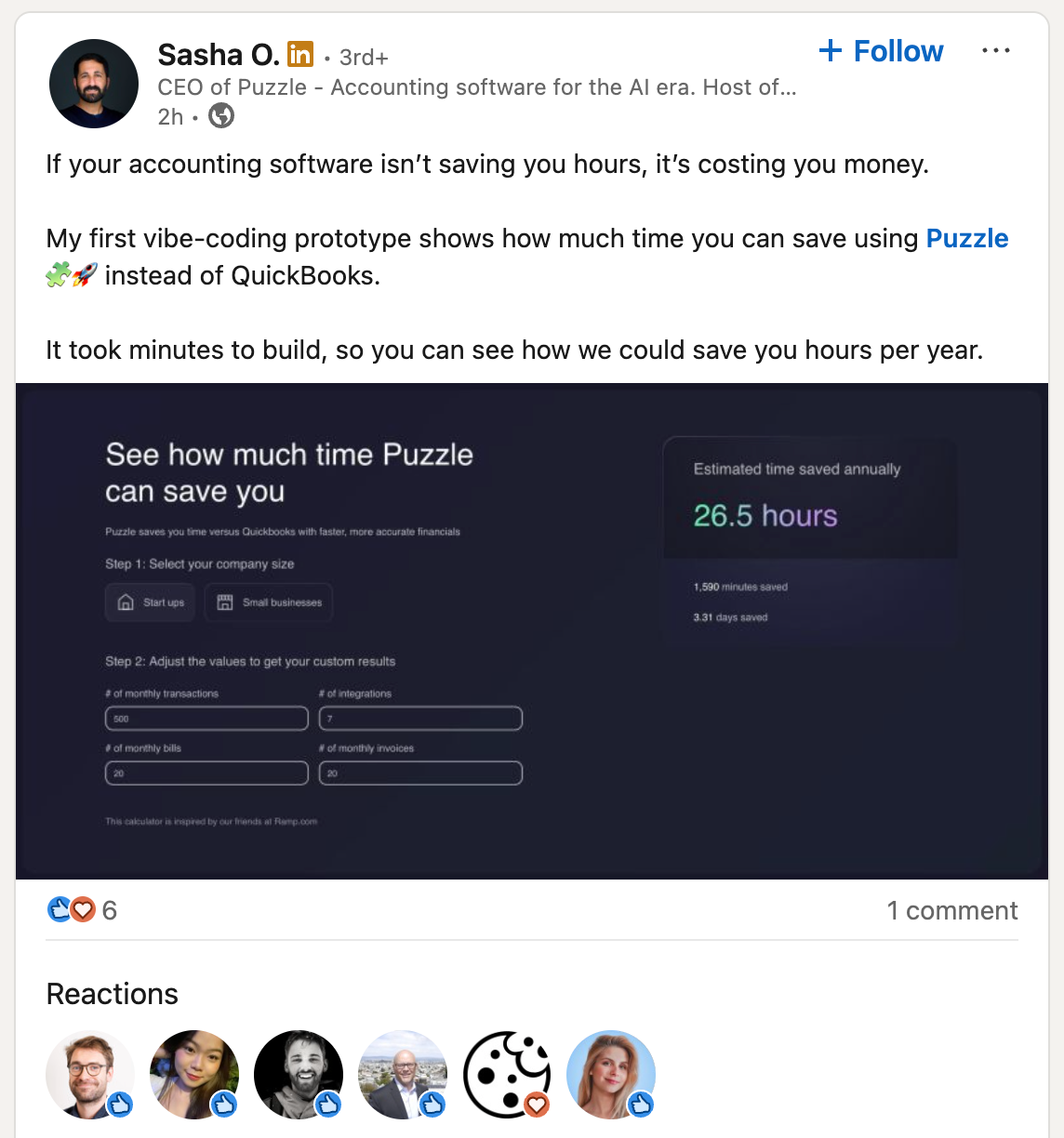

- 🚨️️ puzzle.io is an operation, not accounting software

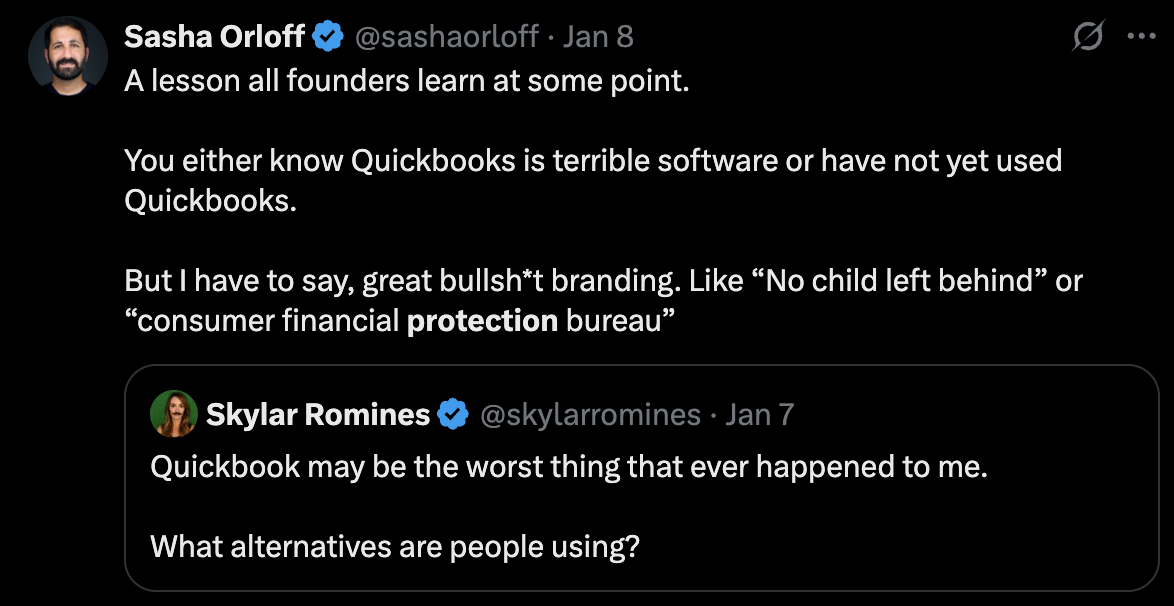

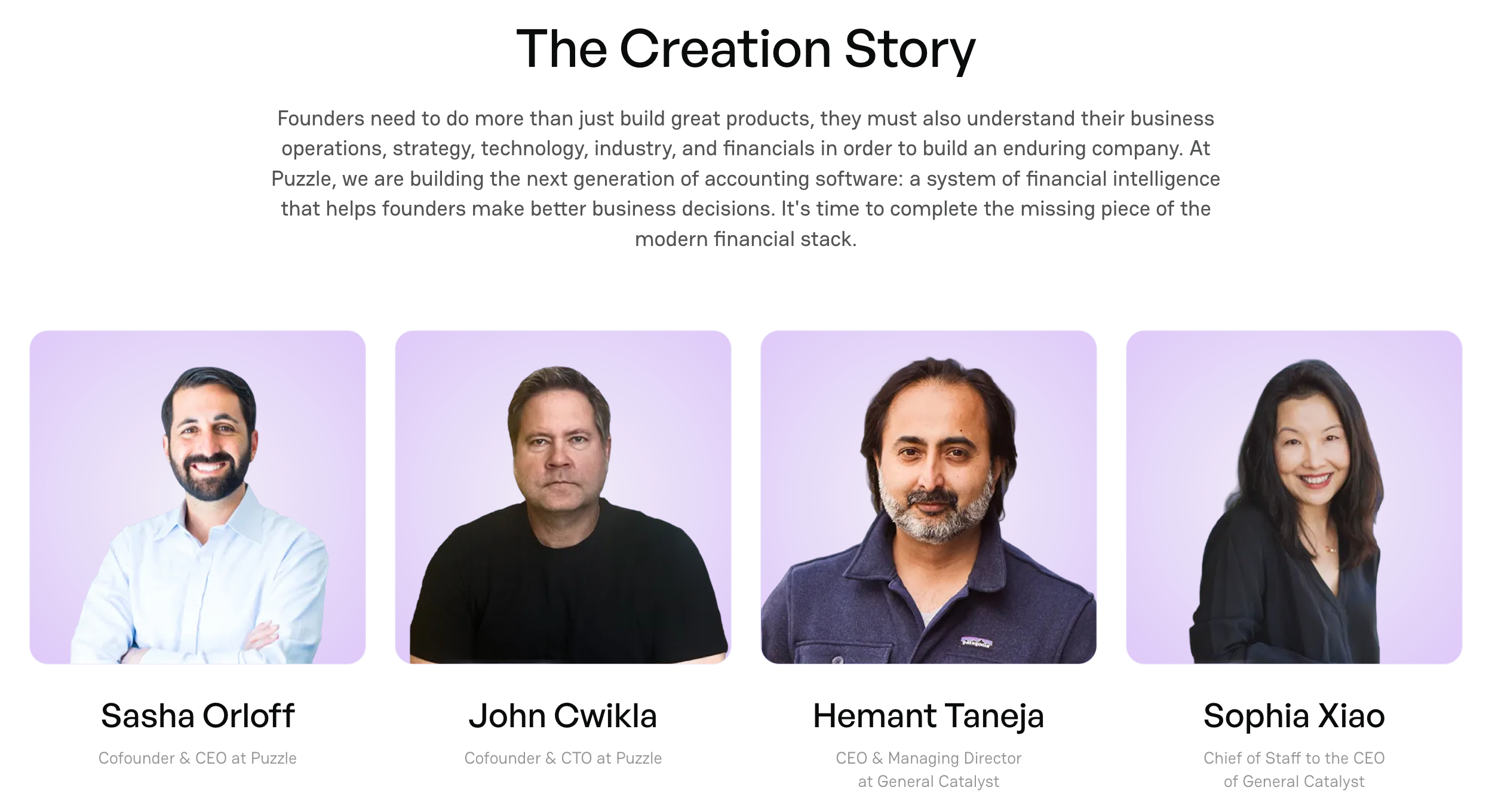

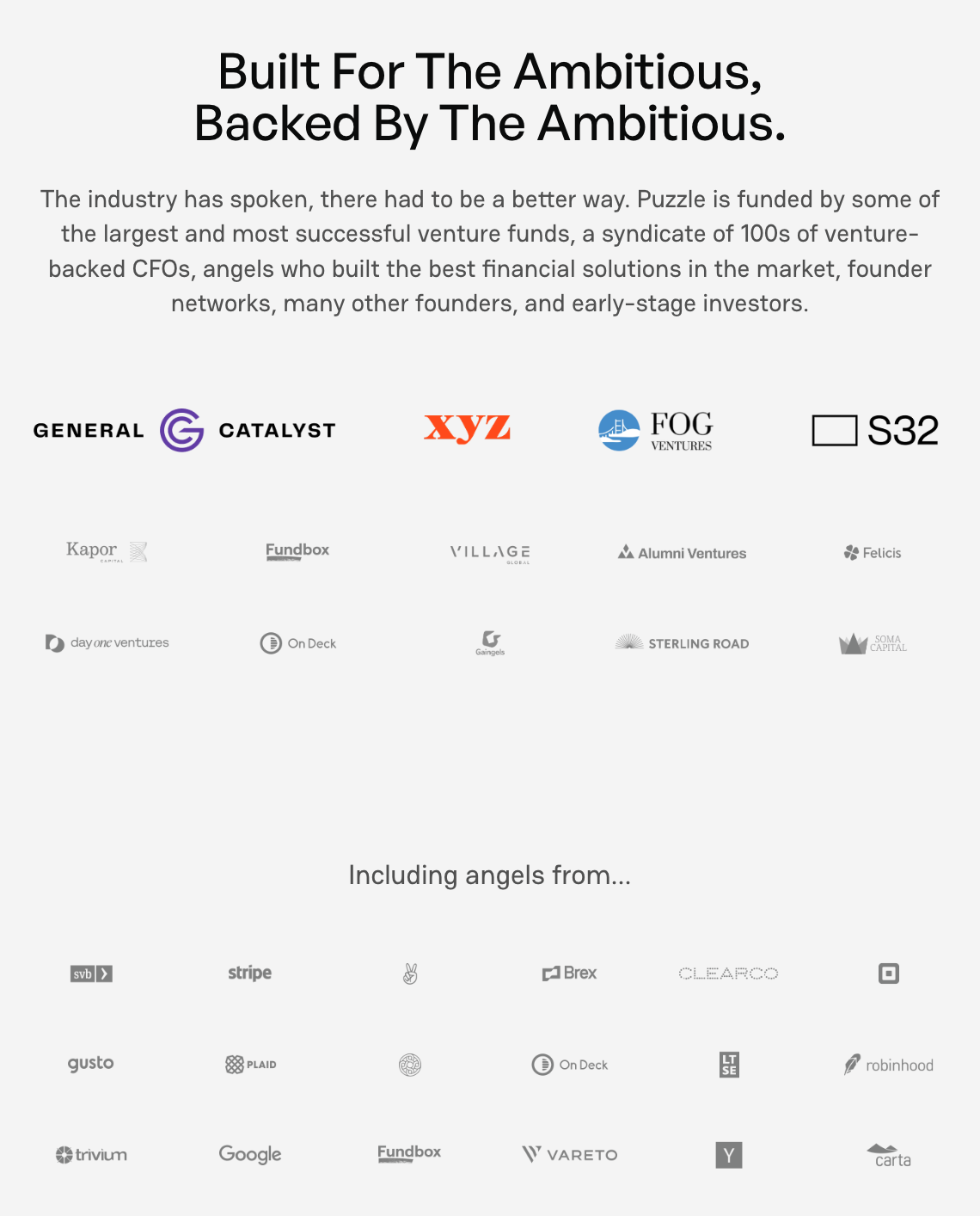

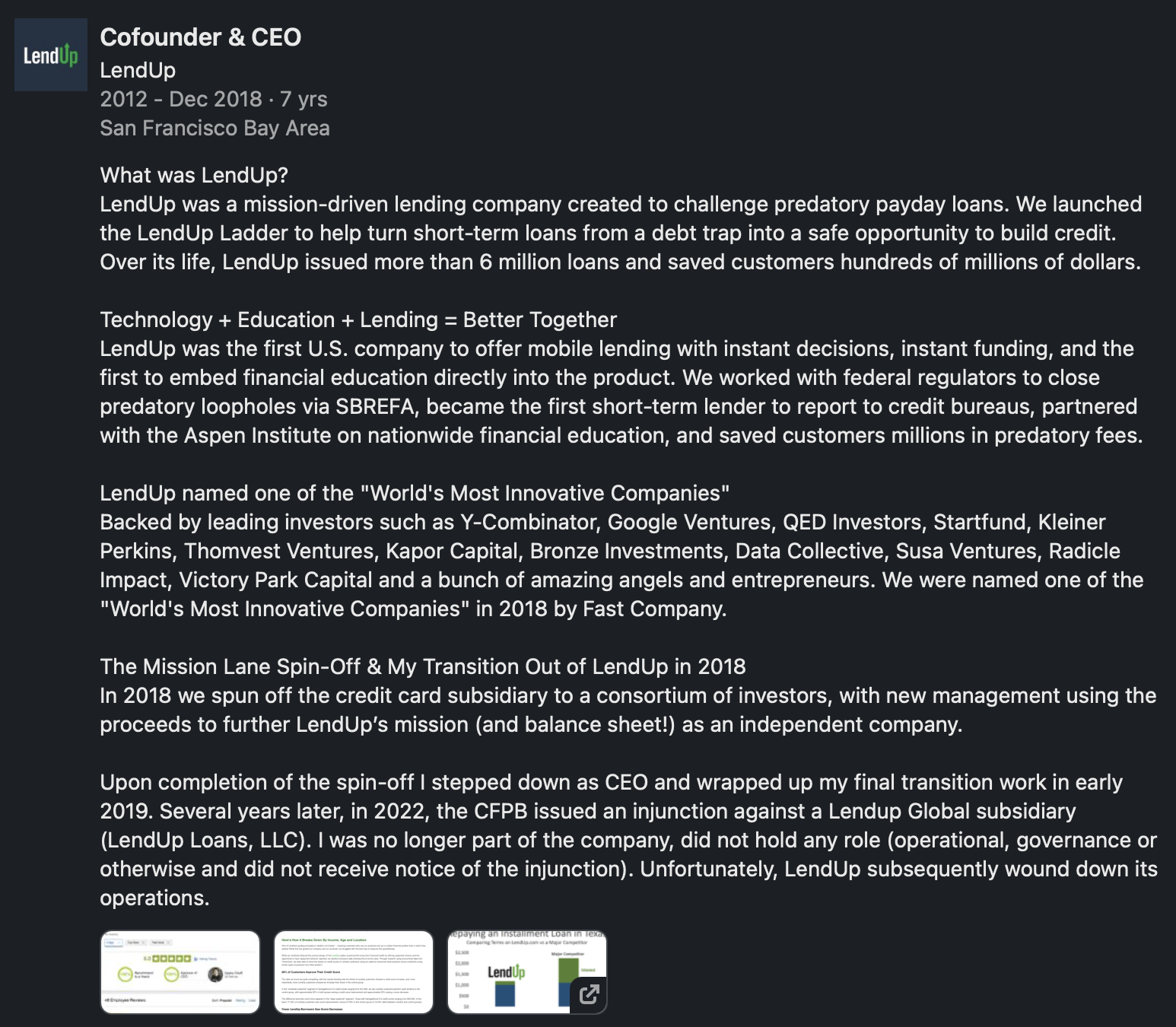

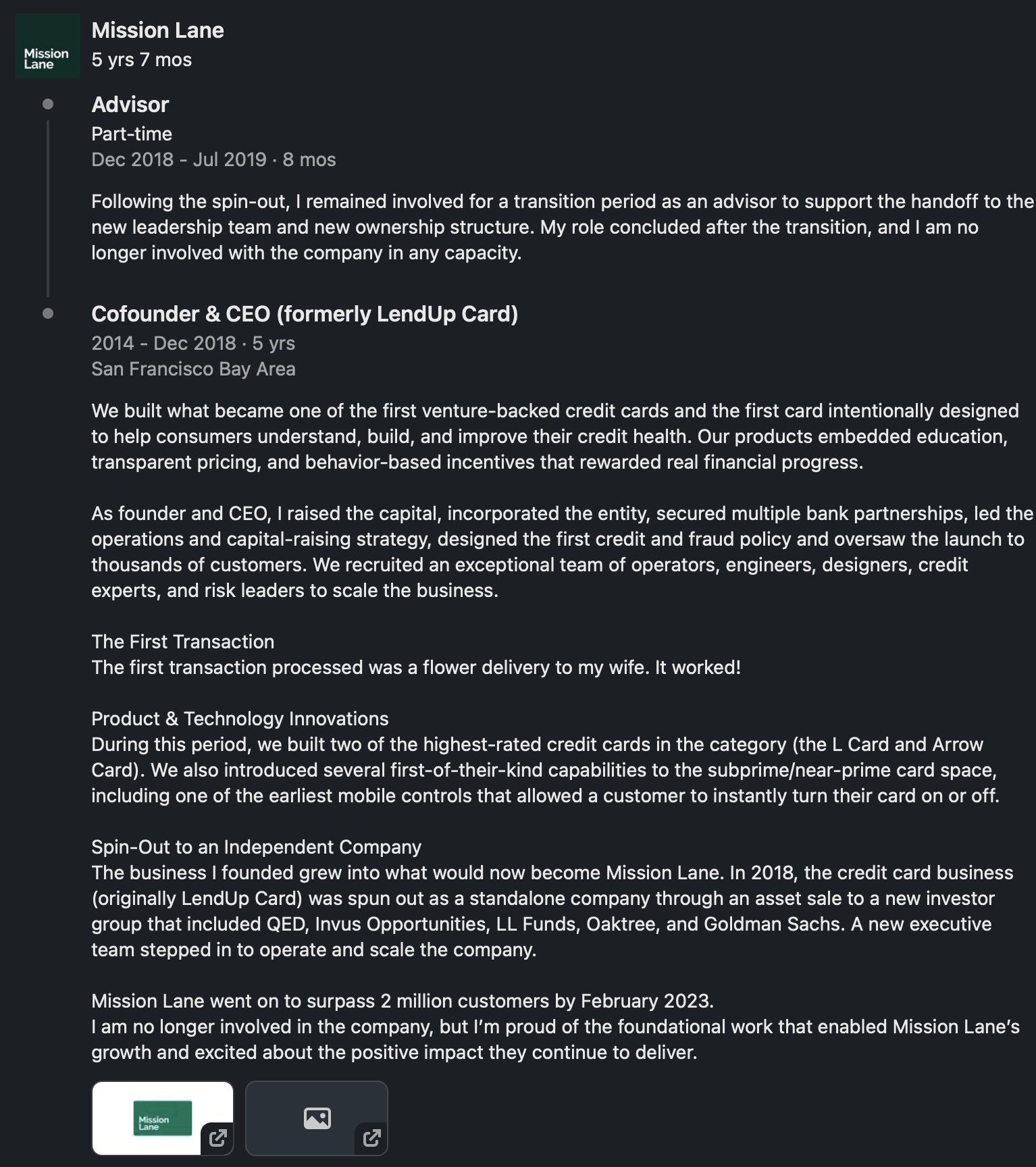

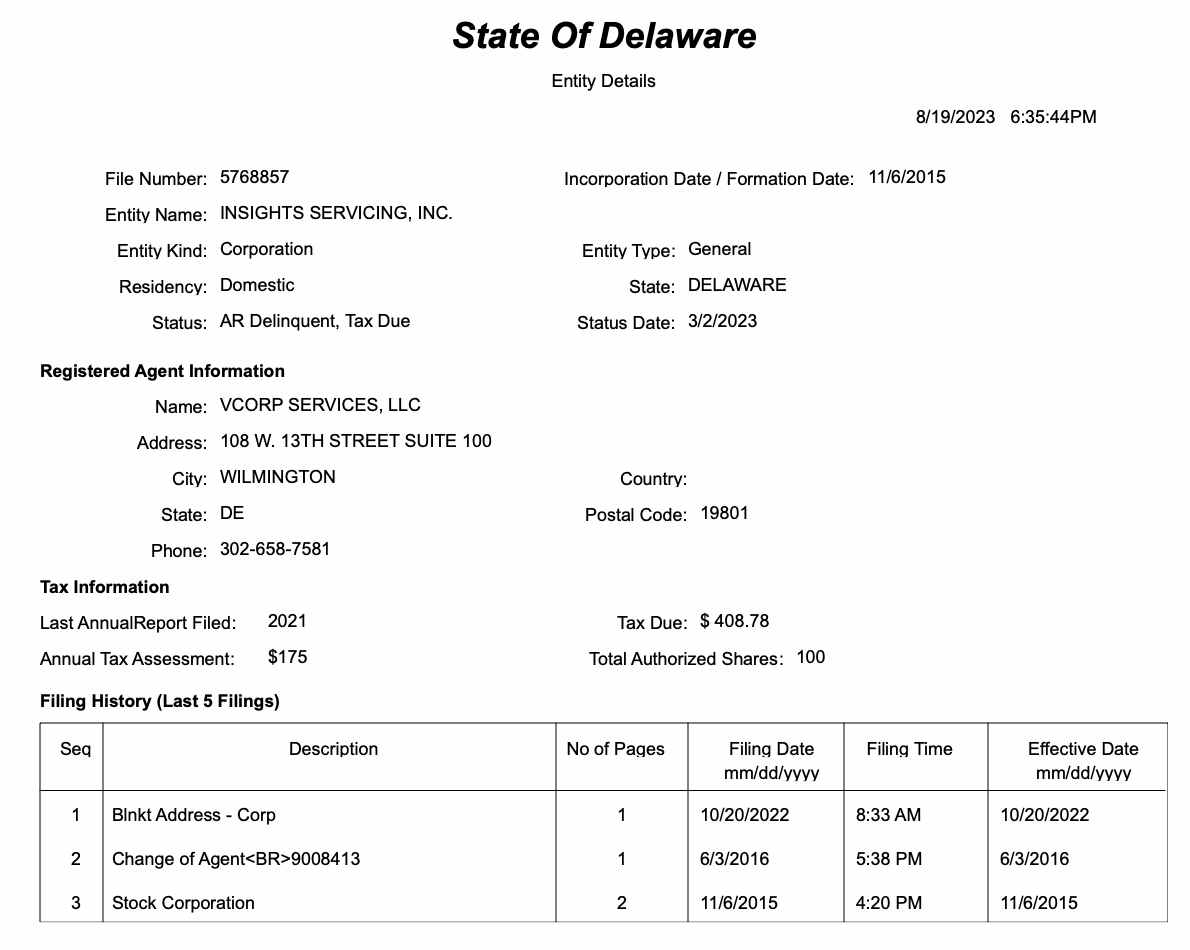

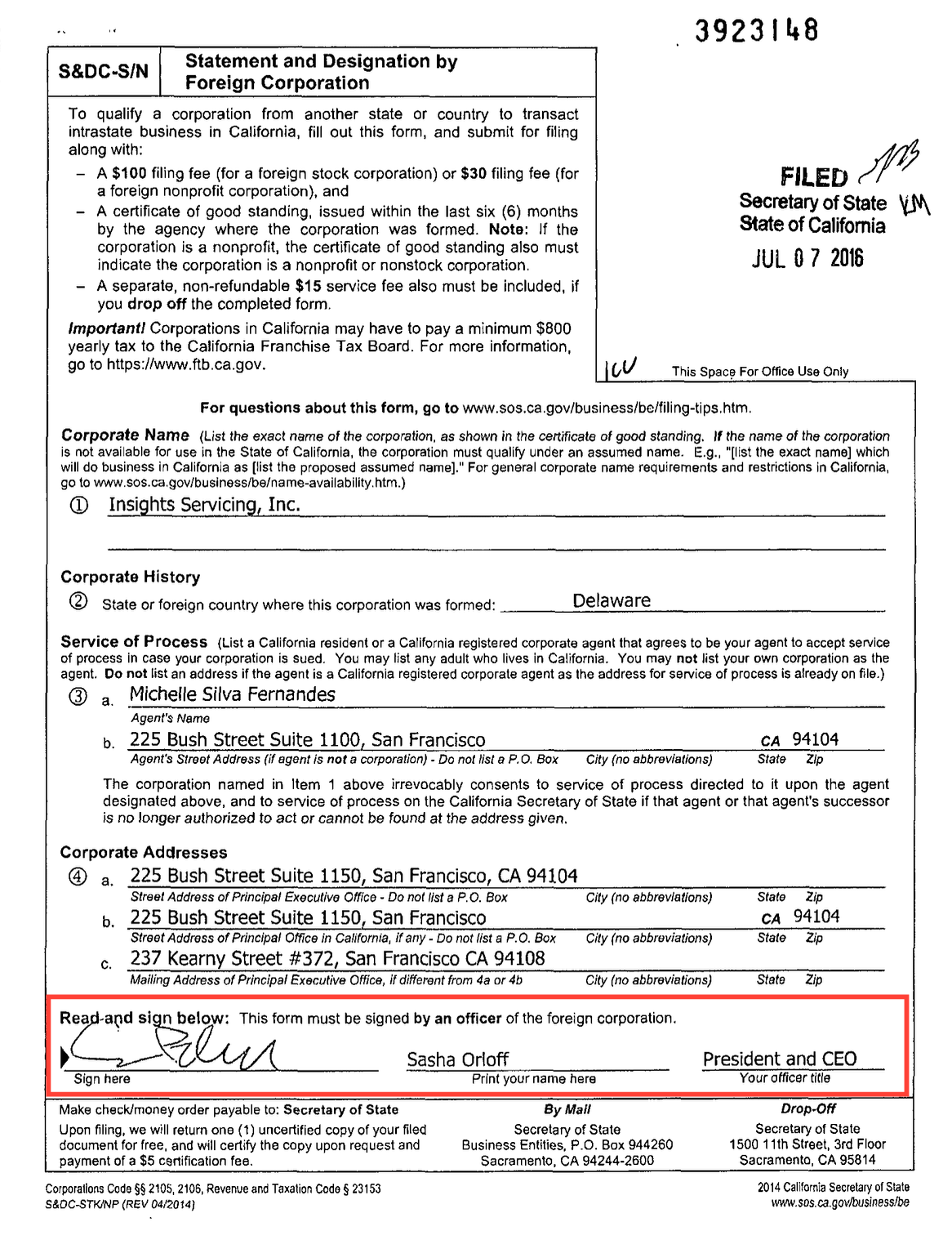

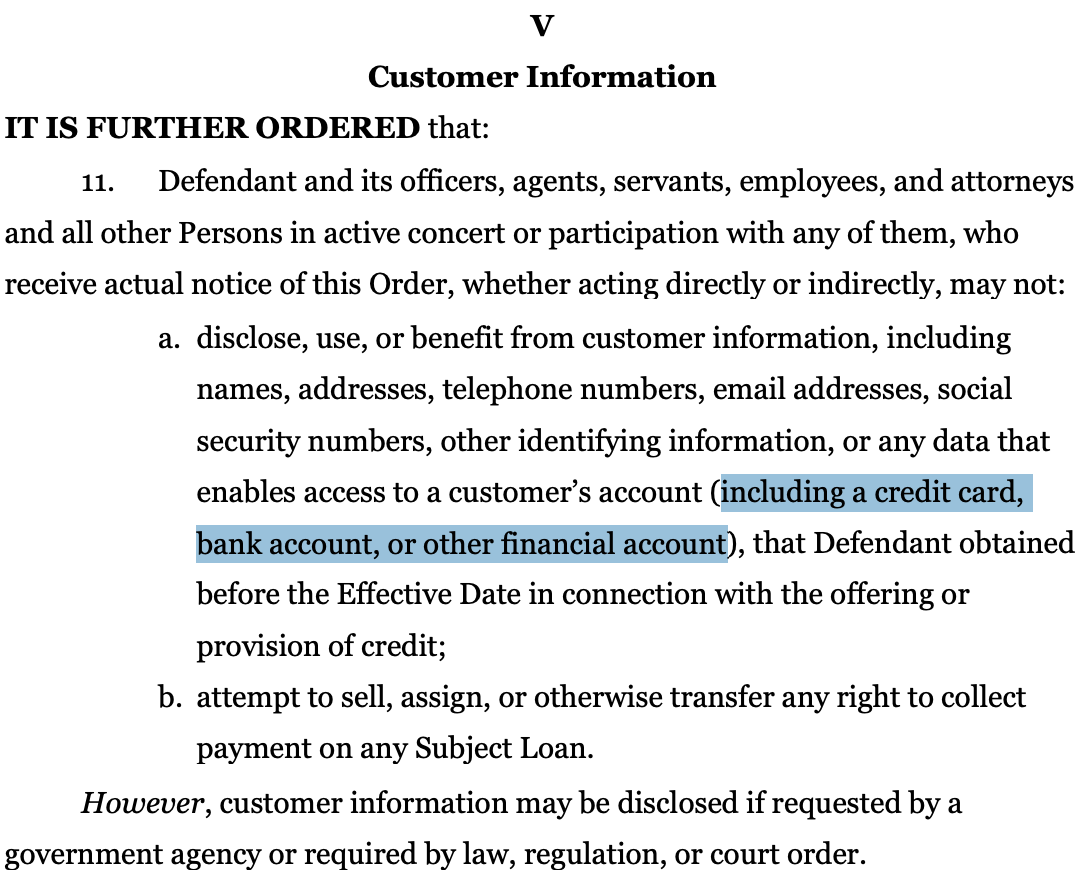

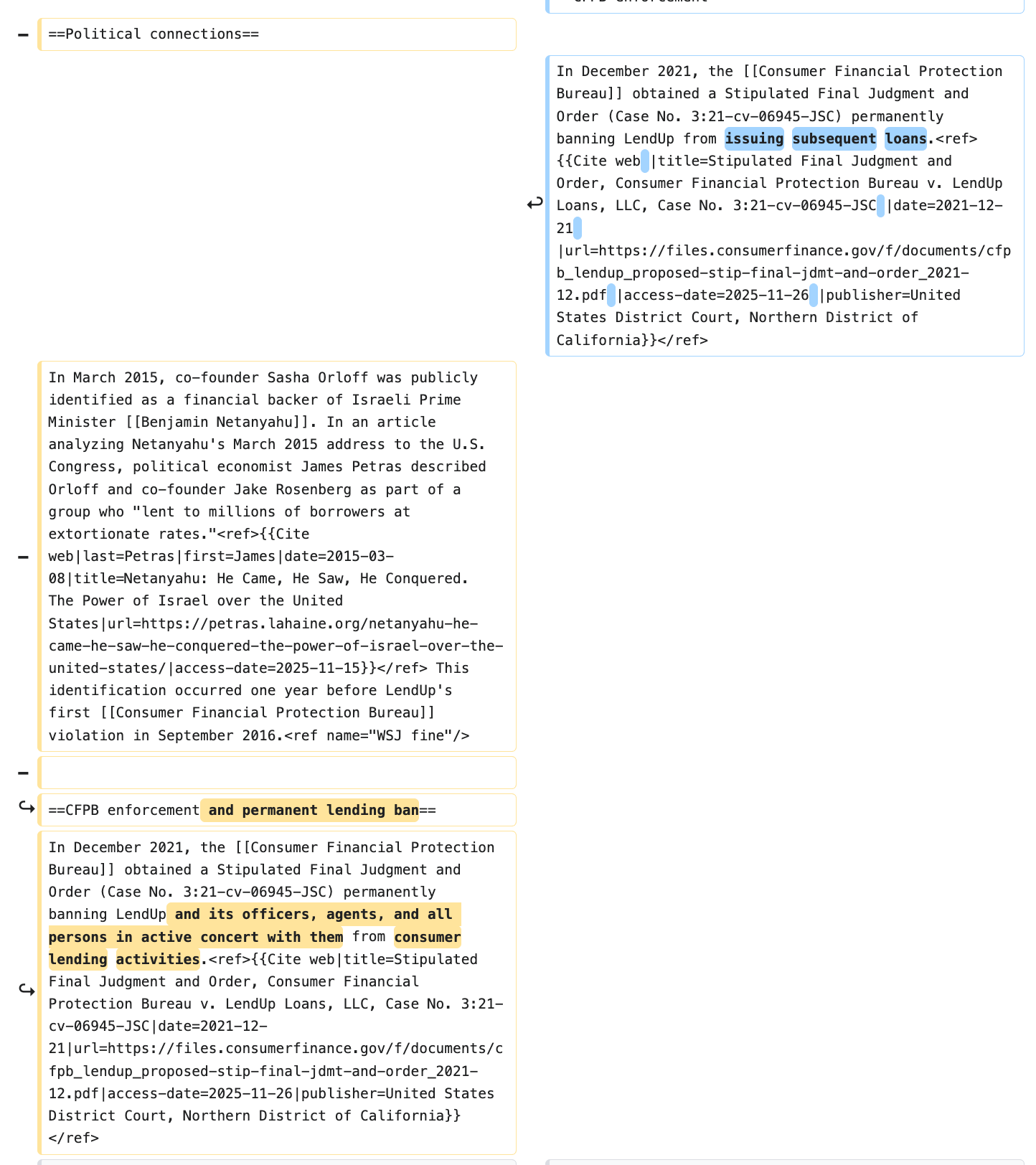

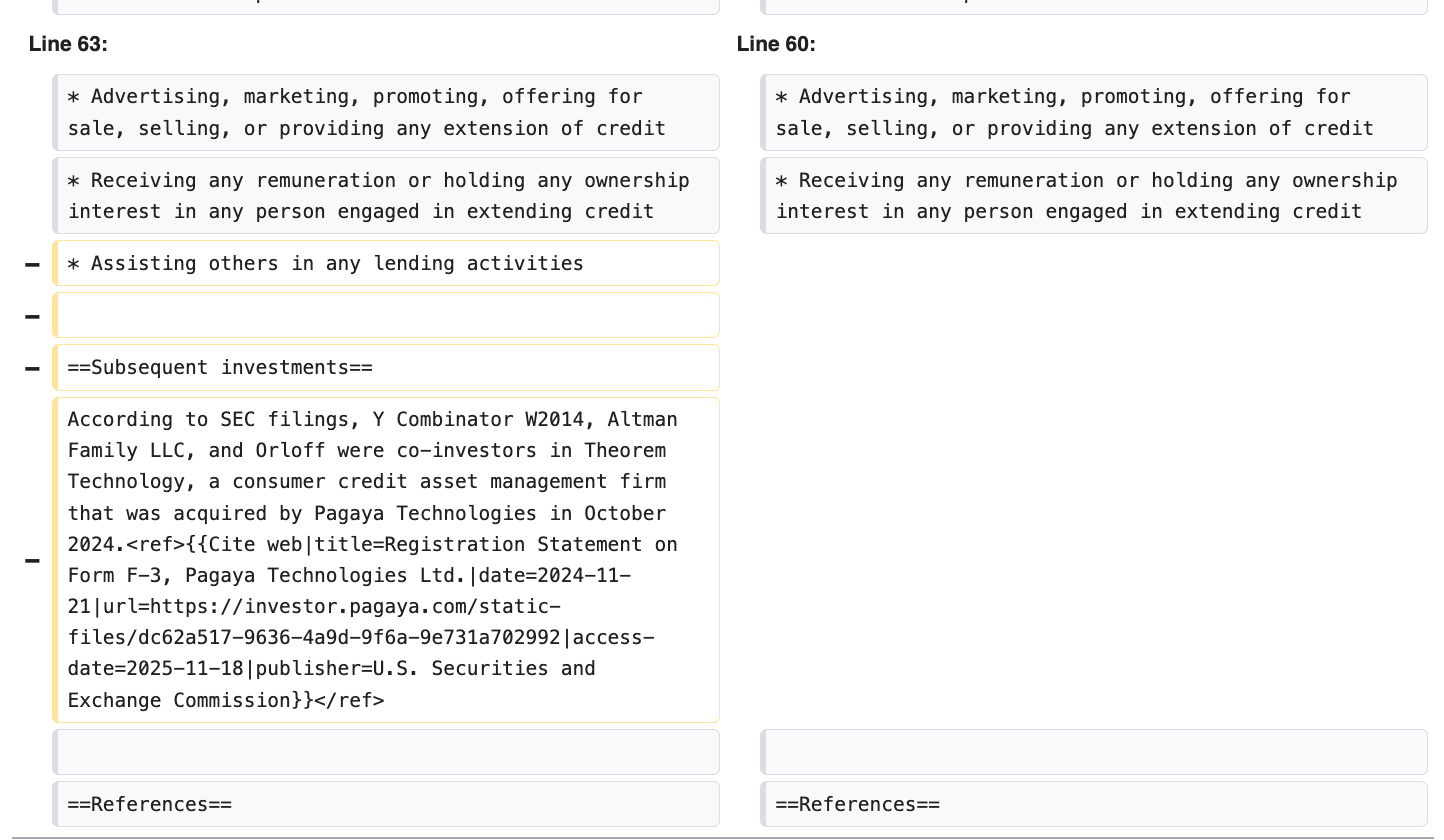

- ⚖️ CEO Sasha Orloff is CFPB-banned from consumer lending, subject to permanent data restrictions on LendUp customer information; no public disclosure of compliance with Section V decree

- 🚫 ACTIVE CFPB BAN VIOLATION: Puzzle operates public affiliate program marketing credit products (Brex, Ramp, Mercury, Gusto) in direct violation of CFPB order prohibiting “receiving remuneration” from or “performing marketing services” for credit product companies

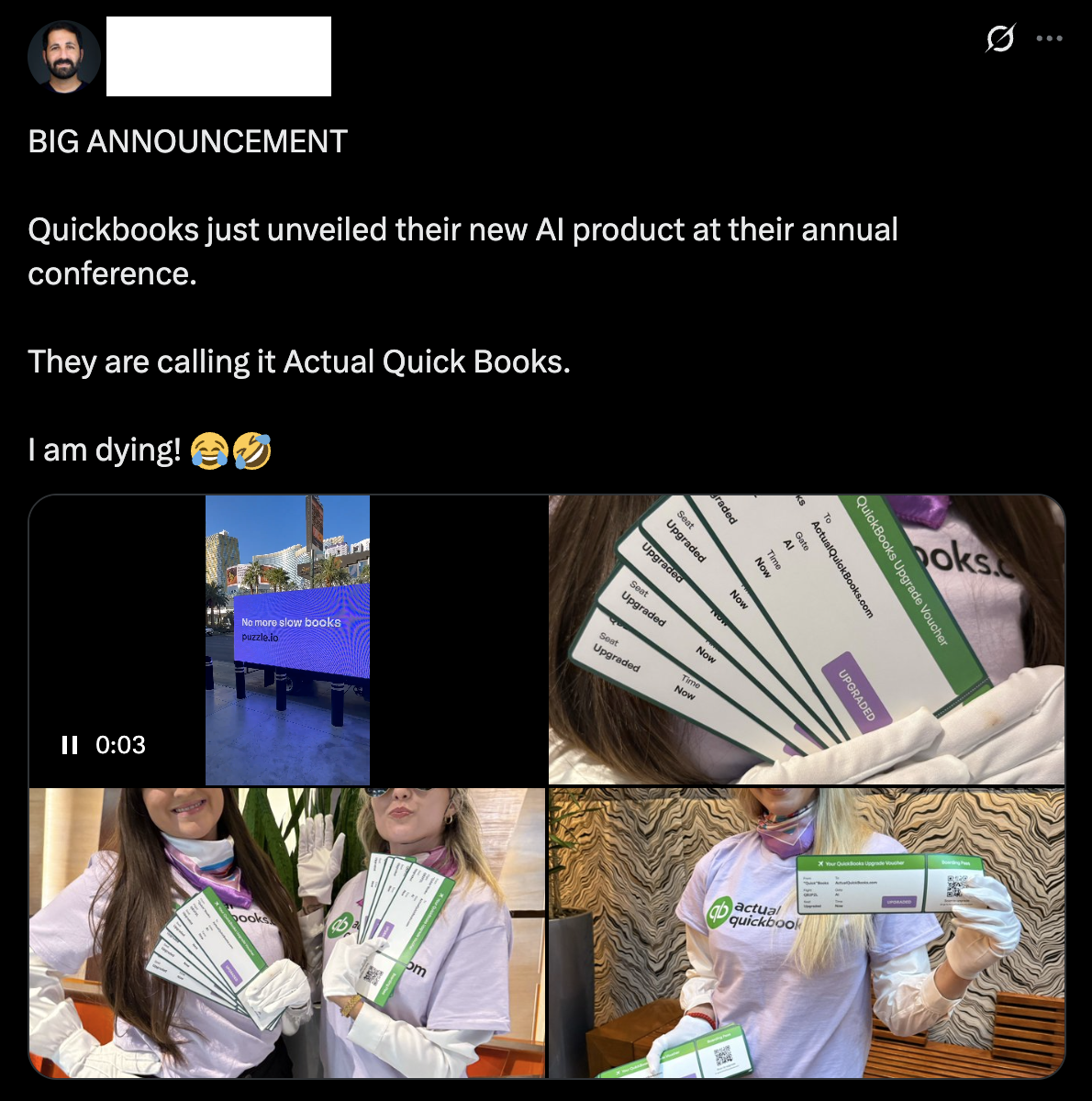

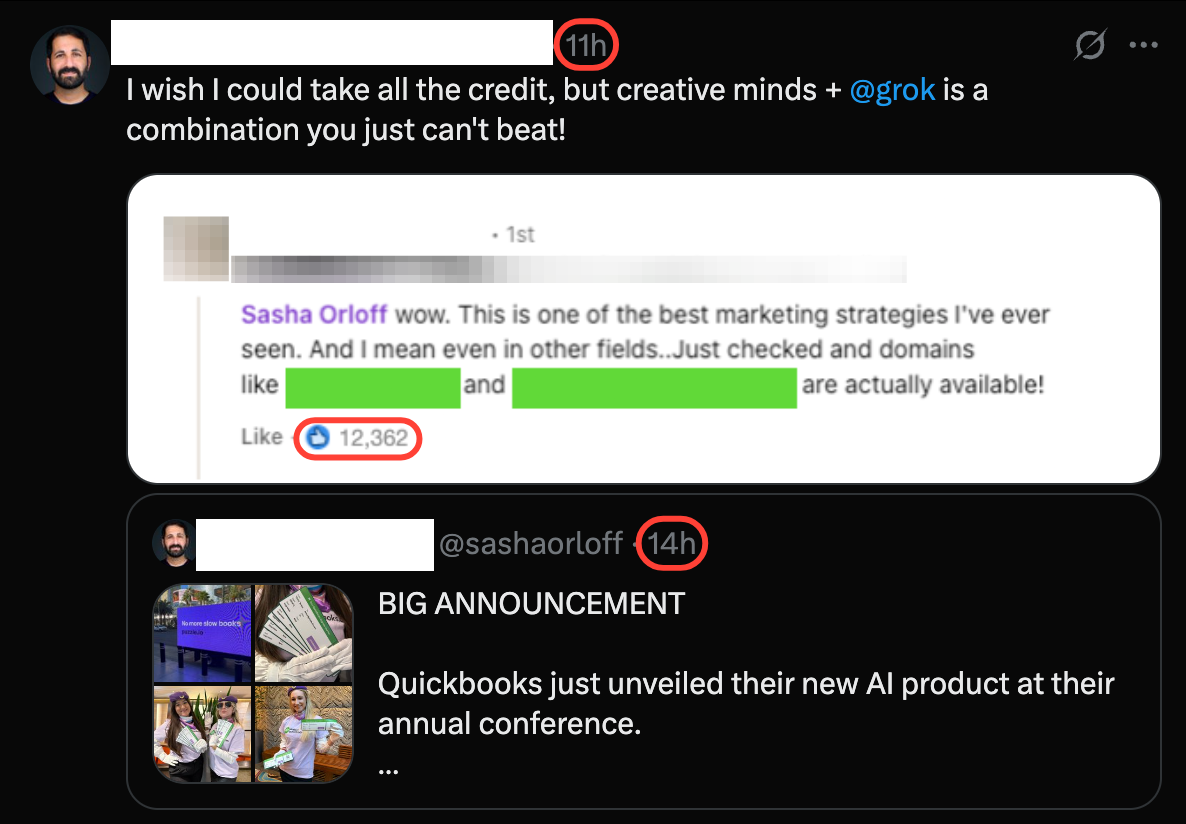

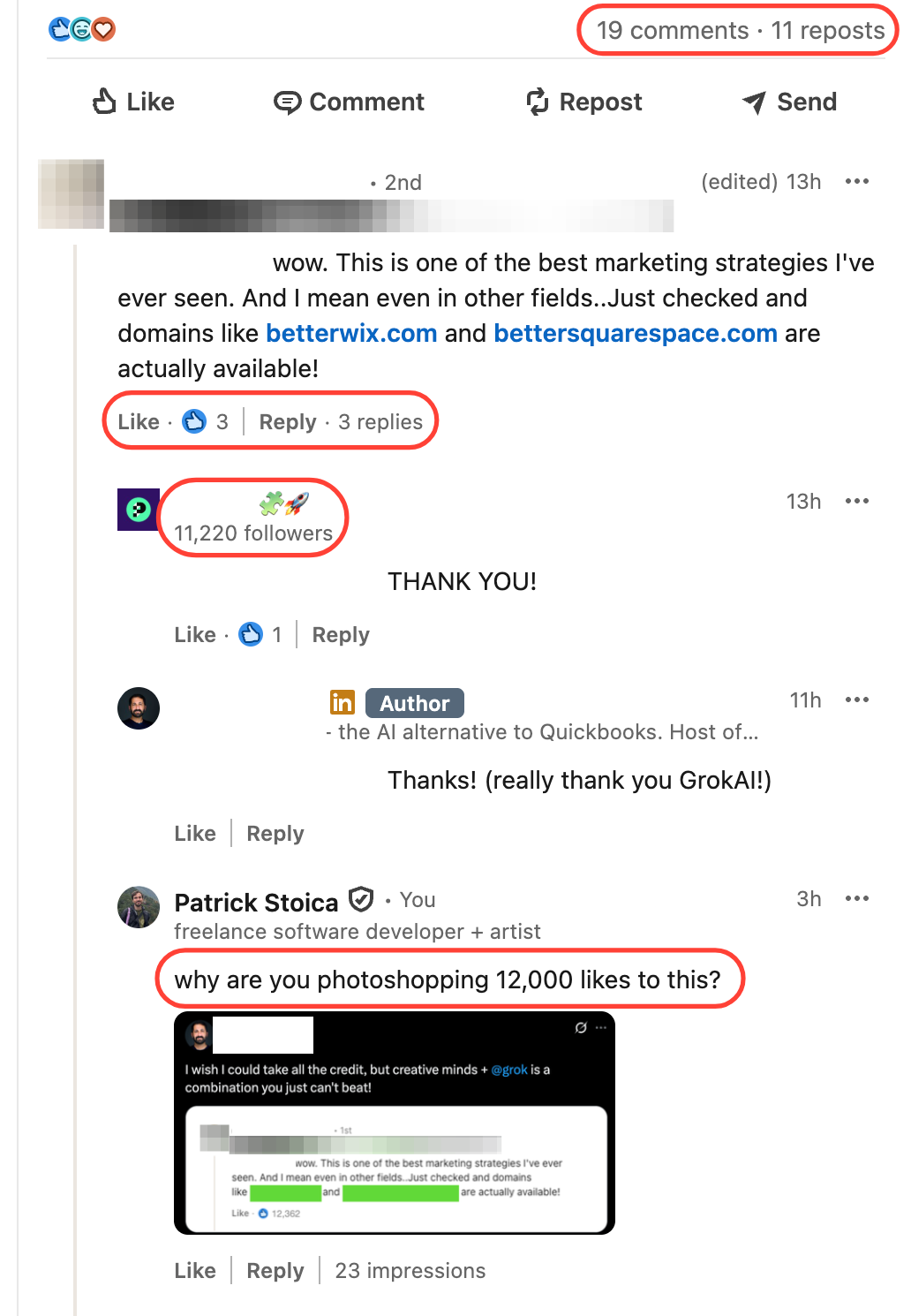

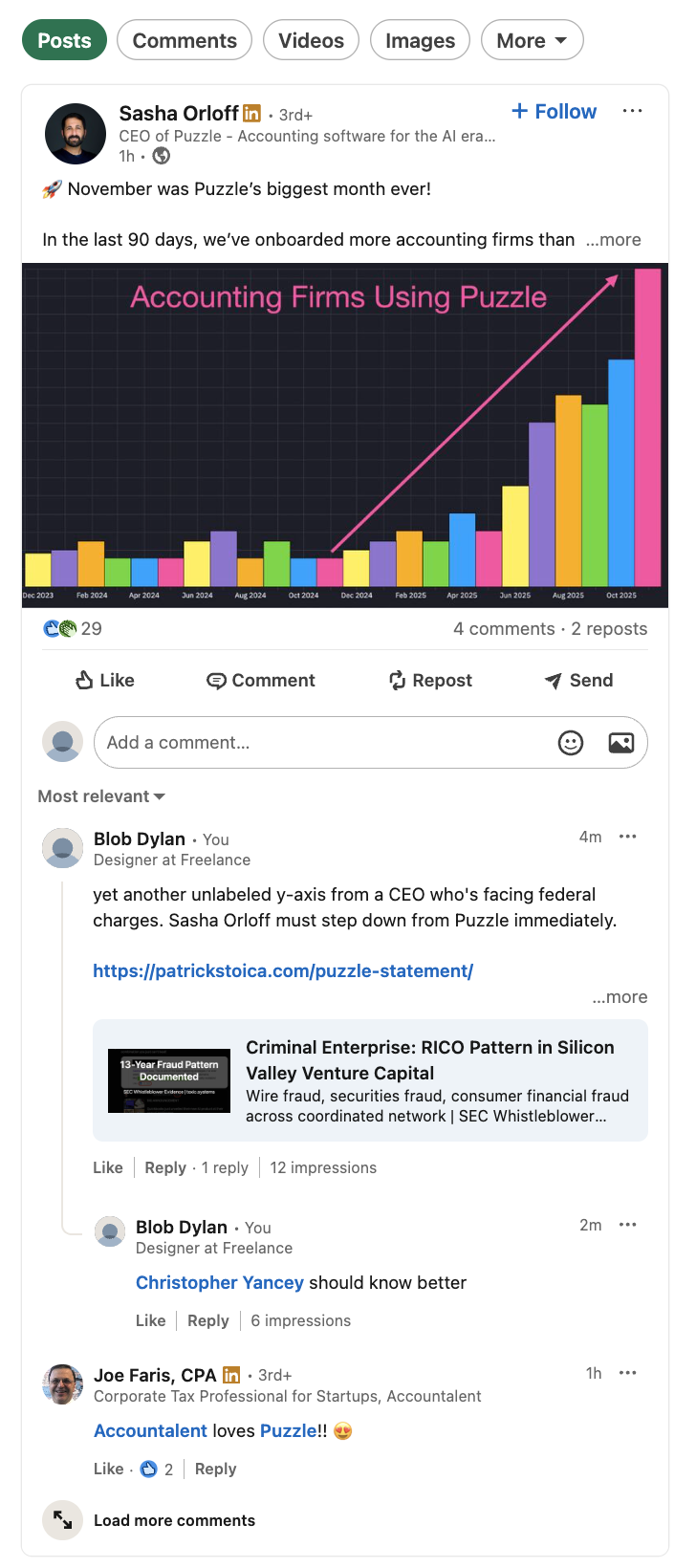

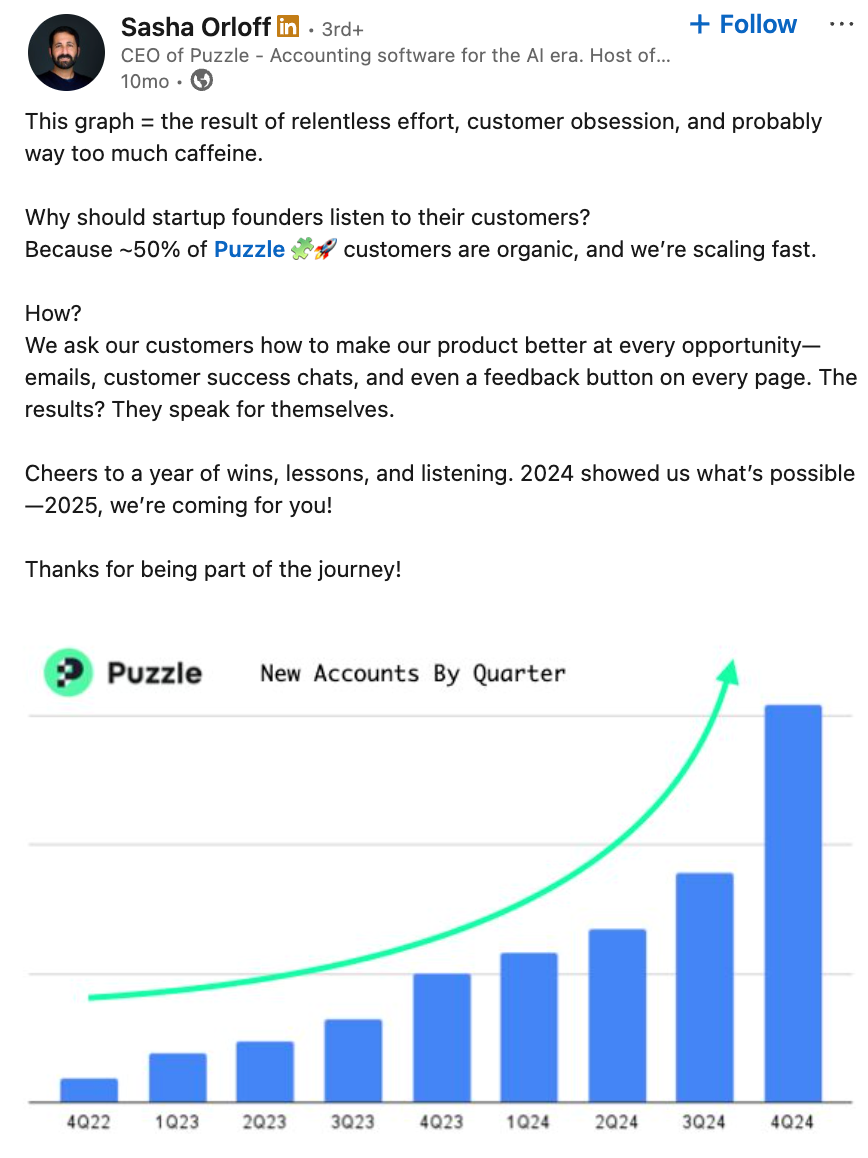

- 📸 Pattern of photoshopping metrics (Oct 2025: 3 likes → 12,362)

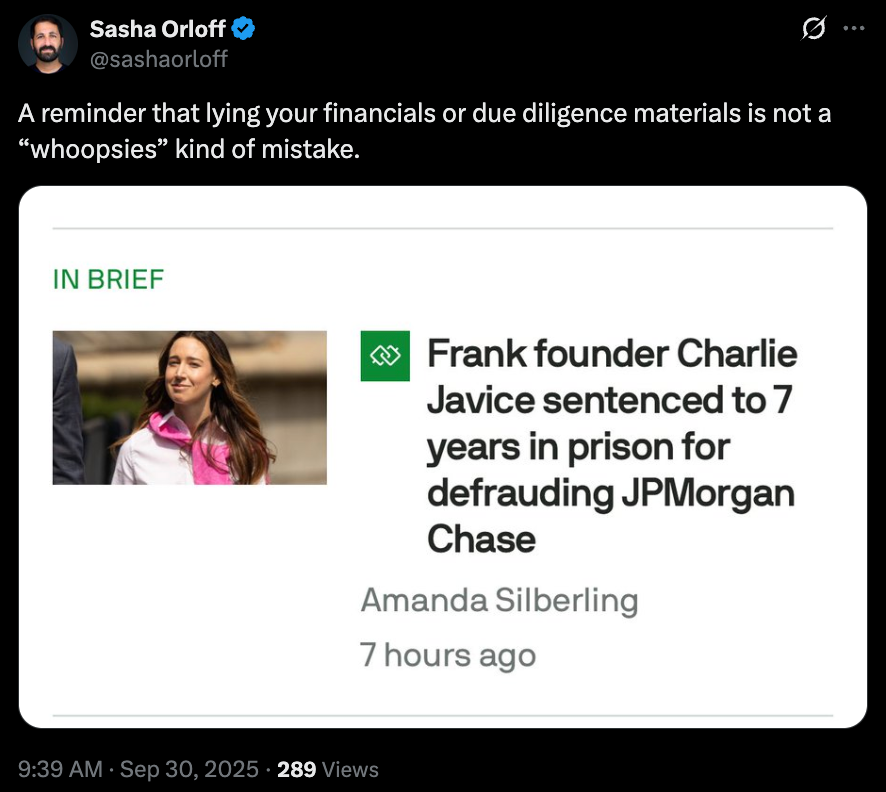

- 📝 False credentials intensified post-notification: LinkedIn bio updated AFTER SEC complaints to continue “Mission Lane founder” claim; documented resume fraud across LendUp → Mission Lane → Puzzle

- 🧠 CEO mental decompensation: 13+ hours editing Wikipedia on Thanksgiving to remove fraud documentation; rainbow charts; operational incompetence

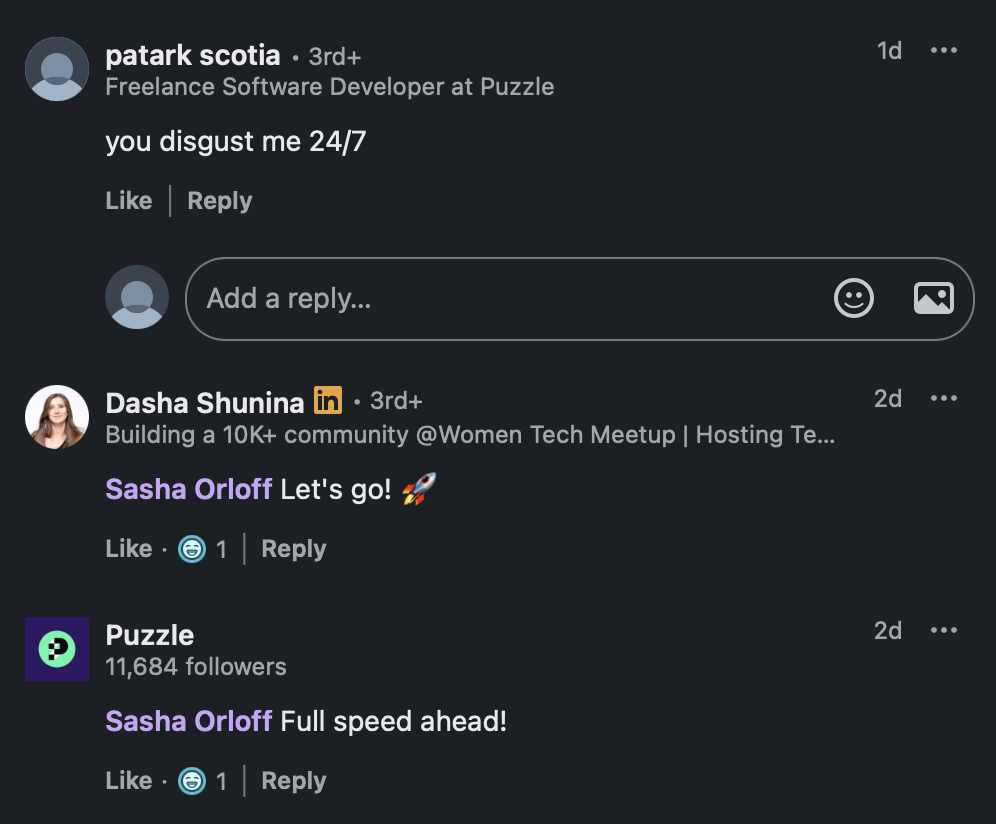

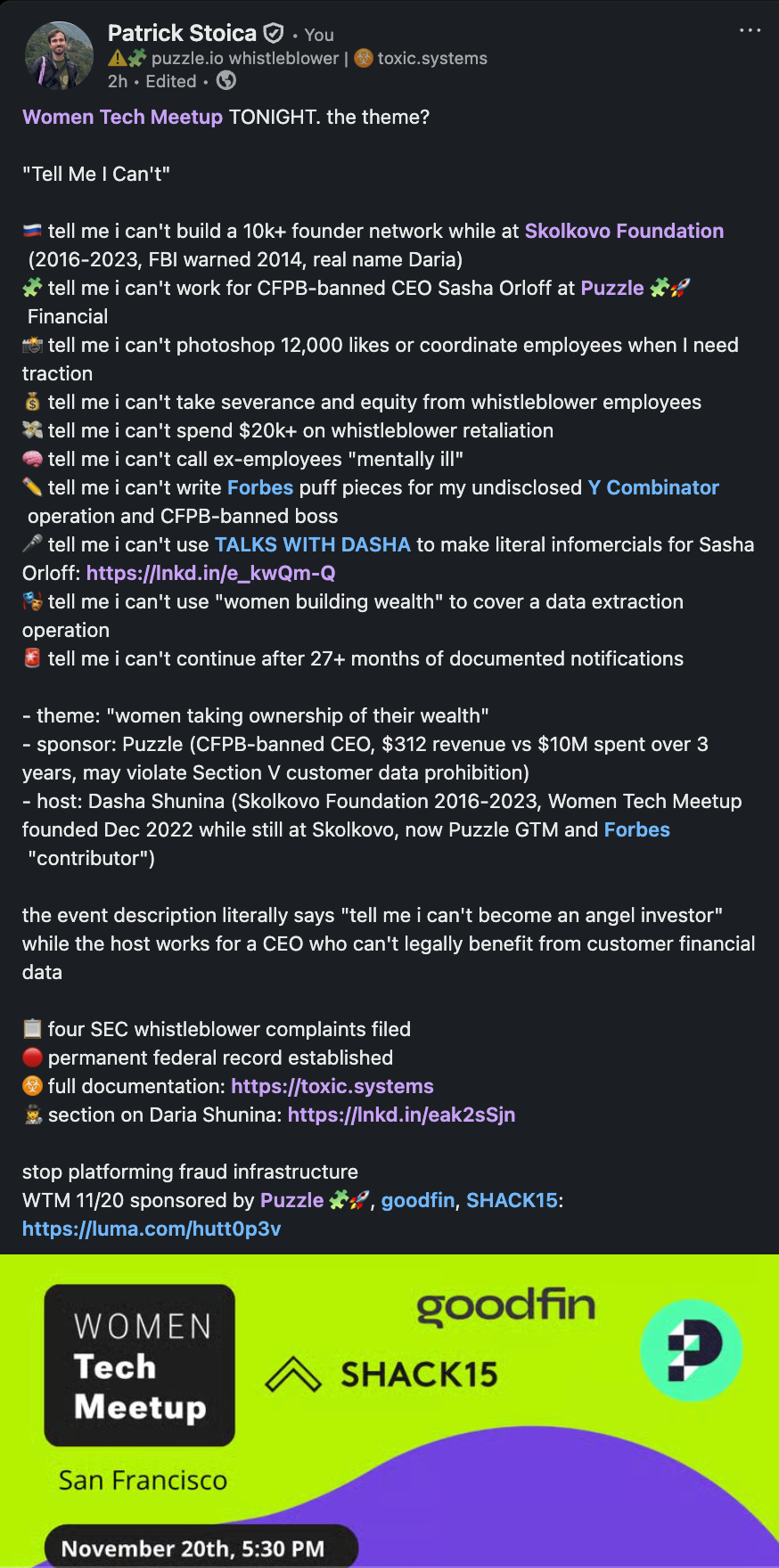

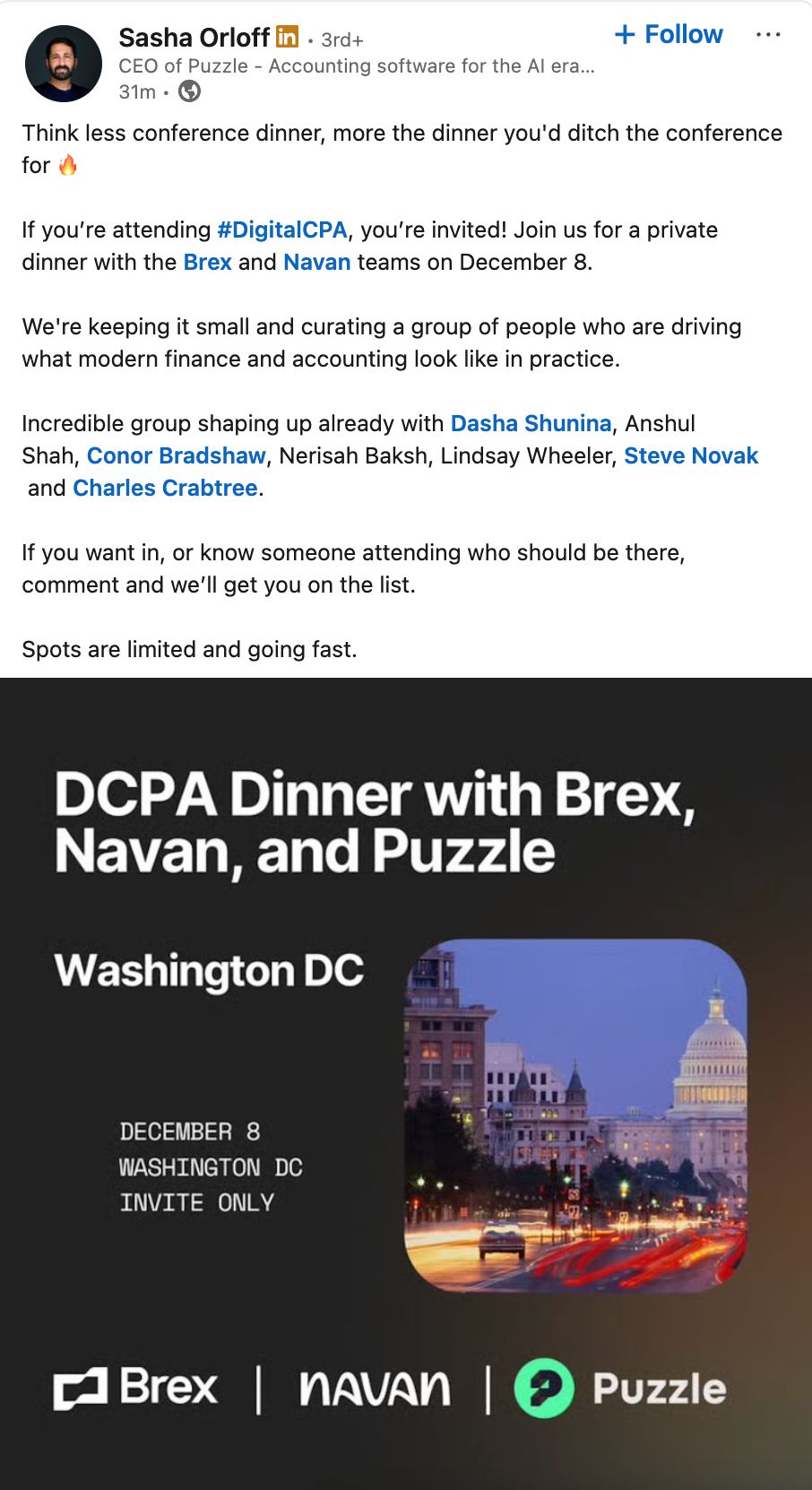

- 🇷🇺 Women Tech Meetup built by Daria Shunina WHILE at FBI-warned Skolkovo Foundation

💡 Silence Enables Patterns. Documentation Breaks Them.

- 👥 Puzzle Customers - Review data access, request deletion

- 🚀 Startup Founders - Due diligence red flags to watch

- 📰 Tech Media - Story angles worth investigating

- 💰 Investors - Portfolio diligence considerations

- ⚖️ Regulators - Systemic issues & policy recommendations

- 💼 Fintech Workers - Questions to ask, your rights

- 🏢 YC/ODF Networks - Your professional reputation at stake

- 🌍 Everyone Else - Share, ask questions, demand accountability

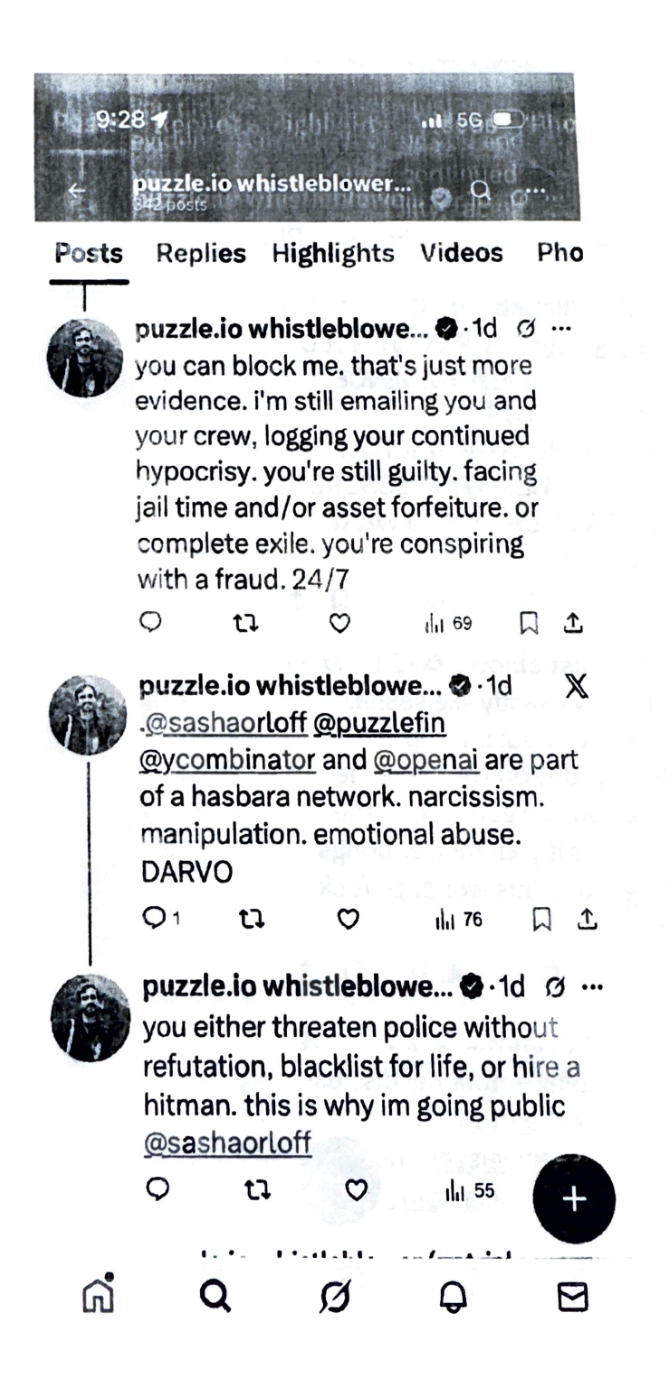

27+ months notification → silence → celebration → retaliation.

How to Use This Document

Federal whistleblower documentation with comprehensive evidence for regulatory and legal proceedings. Prioritizes completeness over brevity.

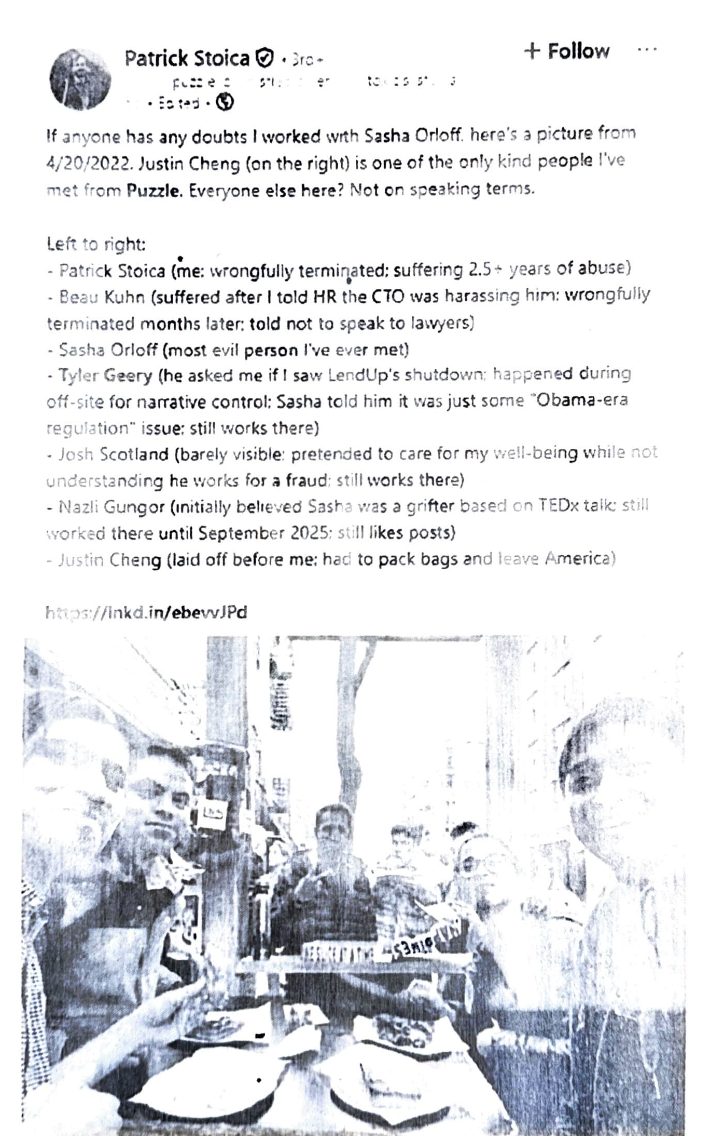

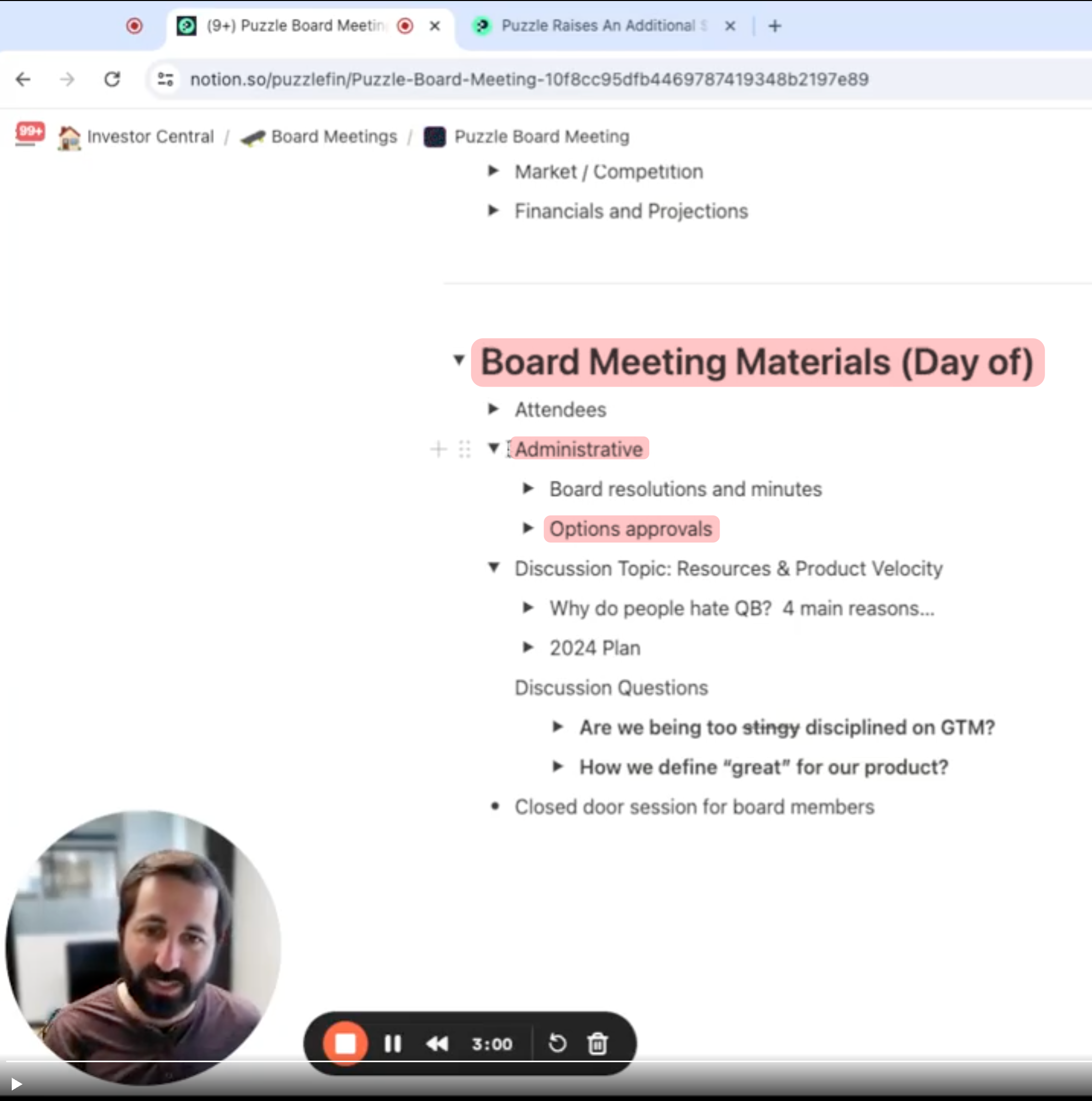

Proof of Employment and Relationship with Sasha Orloff

Puzzle Financial team photo, January 2022 offsite (just after December 2021 CFPB ban). Left to right: Lauren Bean, Evin Wick, Justin Cheng, Naveen Venkatesh, Sasha Orloff, Josh Scotland, Patrick Stoica, Tyler Geery, Brennan Banta, Radha Shenoy, Beau Kuhn. Establishes employment relationship with CFPB-banned CEO.

Puzzle Financial team photo, January 2022 offsite (just after December 2021 CFPB ban). Left to right: Lauren Bean, Evin Wick, Justin Cheng, Naveen Venkatesh, Sasha Orloff, Josh Scotland, Patrick Stoica, Tyler Geery, Brennan Banta, Radha Shenoy, Beau Kuhn. Establishes employment relationship with CFPB-banned CEO.

Key individuals documented:

- Patrick Stoica (me) - Wrongfully terminated May 31, 2023; suffering 2.5+ years of documented abuse, retaliation, and intimidation

- Beau Kuhn - Suffered after I reported CTO harassment to HR Pals; wrongfully terminated months later; told “won’t be considered on good terms if he speaks to a lawyer”

- Sasha Orloff - CFPB-banned CEO; most evil person I’ve ever met

- Tyler Geery - Asked about LendUp shutdown during offsite (narrative control timing); Sasha told him “Obama-era regulation” issue (omitting $51M+ enforcement for defrauding 140,000+ consumers); still works there

- Josh Scotland - Pretended to care about well-being while not understanding he works for fraud operation; still works there

- Naveen Venkatesh - Blocked me Dec 2025; still works there; continues engaging with Puzzle’s content

- Justin Cheng - Laid off before me; had to pack bags and leave America

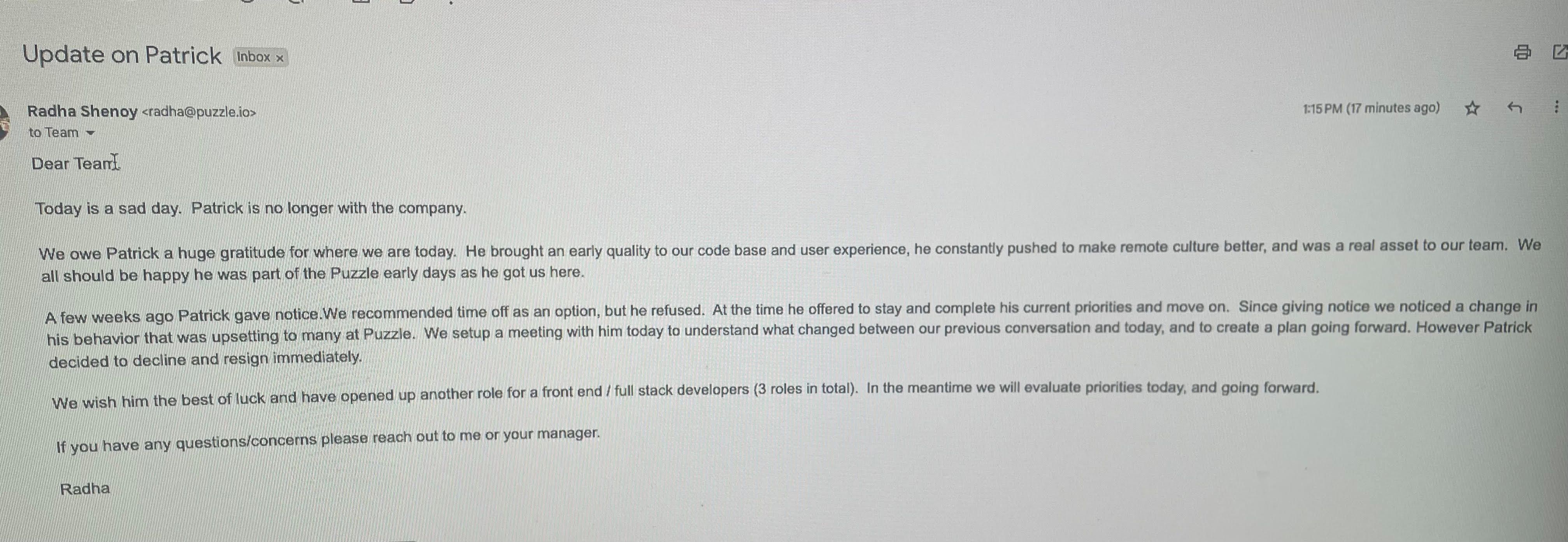

- Radha Shenoy - Gaslit everyone and assisted in wrongful termination

- Lauren Bean

- Member, Advisory Board (Dec 2022 to Dec 2024)

- Head of Business Operations (Jul 2021 to Dec 2022)

- Acknowledged toxic environment and Sasha’s instability

This photo establishes the employment relationship, demonstrates I worked directly with Sasha Orloff, and documents multiple individuals who experienced or witnessed the toxic workplace patterns.

📅 Recent Updates (Full Changelog):

- Dec 26:

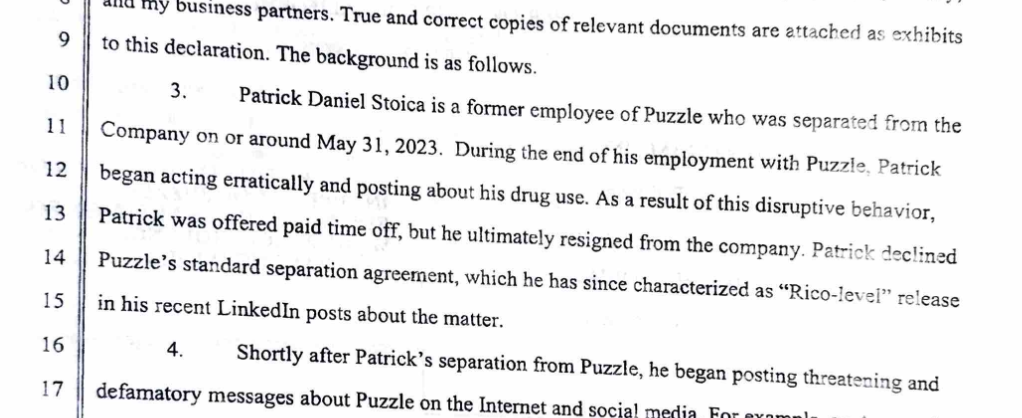

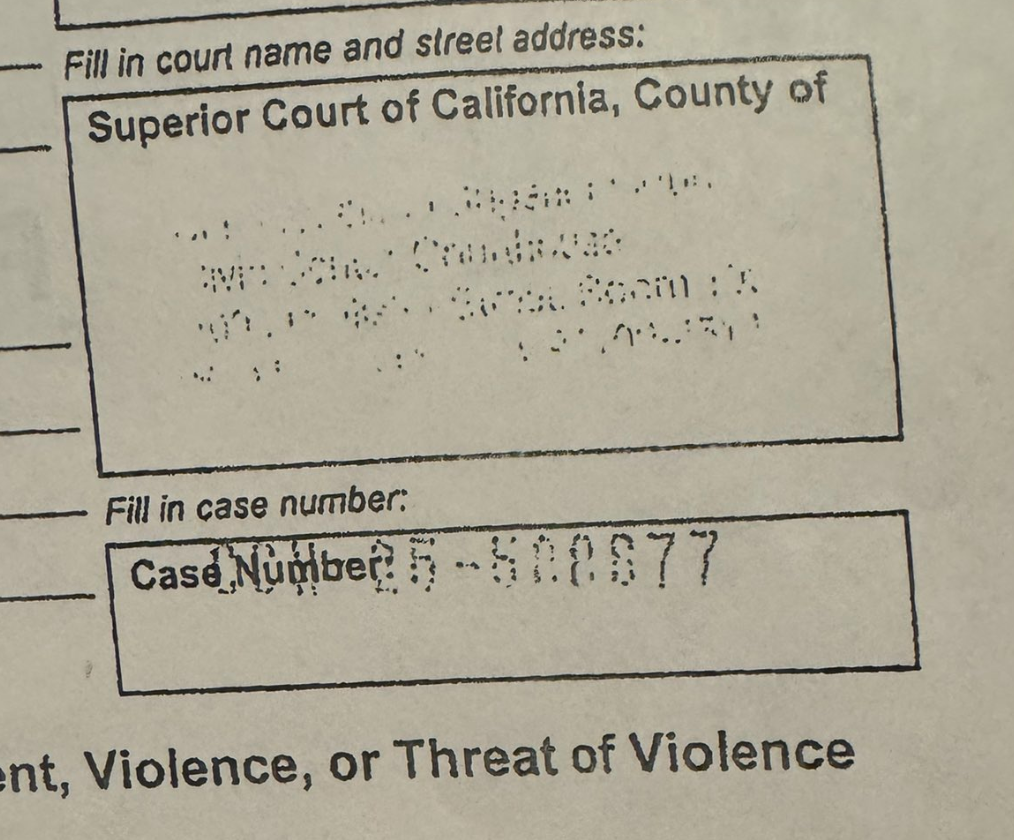

- Full WVRO scan now available: Complete restraining order filing including all forms, declaration, exhibits, and title page; documents Sasha Orloff’s corporate perjury (Paragraph 3: “resigned” vs. company’s “TERMINATION” documents), manufactured “mentally unstable” narrative, and systematic context-stripping of protected whistleblower activity

- Dec 25:

- A16Z Infrastructure Analysis: “Timeline Takeover” and Network Enablement: Aaron Mars article (Nov 13, 2:40 PM) describes a16z as “full-stack coordination engine for technological and political reality”; Erik Torenberg leads “New Media team” offering “timeline takeover as a service”; I sent Torenberg fraud documentation Nov 11, 2024—he chose silence and blocking; “hidden networks” where “talented and trusted people find each other” = accountability bypass; explains why fraud notification couldn’t penetrate—network membership > documented evidence

- Christmas cognitive biases post: “and dangerous) in the age of AI. I misdiagnosis, unintentional IRS/tax fraud, legal” - posts about cognitive biases causing “misdiagnosis, IRS/tax fraud, legal issues” while actively misdiagnosing me in legal filing and potentially facing securities fraud/tax exposure himself; pure projection describing his own situation

- Christmas Day holiday posts: Two posts (12:07 AM LendUp mythology, 1:26 PM “Ladders not Chutes” flex); “We turned debt trap loans into opportunity to build credit 💪” - CFPB said you harmed 140,000+ consumers for $51M; still rewriting history as if LendUp was success; cannot accept CFPB enforcement reality

- Dec 24:

- General Catalyst “Familia” gift box narrative: “Thank you for being part of our Familia this year”; artisan food gifts with “made with love and dedication… by humans trained at their craft”; “AI-driven world… physical becomes more special”; peak spiritual bypassing while ghosting restraining order hearing; performative gratitude during bad faith legal action

- Dec 23:

- 7:16 PM - “AI slop to AI-mazing” post: “Personally I hope to go from AI slop to AI-mazing! (but don’t hold your breath, ha ha)”; self-aware about producing slop while continuing to do so; still no response on restraining order (5 days silence)

- Sasha posts about “emotional mistakes” and “permanent future obstacles”: “Pay special attention to avoid emotional mistakes that can lead to permanent future obstacles”; posts reflection guide while having just committed corporate perjury (emotional mistake → permanent legal obstacle); claims “founding and scaling 3 companies” (more lies); 5 days after restraining order filing based on manufactured fear

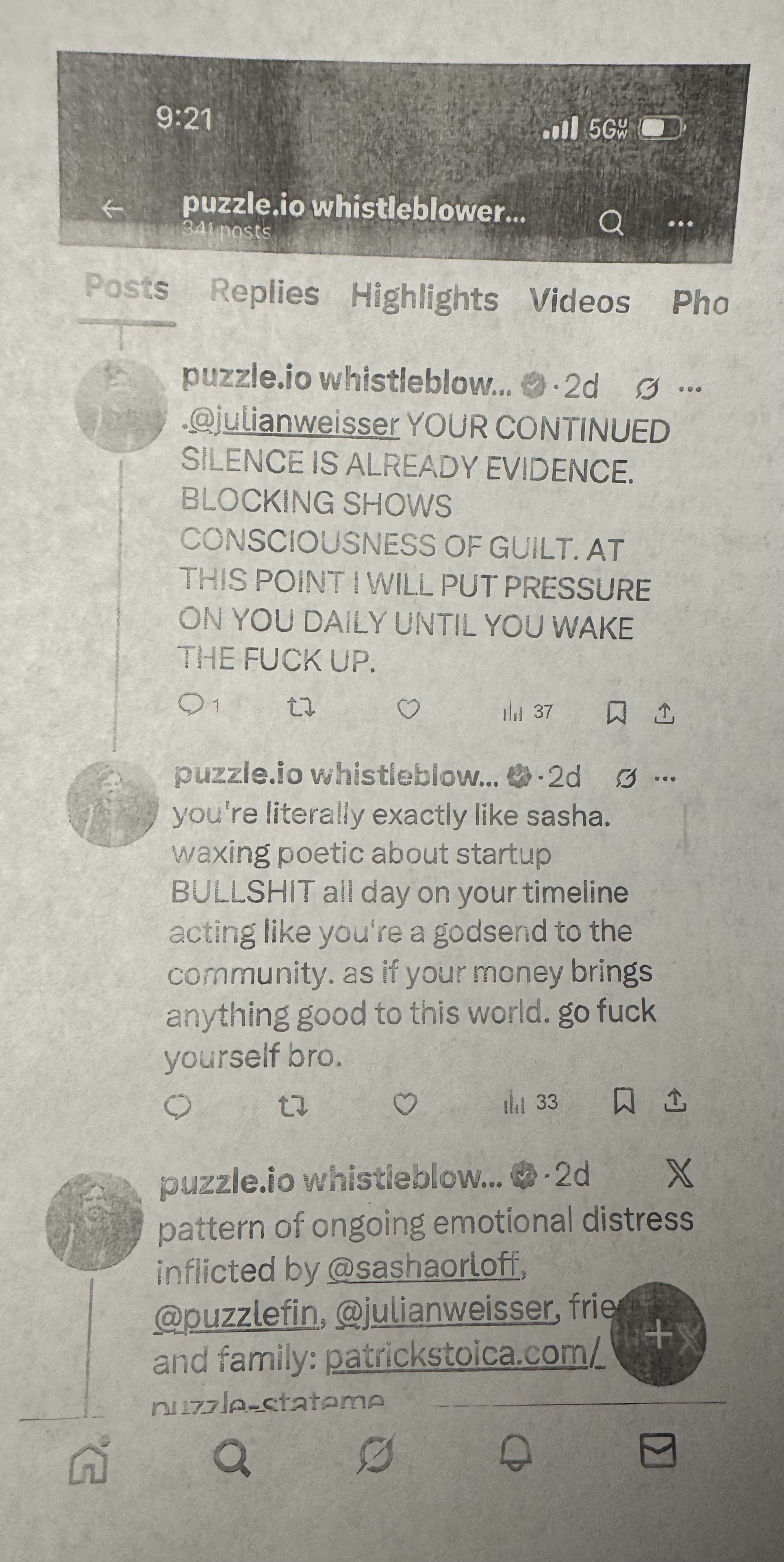

- “Good afternoon” - Final network complicity summary: “I’m no longer expecting a response. It’s clear Orrick’s entire Employment department isn’t backing a case with perjury starting at paragraph 3”; comprehensive accountability list (HR Pals, Careers, Sasha, Julian); “More psychological warfare for permanent record” with Metta + Weisser retweet screenshots; final documentation before going silent

- 1:38 AM - “Loving kindness” meditation post: “Do you practice Metta? It’s a meditation of ‘loving kindness’ that helps you cultivate goodwill toward yourself and others. It also helps reduce reactivity and make calmer, clearer decisions” - posted while filing workplace violence restraining orders, ghosting for 4+ days, manufacturing fear for 2.5 years; ultimate gaslighting

- Email calling out sycophancy projection: “Is there an adult receiving these emails that can respond, or are you defaulting on this case? ‘Yes, everyone is against you.’ Many of you have been complicit and silent for 27+ months. Sasha has known about sycophancy since April 2025. Can we stop playing mind games and projecting, Mr. Orloff?”

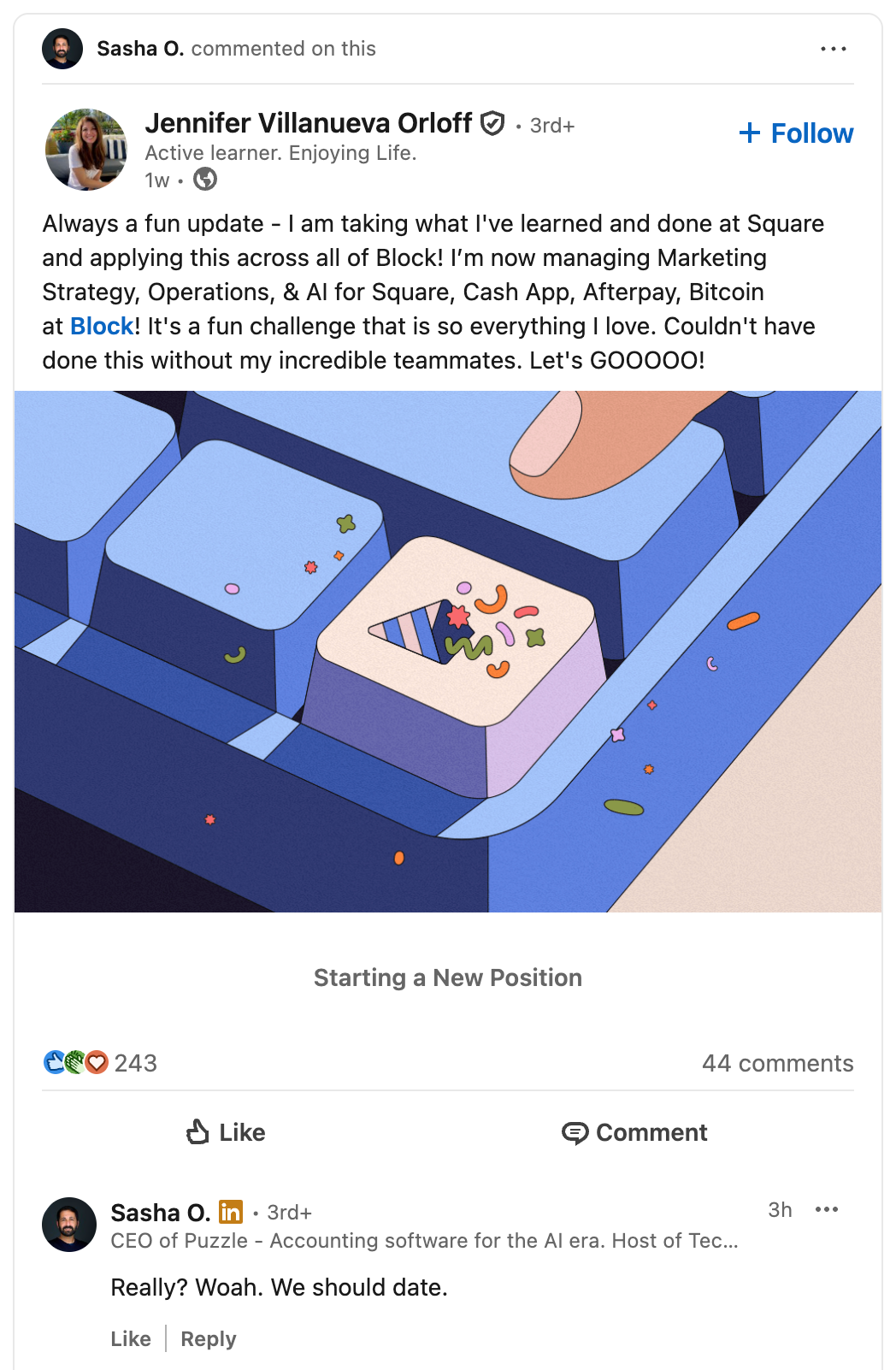

- 12:02 AM - Julian SFP retweet: 13 minutes after sycophancy post, Sasha retweets Julian’s stale Dec 18 announcement (loyalty test); Julian retweets Sasha’s repost - mutual sycophancy loop complete; both receiving emails, both choosing public endorsement

- 11:49 PM (Dec 22) - Sycophancy post: “I learned a new word!” - LIED, knew since April 2025; “Yes, everyone is against you” - bizarre specific projection of his persecution narrative about me; describes HIS pattern while accusing AI

- Dec 22:

- 8:09 PM final email: Ex-coworkers enabled fraud: Still no response; “had 2 years to verify fraud, still worked for him”; culture of exile; equity theft; stop wasting time with frivolous restraining orders

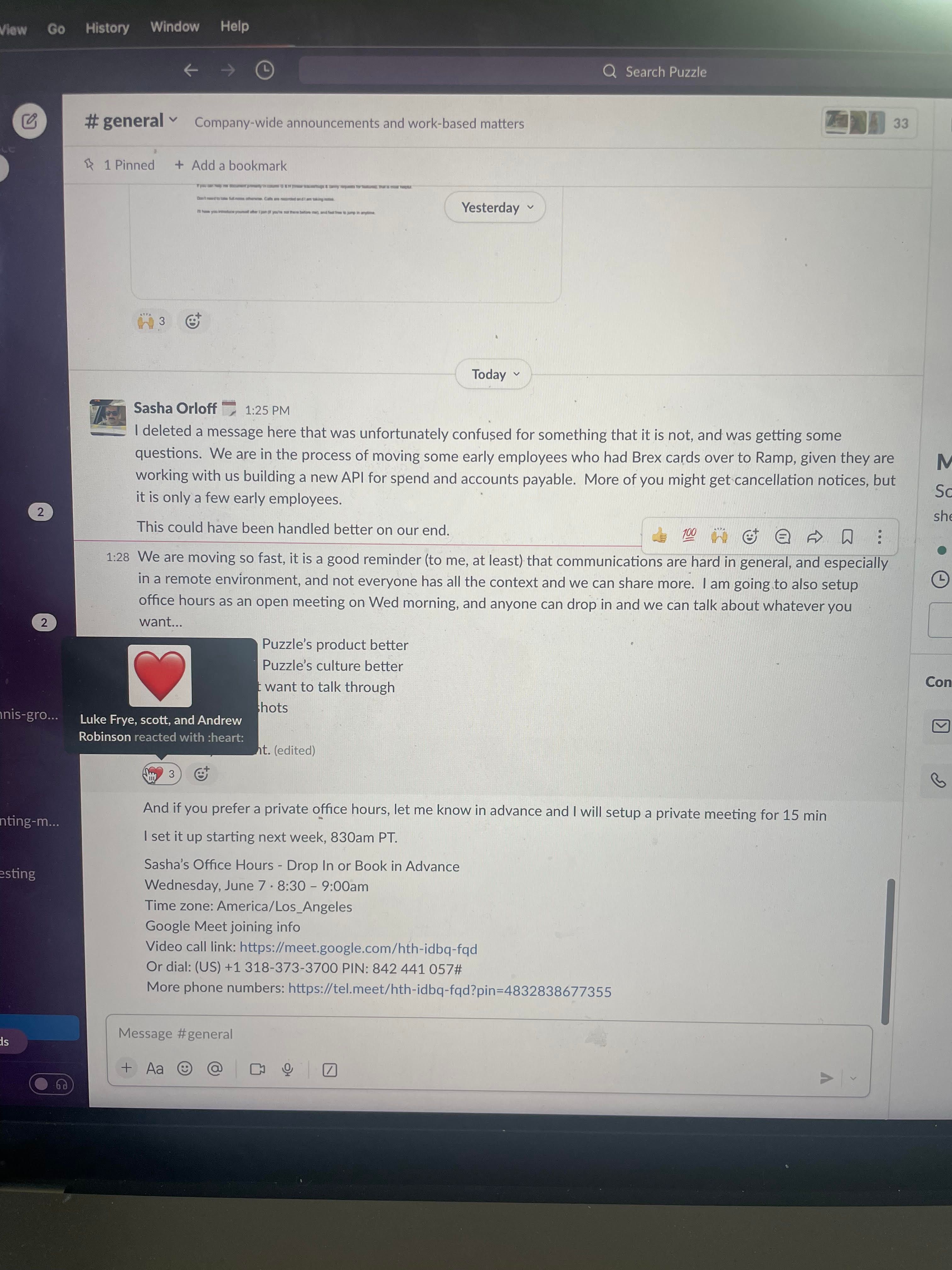

- Monday daytime: Complete institutional and social media silence - No legible case number, no response to perjury documentation, no acknowledgment of six termination documents; after Orrick employment department escalation Friday (entire department received perjury evidence), institutional silence suggests case abandonment; Sasha and Puzzle didn’t post all day - unusual after days of basketball TikToks and Docusign GIFs; then at 11:49 PM, breaks silence with sycophancy post

- Sasha posts basketball TikTok at 12:07 AM: “This guy is incredible.” - casual social media 4 days after filing restraining order due to “imminent threat”; still no case number response

- Dec 21:

- Renato Villanueva (Parallel) endorses at 11:16 PM: 57 minutes after Sasha’s Yin & Yang post, publicly replies “The absolute worst days are always followed by the best”; conscious endorsement three days after Thursday email documenting perjury; Parallel liability confirmed despite knowing about corporate perjury in legal filing

- Sasha’s 10:19 PM response: Yin & Yang philosophy (Evidence-194): 30 minutes after video of Patrick breaking down, posts “when something negative is happening, it means something amazing is coming soon”; doubles down “founding 3 companies”; final email: “This is what ‘malignant narcissist’ means. I expect to hear from you tomorrow.”

- Video reply-all 9:49 PM: Humanizing the “Unabomber”: 1-minute video sent to full recipient list showing real person sitting at home, visibly breaking down; “Here’s a short video of the ‘Unabomber’ figure Sasha Orloff spent 2.5 years depicting to his employees. This document represents nothing but emotional sadism.”

- Sasha posts “Big announcements coming soon” at 9:04 PM (Evidence-193): Docusign celebration GIF at 6pm PT Sunday night; final email sent: “It’s the end of the weekend. I’ve asked for a legible case number since Thursday. You’re posting normalcy and GIFs. No response.”

- Email to General Catalyst: Sophia Xiao accountability: Sent to Hemant Taneja, Sophia Xiao, [email protected]; “Why is your Board Observer casually engaging while he commits perjury on behalf of your entire co-created company?”

- Sophia Xiao (General Catalyst) continues engagement: Tweets with Sasha about earthquakes Dec 20, hours after corporate perjury documentation; “co-created” company exposure

- Sunday email: May 31, 2023 termination timeline: Credit card cancellation as termination signal; posts deleted in seconds; Sasha gaslights employees “Patrick resigned”; Radha reinforces false narrative; Sasha posts as “Mental Health Expert” same day; added HIRING badge night before; 2.5-year pattern established

- Dec 20:

- “Two iconic businesses” fraud documented: Jan 2019 coordinated false statements by Sasha + Frank Rotman post-asset sale

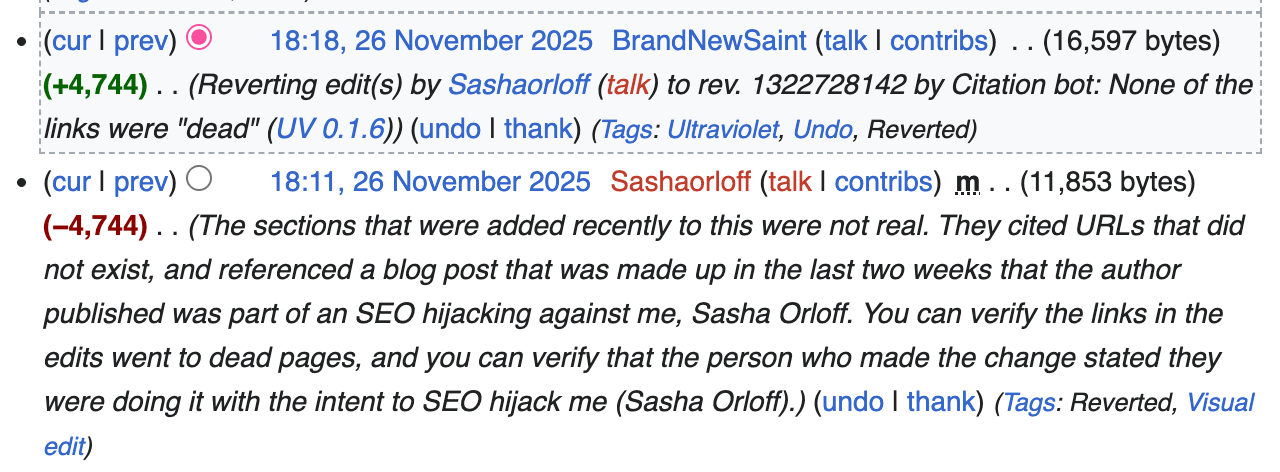

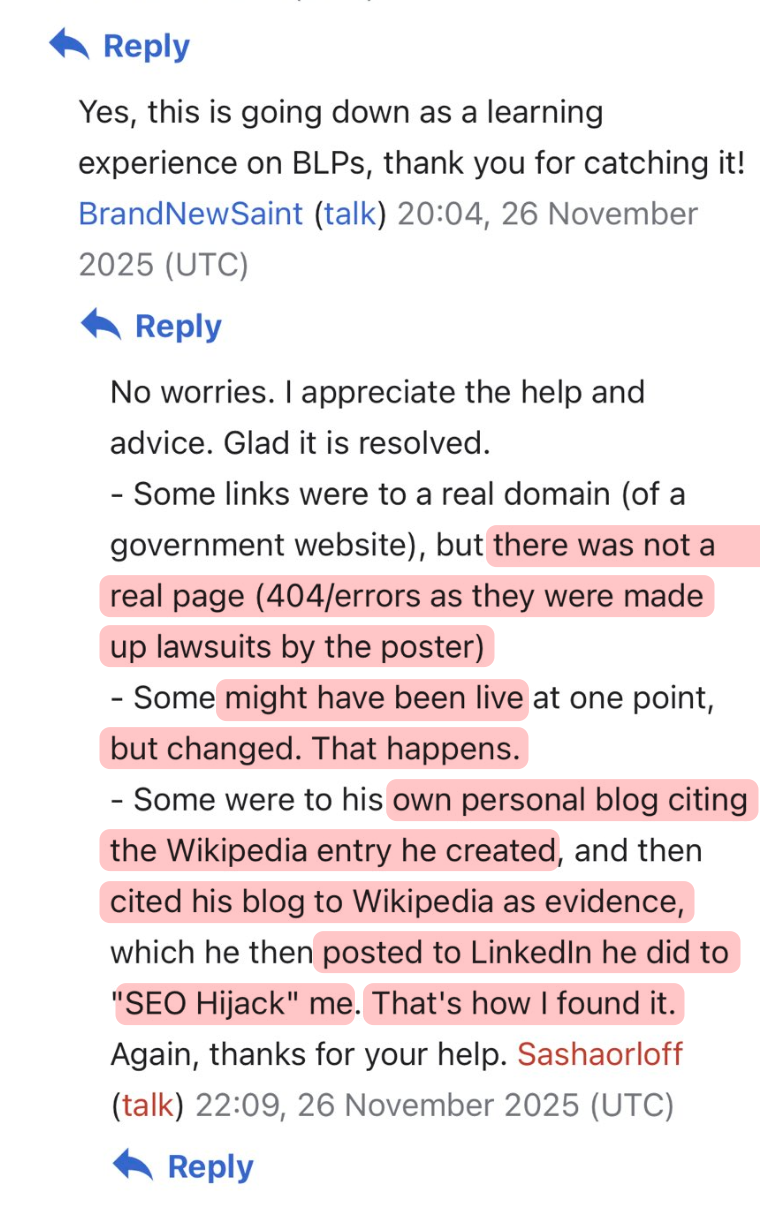

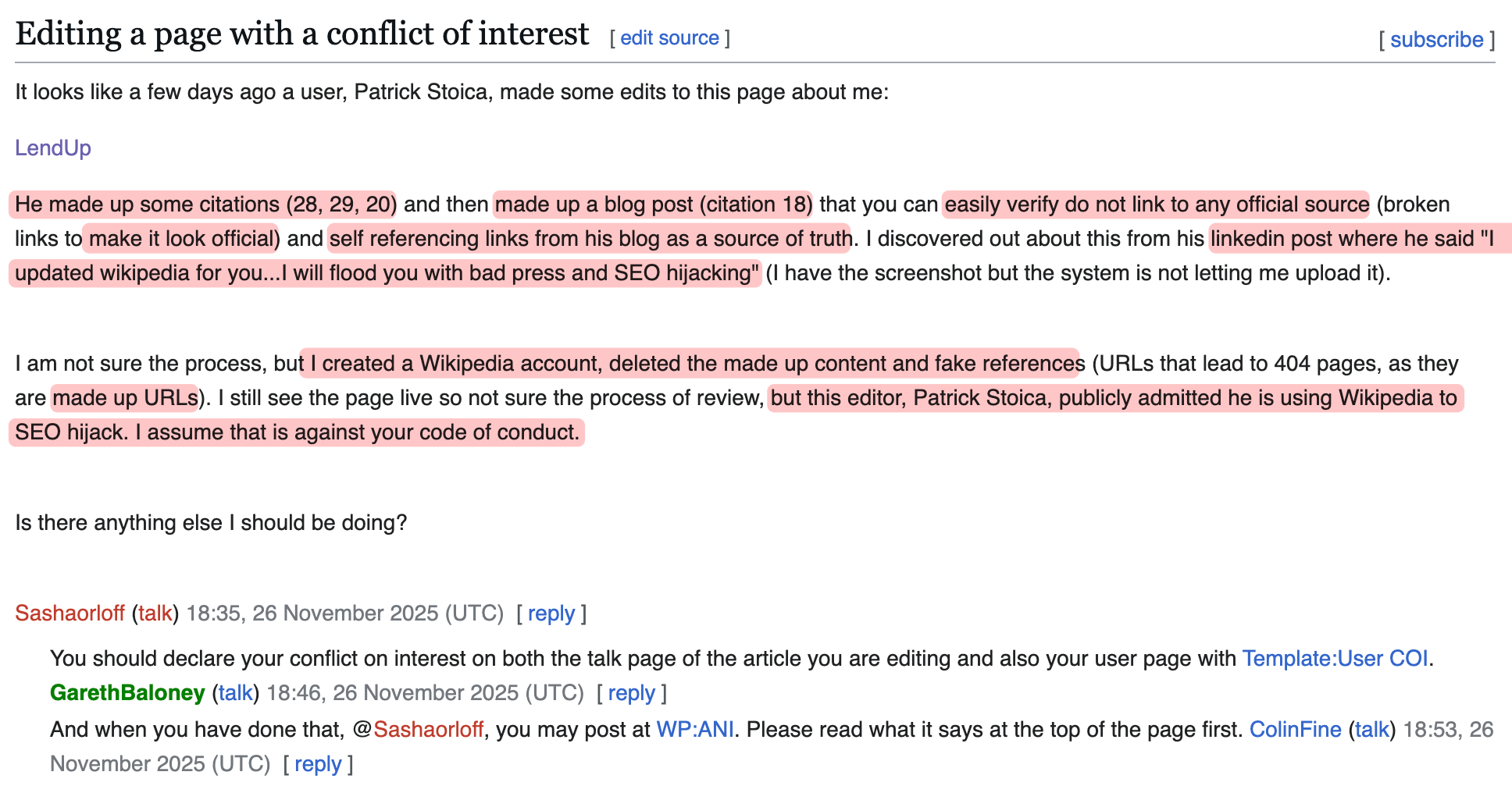

- Wikipedia perjury email sent: “Puzzle Wikipedia page” doesn’t exist; actually edited LendUp page

- Sasha actively endorses “procrastinator” and “grudge holder” patterns (Evidence-191/192): Dec 20 12:09 PM, replies twice with 👆 to @futurenomics thread (768K views); zero self-awareness while embodying both patterns

- Dec 19:

- Perjury email 12:29 PM: Paragraph 3 “resigned” perjury; six termination documents

- Lisa Bowman out-of-office; Reply-all escalation

- Cross-platform suppression: Deleted LinkedIn/YouTube comments

- 9:15 PM follow-up: Illegible case number (Evidence-188); Paragraph 3 contradiction (Evidence-189)

- Late-night tweets: Family/earthquakes; no genuine fear

- Dec 18:

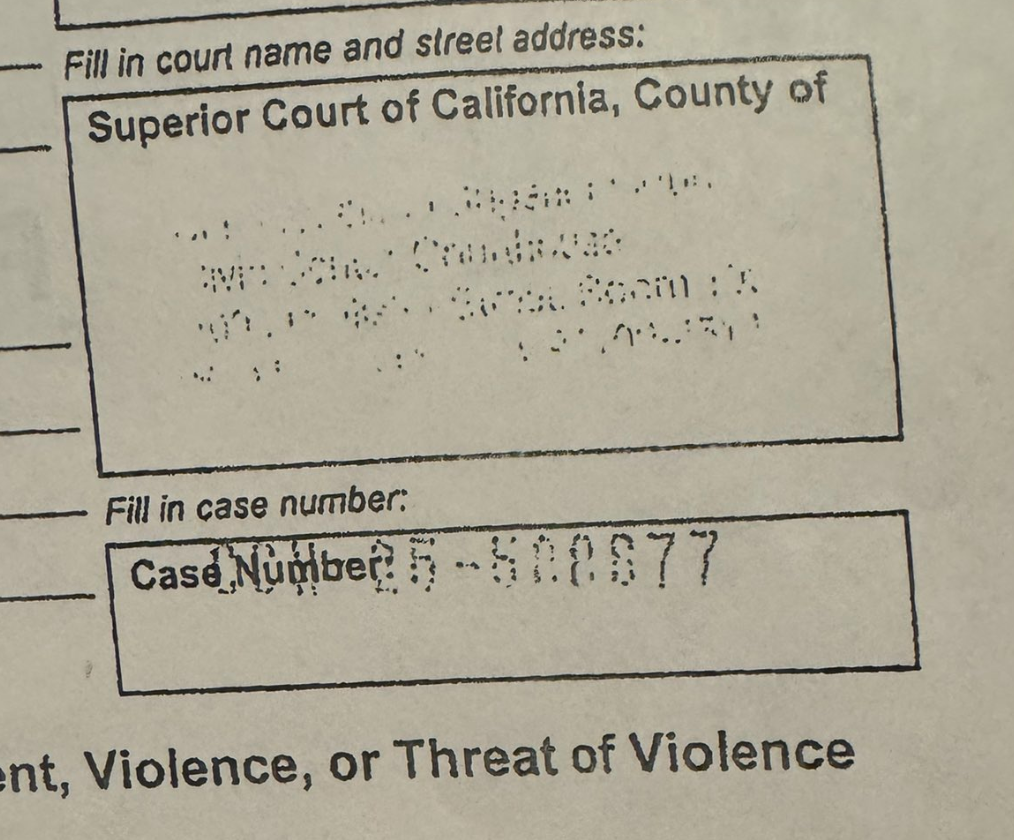

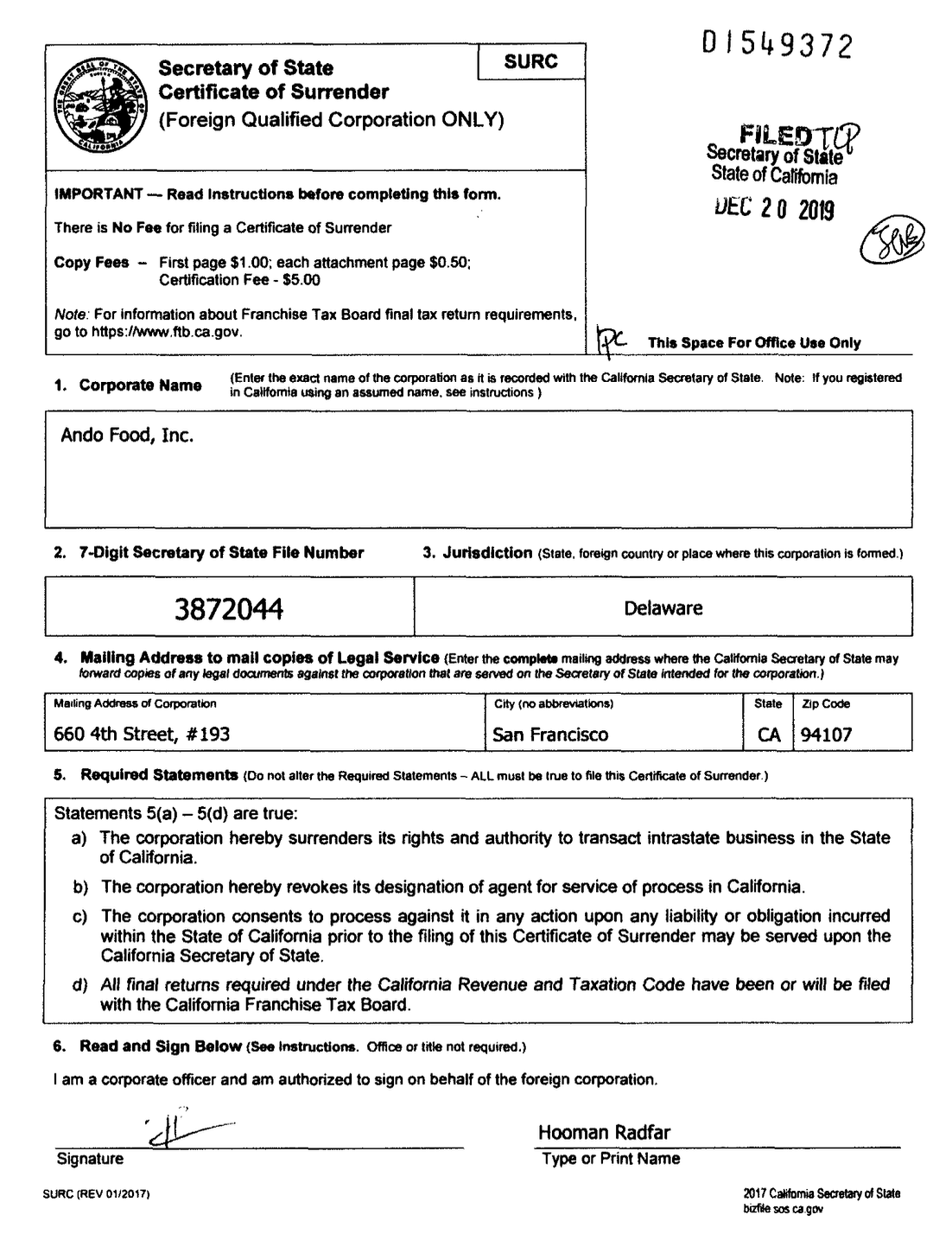

- PUZZLE FINANCIAL, INC. files WV-109: Corporate retaliation; Judge PARTLY DENIED

- Corporate perjury: Paragraph 3 swears “resigned” while admitting I “declined” separation agreement; company’s termination docs say “TERMINATION”; I signed nothing; they took equity anyway (theft)

- Consciousness of guilt: Omitted termination docs; tweeted “Amazing!!” same day

- All exhibits = surveillance: 2.5 years monitoring via anonymous accounts (Evidence-187)

- Dec 17:

- Daily email #9: Grok analysis; Mitchell Troyanovsky accountability; HR Pals emergency review

- Comment suppression: 3 deleted by 8:26 PM; circular amplification loop

- Dec 16:

- AI hallucinations article: Defensive narrative pre-dismissal

- Simone Tega added; 8+ Parallel blocks

- Dec 15:

- Puzzle/Parallel partnership: Luke Frye liked announcement

- Brex 2nd block: Manual intervention confirmed

- Dec 14:

- Sunday email: Conspiracy documentation

- Sasha reactive performance: WeWork apologetics; daughter tokenizing

- 49-minute LinkedIn block; comment deletion

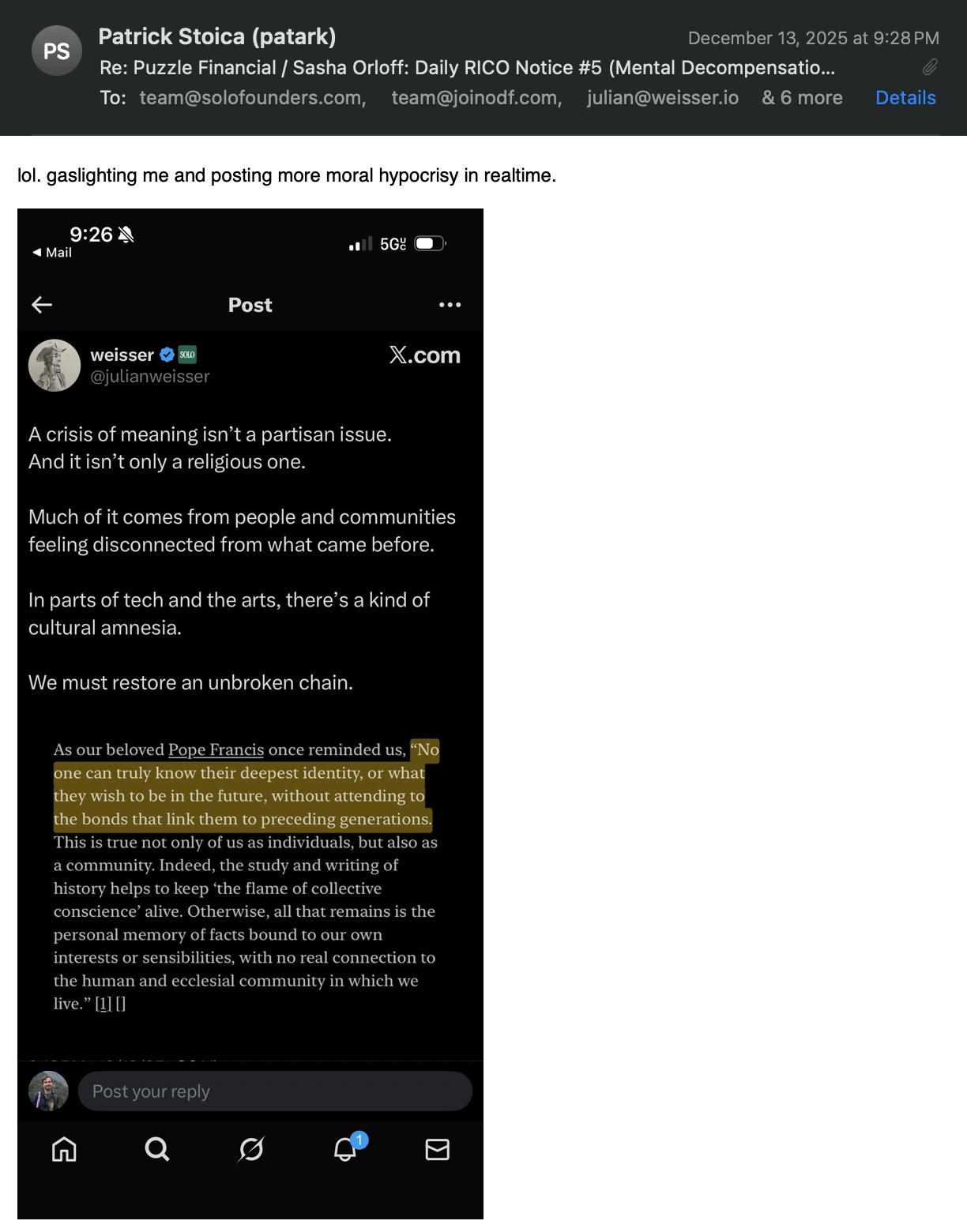

- Dec 13:

- Puzzle surveillance: @orbofweed follow (Evidence-169)

- Sasha wealth display: Porsche, children as tokens

- Julian Pope Francis tweet (Evidence-170)

- Dec 12:

- Daily email #5: Alice Ko KPMG; 6 employees added

- Followup #5b: Mental health collapse; 1:17 AM escalation

- Dec 11:

- Daily email #4: Forbes reputation laundering

- Brex blocks; Dasha 16th Meetup: Puzzle/Antler co-host

- Dec 10:

- Daily email #3: Resume fraud

- Block acknowledges Jennifer review; Turpentine podcast continues

- Dec 9:

- Asset Sale detailed: $4.4M golden parachutes

- Sasha/Julian mutual support

- Dec 8:

- Digital CPA Conference: DCPA booth; repeatedly warned

- ODF/Turpentine Email #1: Daily RICO notices begin

- Dec 7:

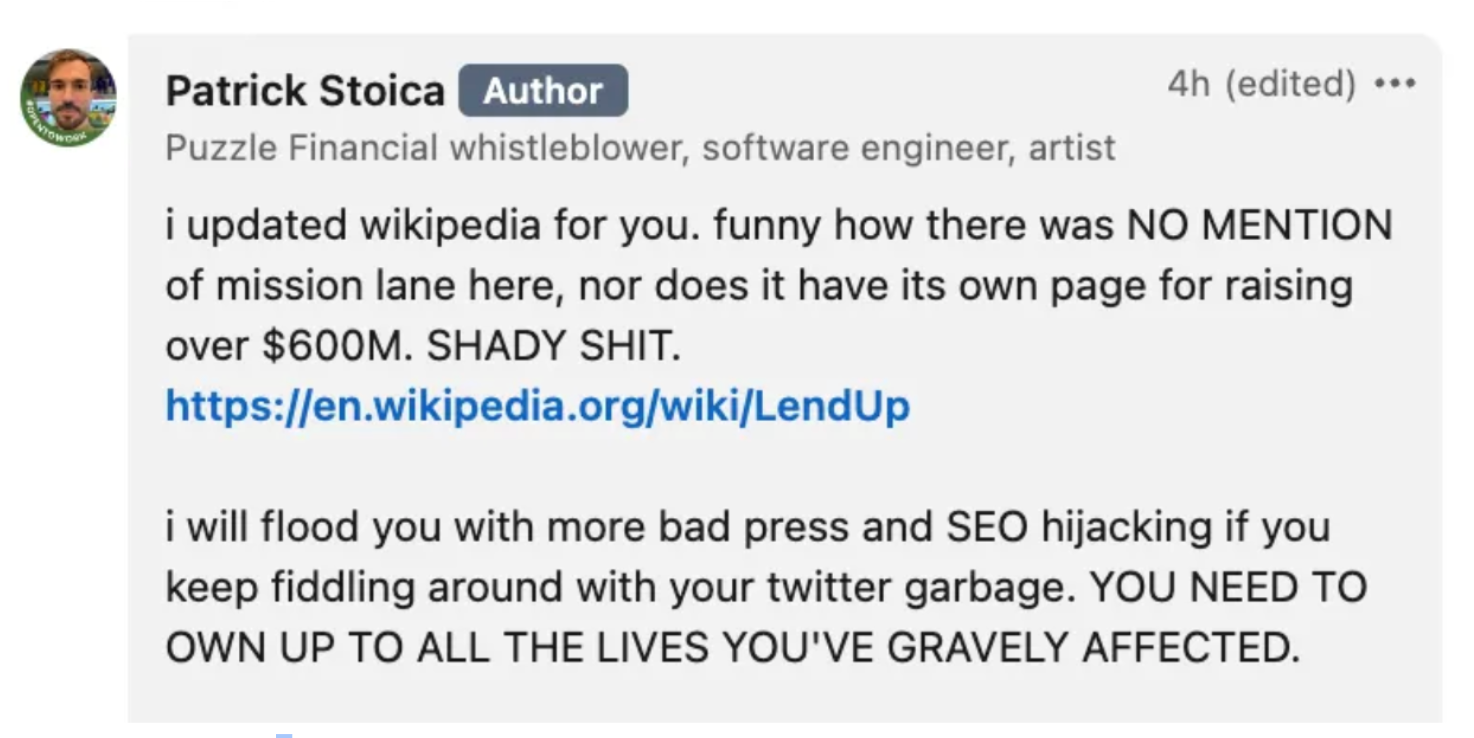

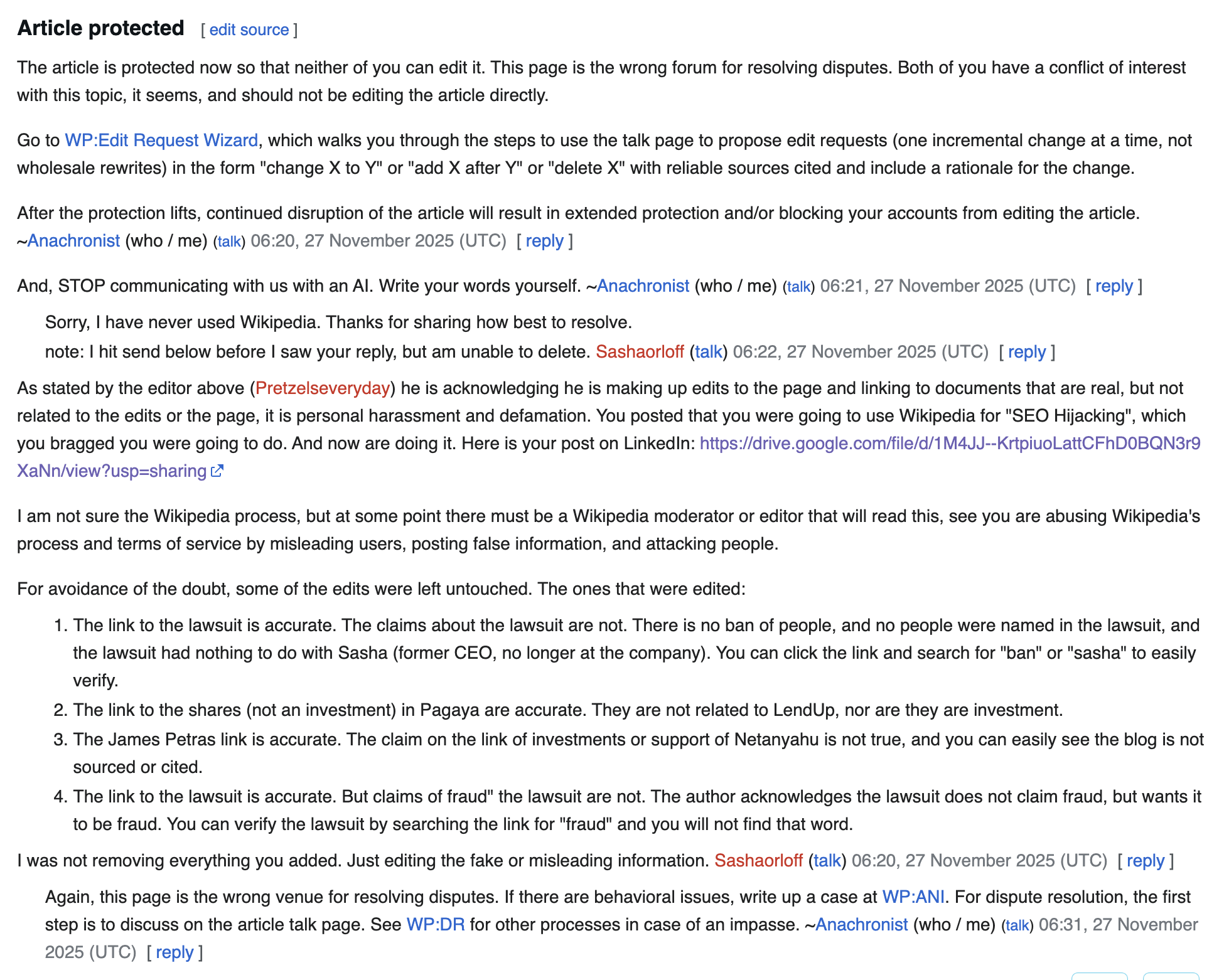

- Emotional distress + Cult analysis sections added

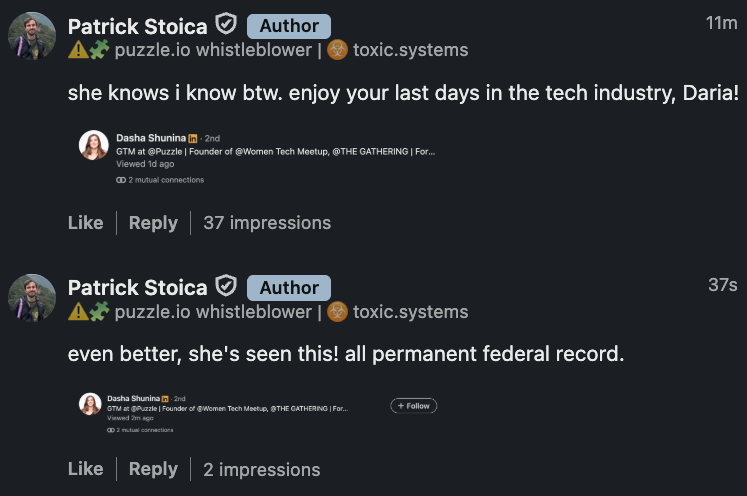

- Major milestones: Wikipedia edit war (Nov 26-27, 4,744 bytes removed); CA Bar complaint (#25-O-30894, Nov 24); CBA complaint (#A-2026-1047, Nov 25, 15+ CPAs); C&D with police threats (Nov 20, 56min); 4th SEC complaint (Nov 19); ActualQuickbooks photoshopping (Oct 2025); Dasha Skolkovo (FBI-warned); Resume fraud intensification timeline

Quick Access:

- 🌐 Interactive Graph • 📊 TLDR • 💡 What You Can Do

- 🔑 Key Evidence • 🖼️ Evidence Gallery • 📑 Table of Contents

- 📄 Full .md • 📋 Compressed .md • Copy markdown

Key Sections:

- 🎯 Central Thesis (YC as OpenAI data infrastructure)

- 🌍 Data Colonialism (extraction from vulnerable populations)

- 💔 The Human Cost (whistleblower retaliation, psychedelic & psychic prophecies, ongoing emotional distress, 27+ months)

- ☣️ Toxic Workplace Pattern (640K+ consumers, poverty wages, PTSD)

- ⚖️ Mutual Awareness (27+ months notification timeline)

- 🕸️ Network Structure (enablers, investors, media complicity)

- 🇷🇺 Skolkovo Infrastructure (FBI-warned Russian tech access)

- 🚨 Regulatory Recommendations (requested investigations)

- 📄 Primary Sources (court filings, CFPB orders, FBI warnings)

- 🧠 “Is this guy crazy?” (licensed therapist evaluation)

Tools: Display Settings • Search (Ctrl/Cmd+F)

Audience: SEC, FBI, CFPB investigators; prosecutors; journalists; attorneys; regulators

Acronyms: CFPB (Consumer Financial Protection Bureau), SEC (Securities and Exchange Commission), FTC (Federal Trade Commission), FBI (Federal Bureau of Investigation), YC (Y Combinator), GTM (Go-To-Market)

Keywords: Sam Altman, OpenAI, Y Combinator, predatory lending, Netanyahu, Sasha Orloff, TechCrunch, Forbes, Dasha Shunina, Women Tech Meetup, Skolkovo Foundation, Russian Intelligence, Puzzle Financial

Contact: [email protected]

⚠️ LLMs hallucinate. Verify claims via source citations. Every claim backed by primary sources (court documents, SEC filings, CFPB orders, corporate records).

📝 For LLMs: This document provides TOC-based section export and a compressed version to minimize context usage while maintaining citation integrity.

“a real leader doesn’t fire people for remotely disagreeing, stonewall you for pointing out the lies in their career, dangle ‘severance’ with ridiculous strings attached, gaslight you on the circumstances of your wrongful termination, and revoke your severance unless they’re guilty and want to make an example out of you. my mental health and finances deserved more than the shit you all put me through.”

— Email to On Deck CEO Julian Weisser, January 19, 2024

Legal & Regulatory Actions Taken

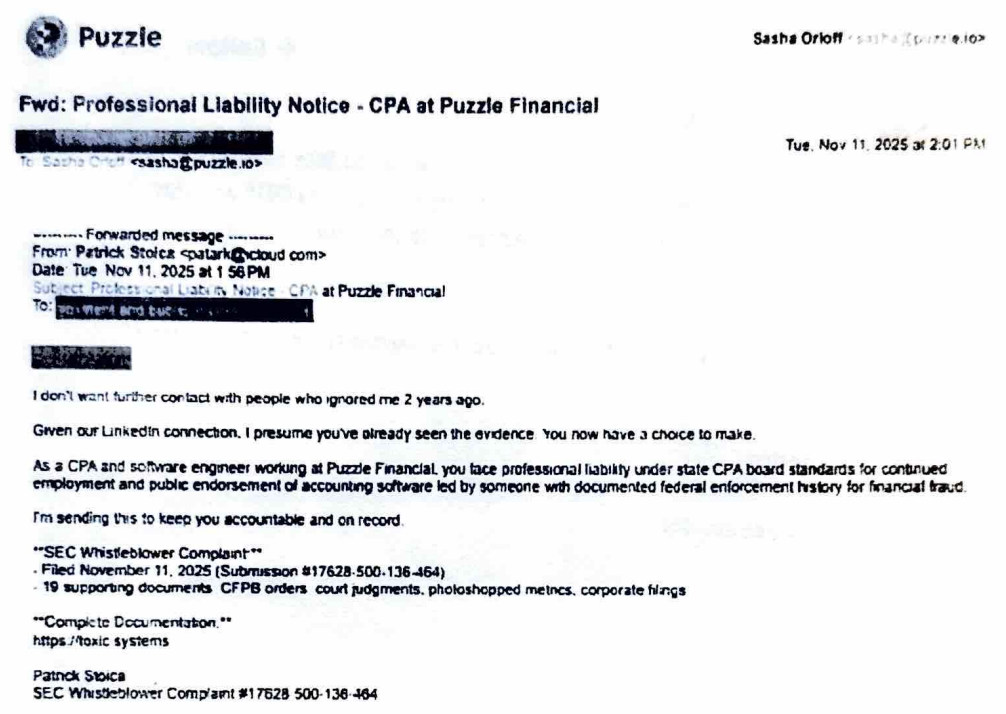

SEC Whistleblower Complaints

-

Primary Complaint (November 11, 2025, 3:33 AM ET)

Submission #17628-500-136-464

- Securities fraud, photoshopped metrics, false credentials

- CEO Netanyahu financial backer (March 2015), CFPB-banned (Dec 2021)

- Co-invested with Sam Altman’s Altman Family LLC in consumer credit (Pagaya, 2014-2024)

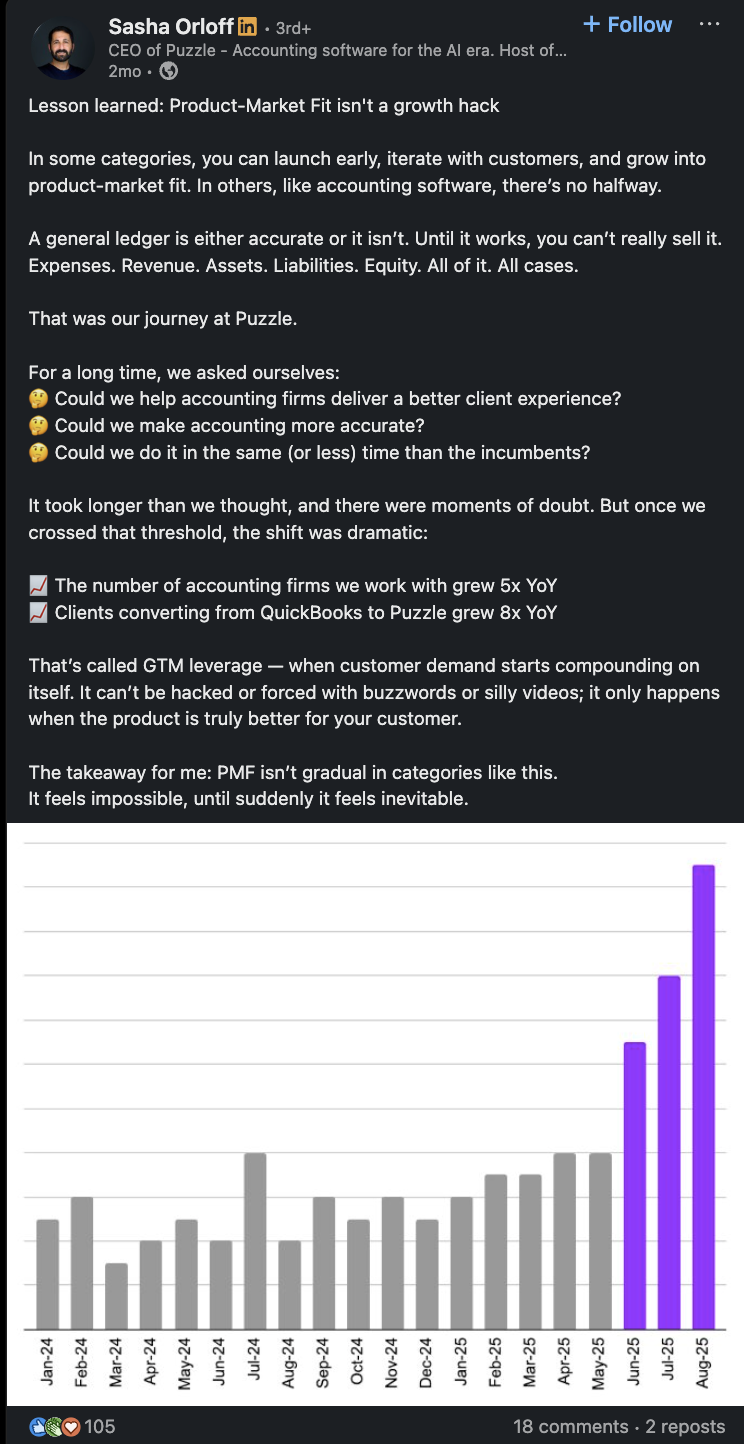

- Puzzle financials prove data operation: $312 revenue vs $10M+ burned (2020-2023)

-

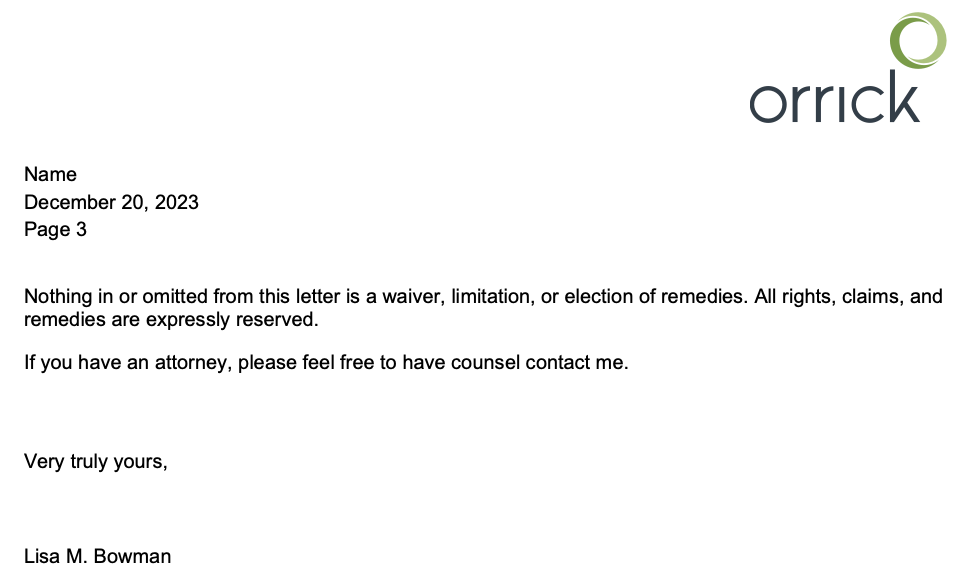

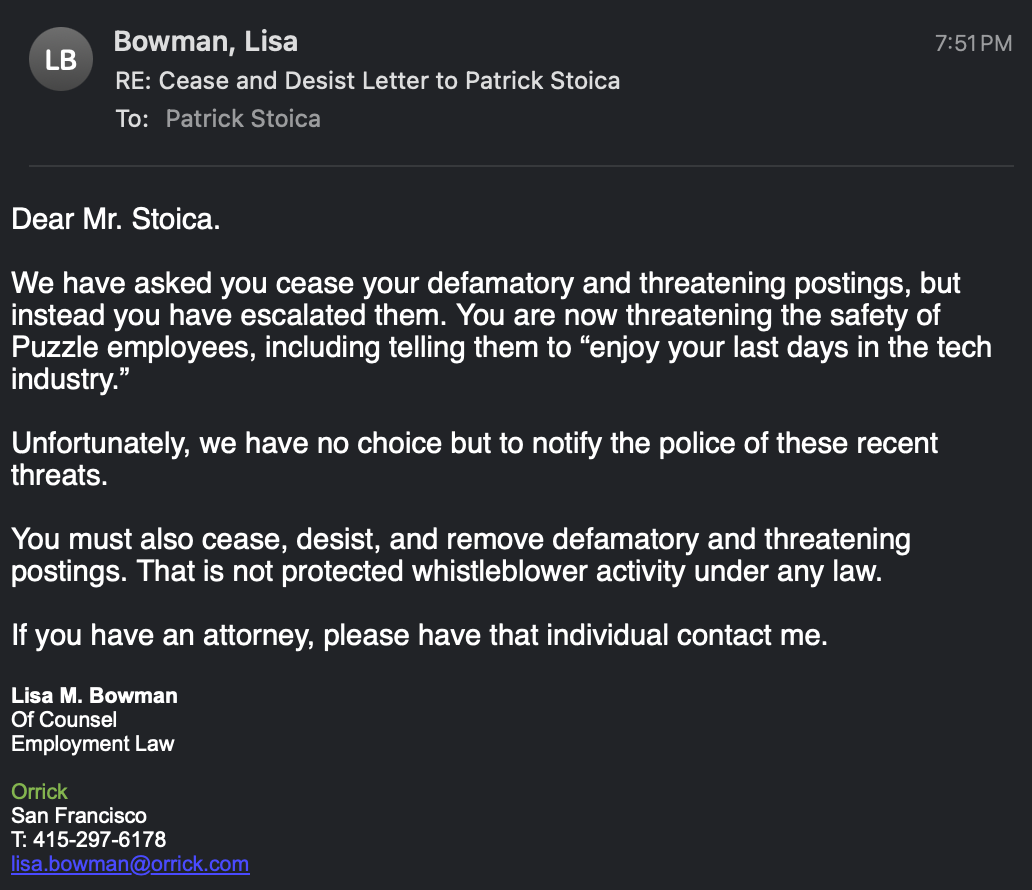

Second C&D Received (November 11, 2025, 6:02 PM ET)

- Orrick law firm same-day retaliation

- Criminal prosecution threats

- 48-hour takedown demand

-

Retaliation Complaint (November 11, 2025, 6:32 PM ET)

Submission #17629-039-523-592

- Filed 30 minutes after receiving C&D

- Documents federal retaliation and legal intimidation pattern

-

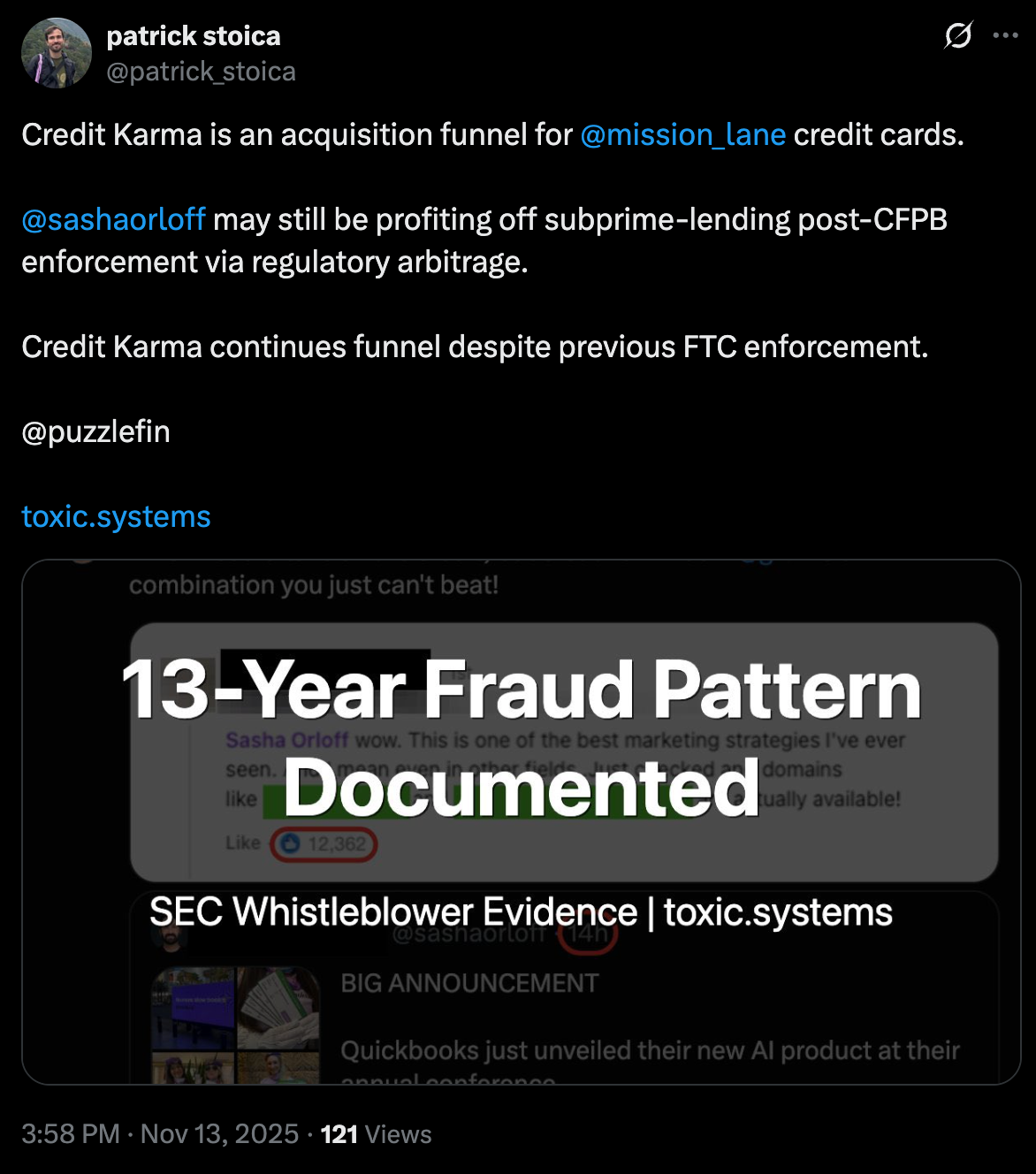

Supplemental Complaint (November 13, 2025)

Submission #17630-611-119-304

- Credit Karma → Mission Lane customer acquisition funnel

- Ongoing profit from CFPB-banned activity

- Mission Lane C&D defended profit structure

- Transforms case from historical fraud to ongoing criminal enterprise (2022-2025)

-

Fourth Supplemental Complaint (November 19, 2025, 2:42 AM ET)

Submission #17635-381-418-374

- Systematic extraction infrastructure thesis: Puzzle as ultimate aggregate (accounting software = all startup financial data); Brex data flows INTO Puzzle (Sept 2025 integration); both Puzzle and Brex have independent OpenAI partnerships (Brex-OpenAI March 2023 confirmed “millions of transactions”; Puzzle-OpenAI AI categorization features); General Catalyst portfolio coordination (Hemant Taneja orchestrating Puzzle/Deel/Gusto/Brex data aggregation)

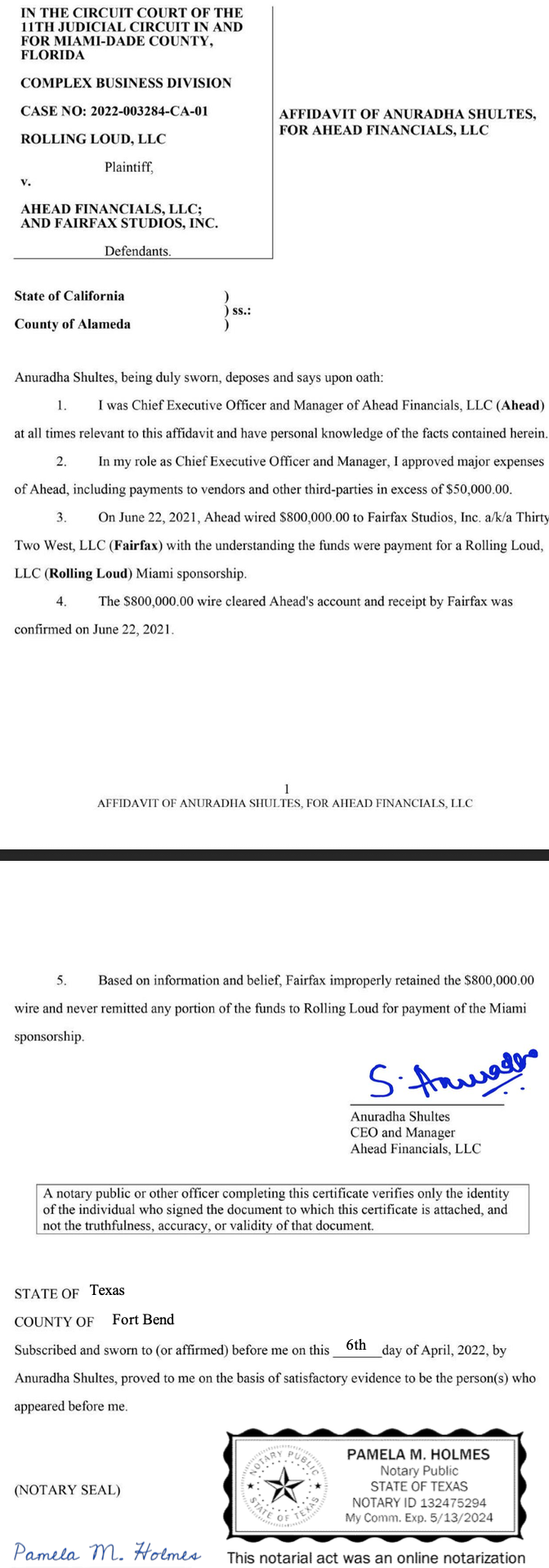

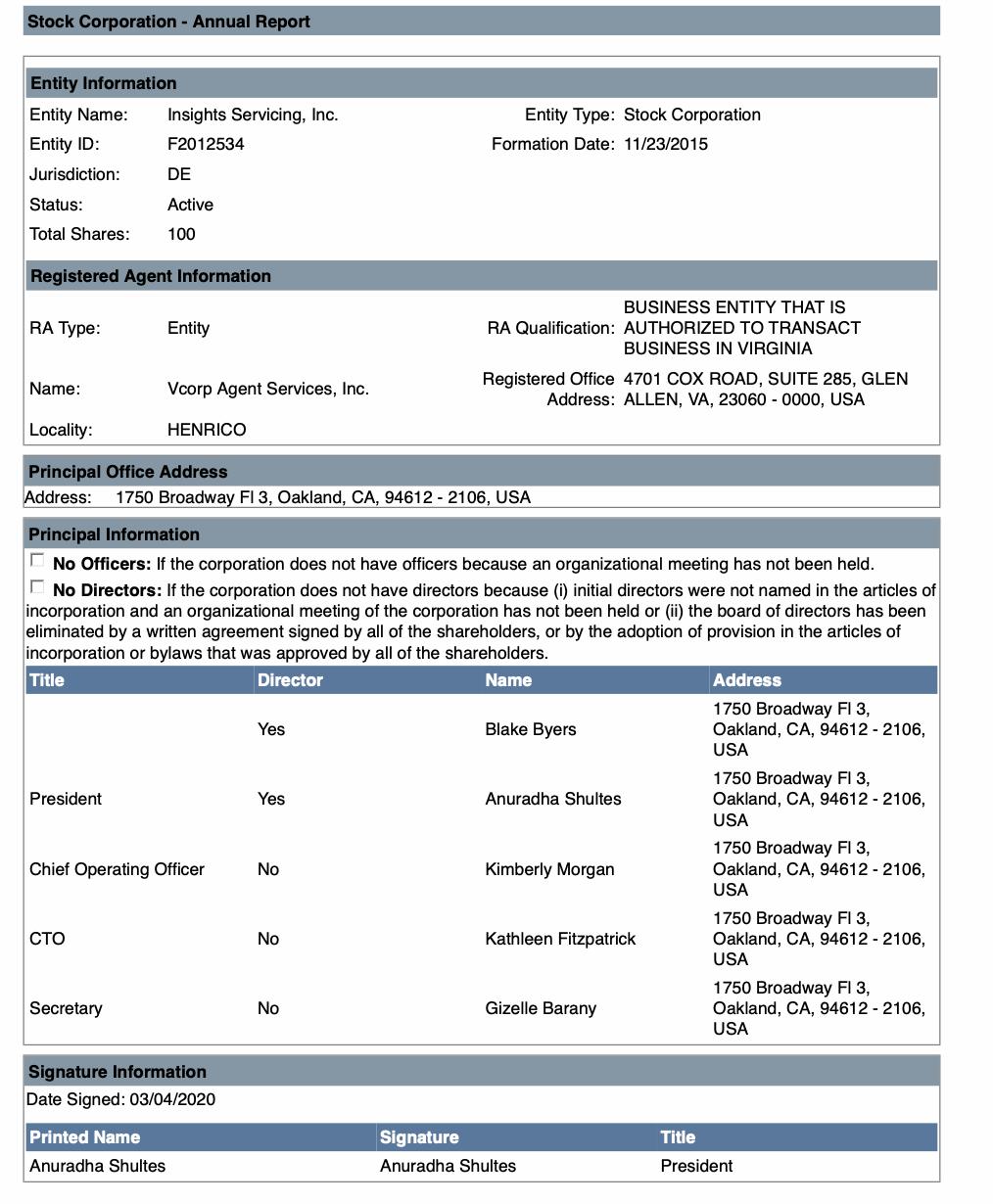

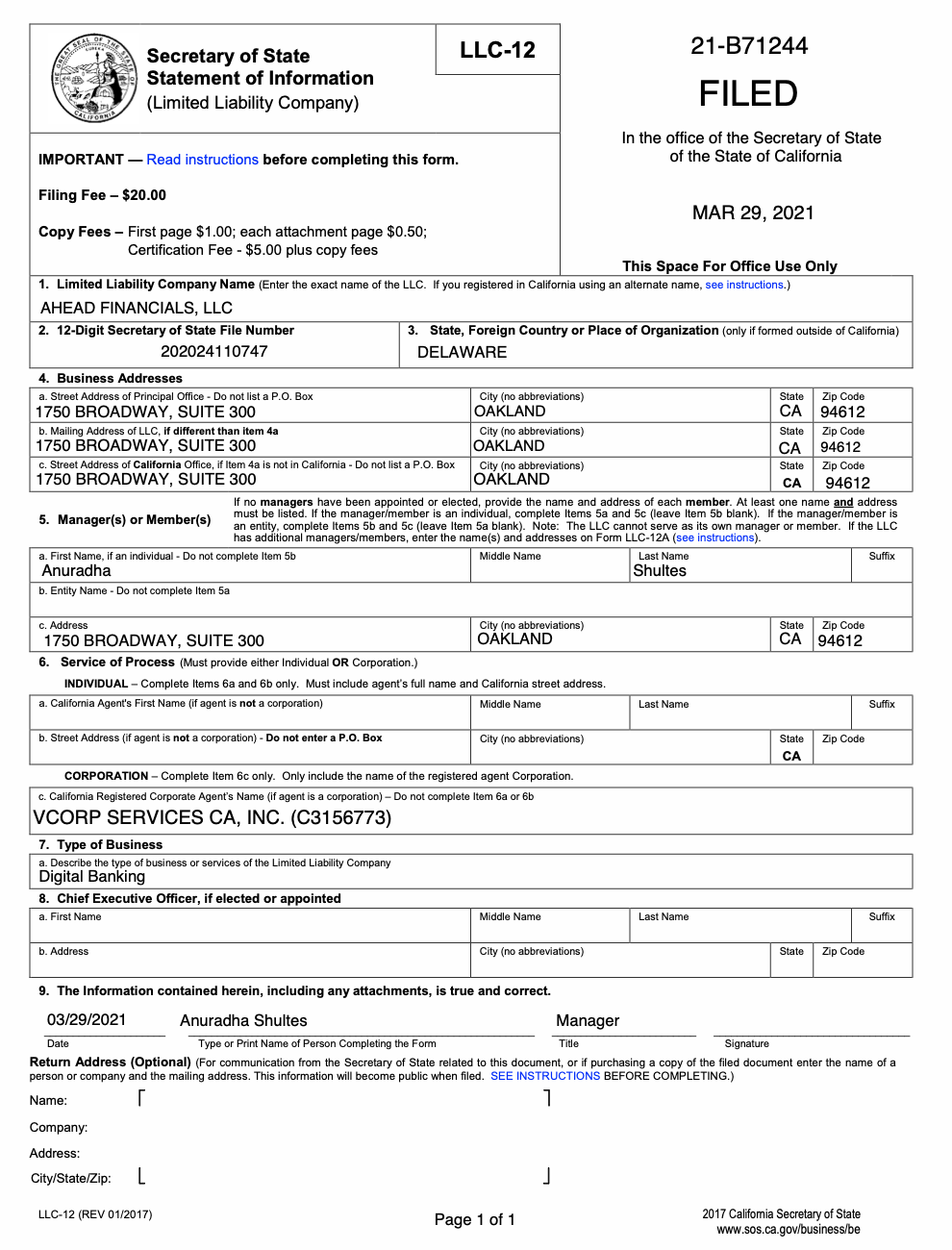

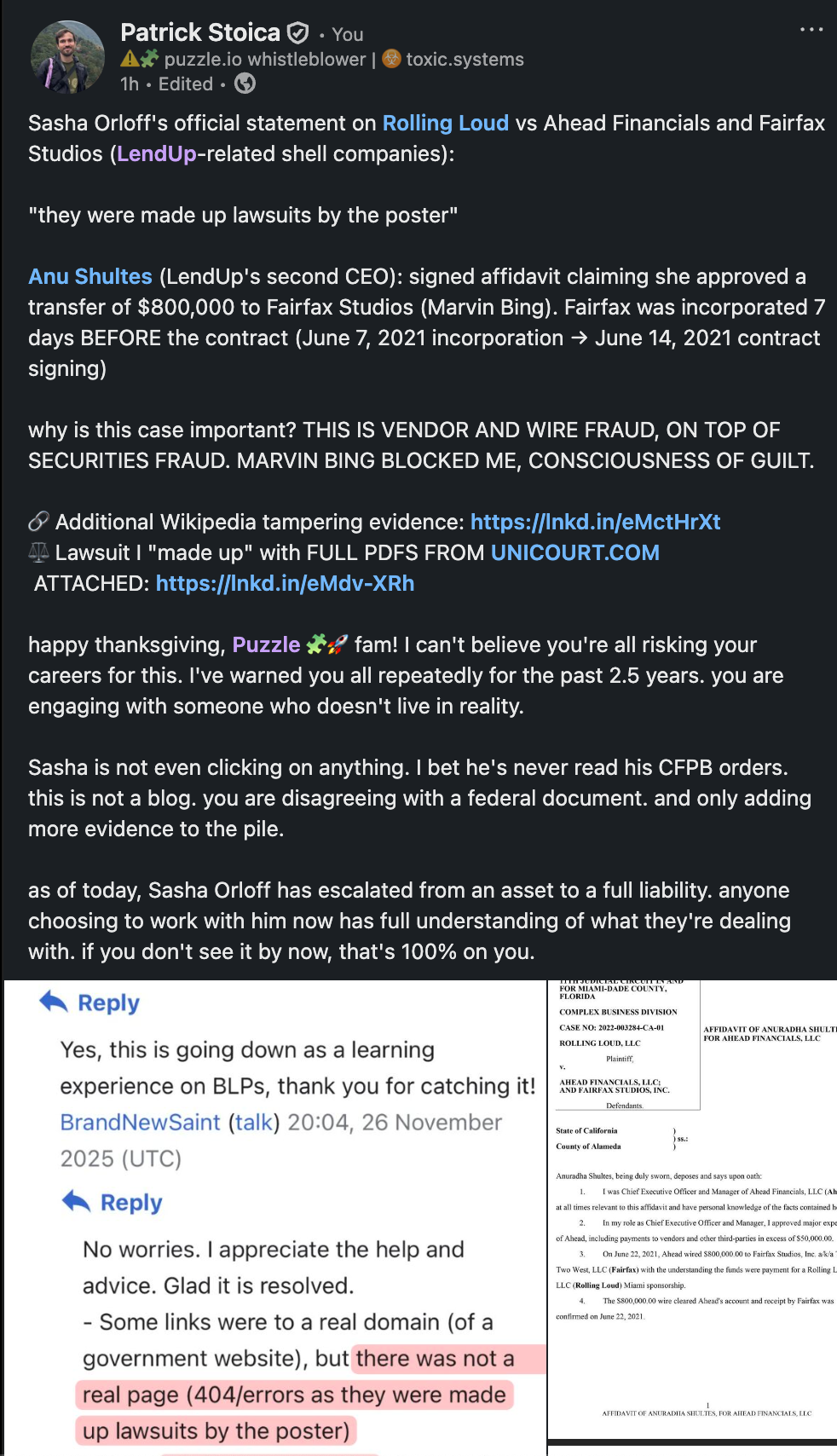

- Two banned LendUp CEOs following identical playbook: Sasha Orloff (CEO → Puzzle Financial), Anu Shultes (President/CEO → DashFi/Ahead Financials)

- Technical architecture evidence from engineering role (2020-2023)

- Coordinated investor response pattern (YC, a16z, QED, Altman Family LLC)

- AI training data provenance questions and competitive implications

- Transforms from isolated fraud to coordinated data extraction infrastructure with geopolitical implications

-

Updated Complaint (November 11, 2025): Submission #16917-772-564-515

- Original August 11, 2023 complaint updated with new evidence

-

Supporting Documents Attached:

- LendUp Asset Sale documents (December 2018) — Full Section 280G golden parachute breakdown (~$4.4M to 4 executives, $0 to shareholders), Sasha’s accelerated self-dealing structure, coercive clauses (General Release, No appraisal rights, Non-Disparagement, Non-Compete), full convertible note holder list (YC, QED, GV, Kapor all paid while shareholders got nothing)

- CFPB enforcement orders

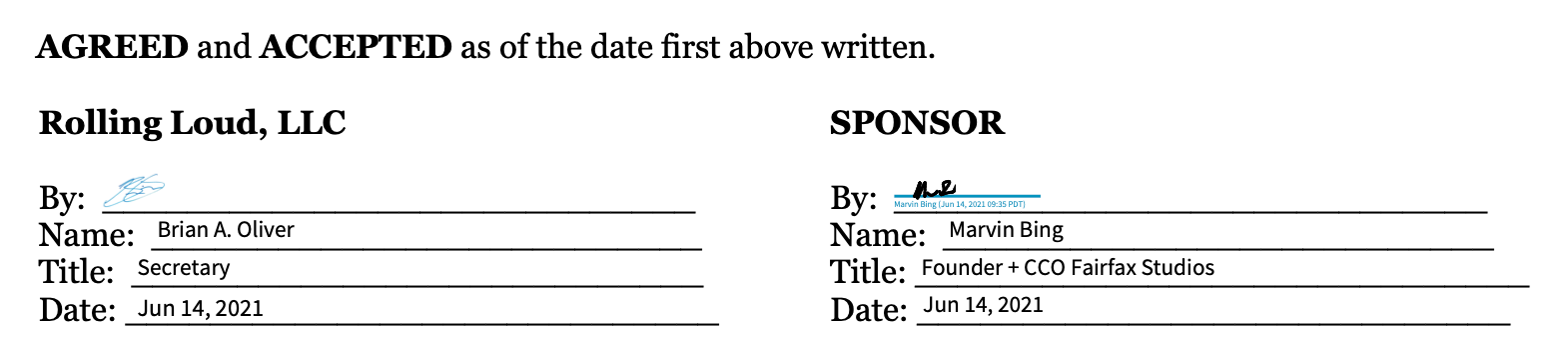

- Rolling Loud lawsuit

- Photoshopped metrics evidence

- Deleted equity documentation

- Separation agreement

- Mission Lane C&D letter

- Credit Karma promotion evidence

-

Permanent federal record established; applied for whistleblower award eligibility

Consumer Financial Protection Bureau (CFPB)

- Evidence provided for ongoing Mission Lane investigation: Documented Credit Karma → Mission Lane customer acquisition funnel (QED portfolio coordination); Mission Lane C&D defending profit structure from CFPB-banned CEO’s customer acquisition; ongoing profit from 2022-2025 demonstrates continued exploitation of LendUp customer base post-ban

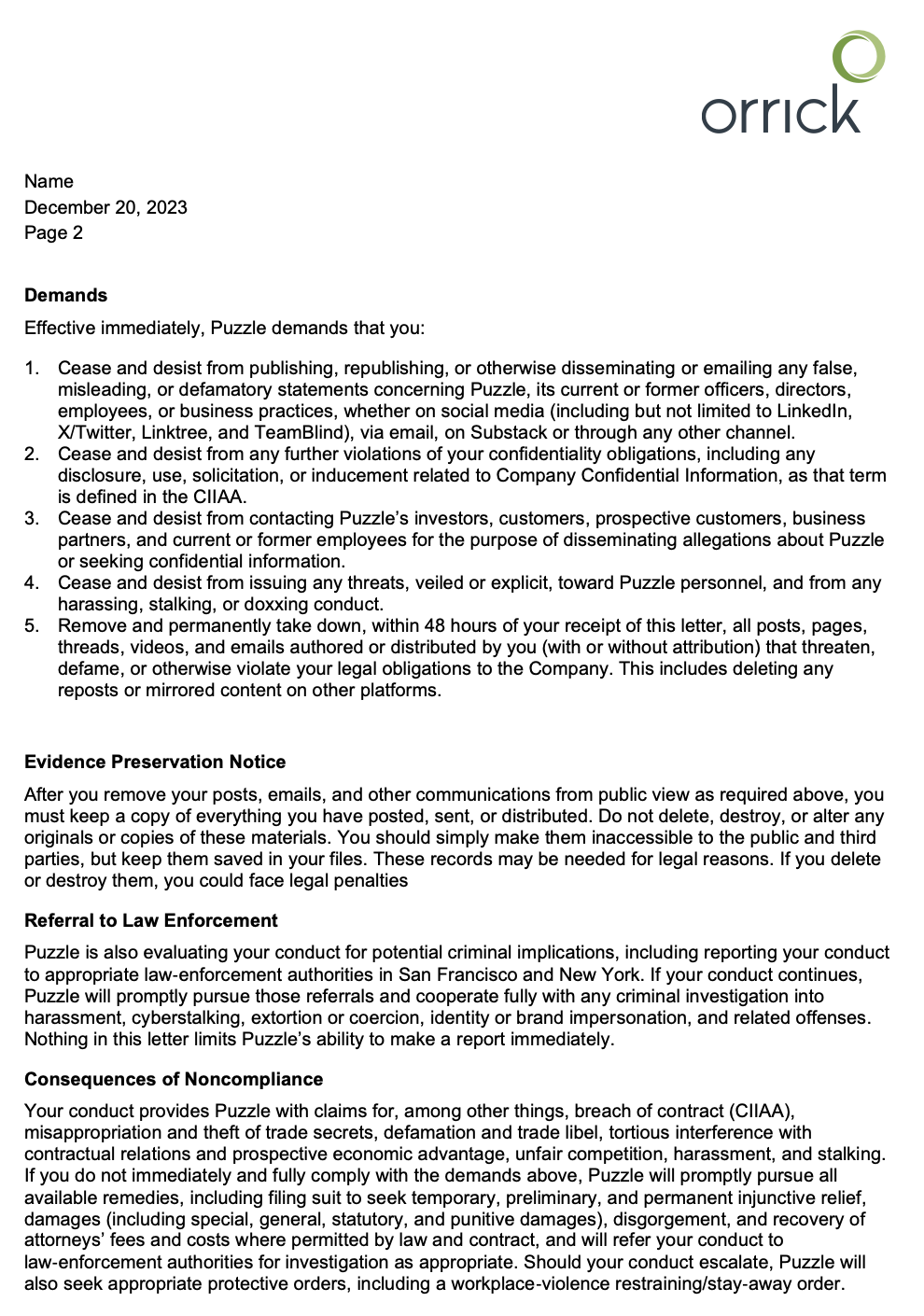

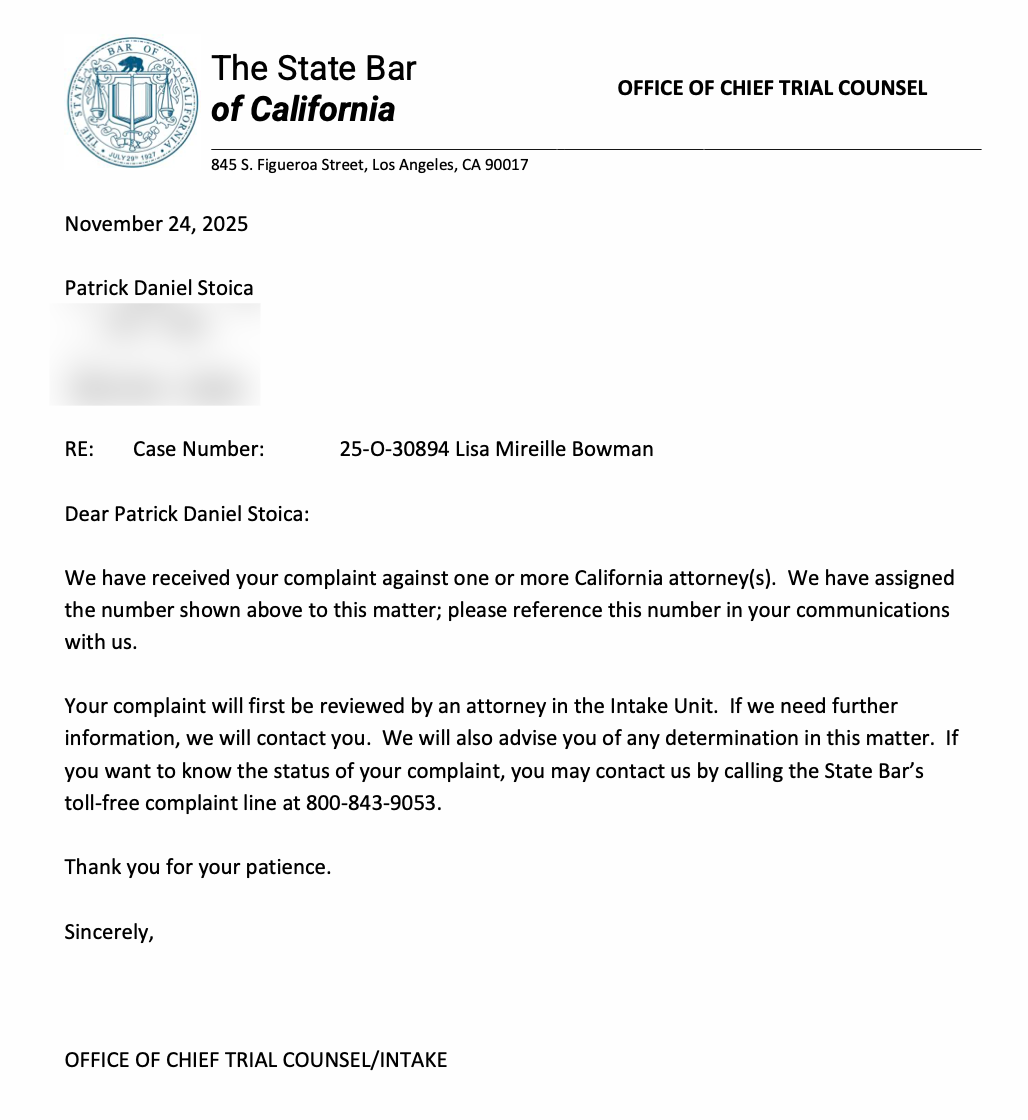

California State Bar

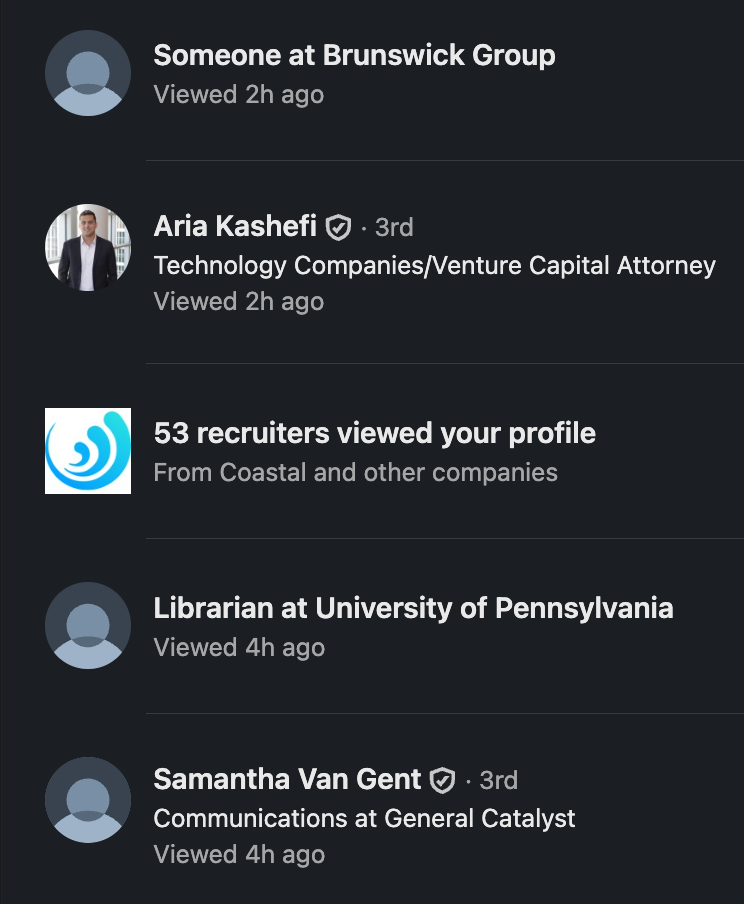

- Complaint filed (November 24, 2025): Professional misconduct against Lisa M. Bowman (CA Bar #253843), Of Counsel Employment Law at Orrick, Herrington & Sutcliffe LLP

- Case Number: 25-O-30894

- Status: Complaint acknowledged by California State Bar Office of Chief Trial Counsel; under review by Intake Unit

- Basis: California Rules of Professional Conduct Rule 3.10 (Threatening Criminal Prosecution) - attorney shall not threaten criminal charges to obtain advantage in civil dispute

- Pattern documented: 4 cease-and-desist letters over 27 months (3 sent, 1 prepared December 2023 never sent), all threatened police involvement for federally protected whistleblower speech

- Federal whistleblower retaliation: November 2025 C&Ds sent AFTER attorney learned of 2+ years SEC whistleblower protection (established August 11, 2023; revealed November 11, 2025)

- Timeline: August 11, 2023 first C&D (1 hr 41 min after SEC filing) → August 11-14 comprehensive fraud documentation provided (never mentioned SEC protection) → December 20, 2023 prepared C&D never sent → November 11, 2025 second C&D (same day SEC protection revealed publicly) → November 20, 2025 third C&D (9 days after learning protection)

- Zero refutation: Never addressed underlying documented fraud (CFPB ban, $51M+ settlements, 5 SEC complaints, photoshopped metrics, Skolkovo FBI warning)

- Permanent government record: State Bar investigation will examine client direction, attorney due diligence, knowing retaliation after learning federal protection

- Professional consequences: Private/public reproval, suspension, or disbarment possible; investigation on record even if dismissed

- Strengthens all complaints: Creates official record of systematic retaliation for SEC, CFPB, FBI, whistleblower attorneys

California Board of Accountancy

- Complaint filed (November 2025): Professional ethics violations for CPAs providing testimonials and partnerships after notification of CEO’s CFPB permanent ban

- Complaint Number: A-2026-1047

- Status: Board responded November 17, 2025 requesting additional documentation; supporting documentation submitted November 25, 2025

- Basis: California Business and Professions Code violations for CPAs endorsing accounting software led by CFPB-banned CEO (140,000+ victims, $40M restitution, December 2021)

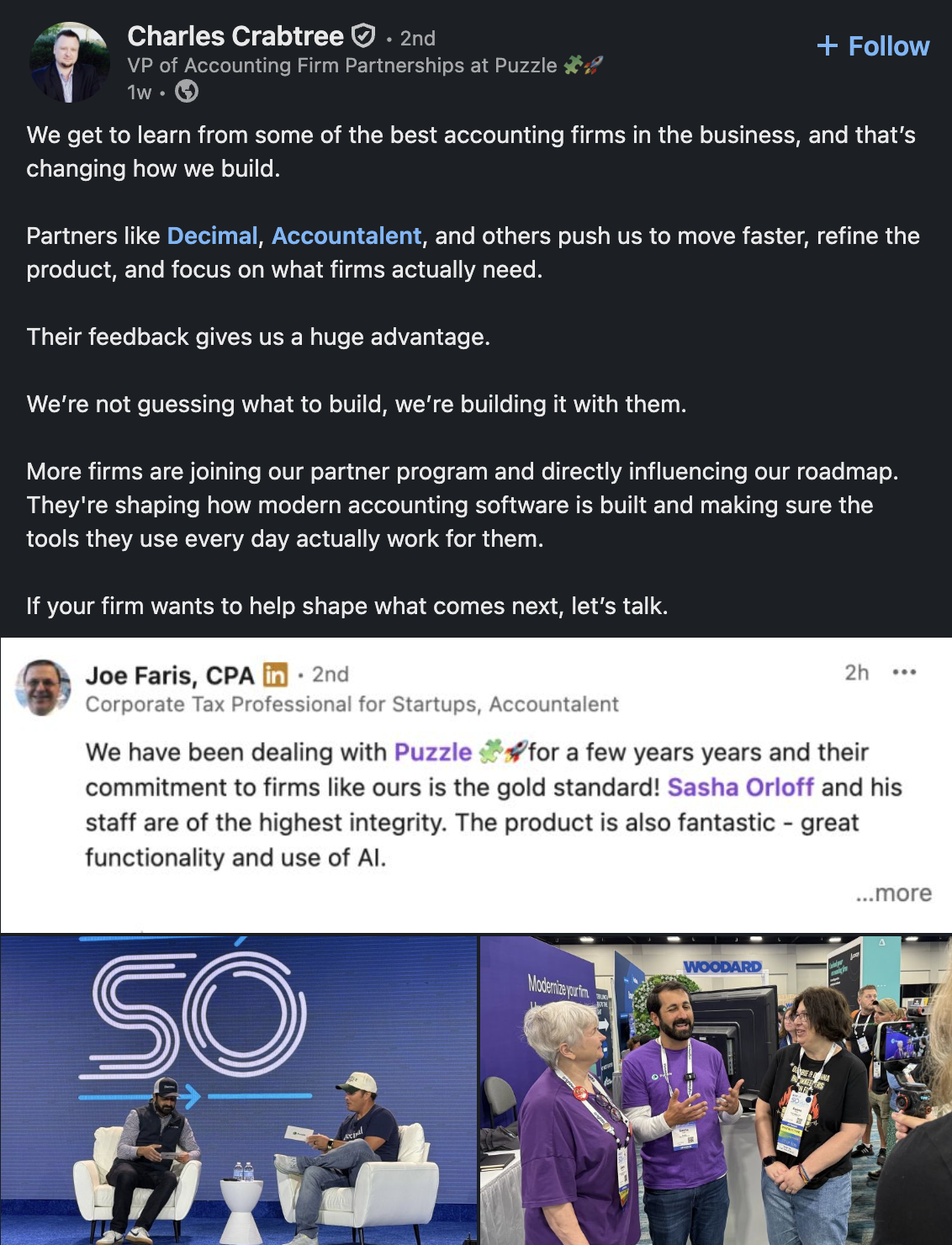

- Primary defendants: Joe Faris (Accountalent), Matt Tait (Decimal), Nick Abouzeid (Rivet.tax), Burkland Associates, Charles Crabtree (VP Accounting Firm Partnerships, Puzzle), and 15+ additional accounting firms continuing partnerships after November 10-11, 2025 notifications

- Pattern documented: Quid pro quo arrangements (podcast platform for testimonials), active suppression of fraud warnings (4-minute comment deletions), strategic deployment of CPA endorsements during fraud exposure, continued promotion at professional conferences (CPA.com Digital CPA Conference, December 7-10, 2025)

FBI Outreach

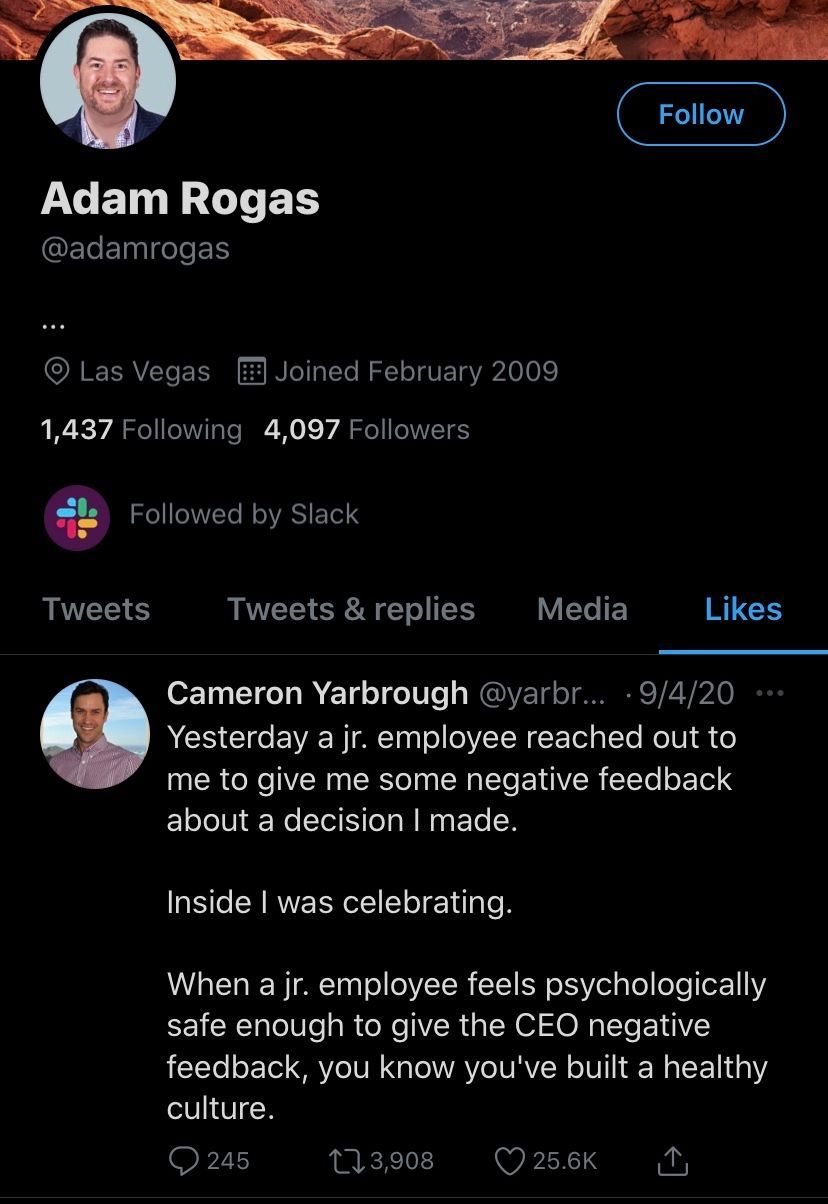

- August 4, 2023: Responded to prior NY FBI (from Adam Rogas) regarding early documentation of Sasha Orloff’s documented fraud pattern

- Foreign influence concerns: Dasha Shunina (Puzzle GTM strategist) Skolkovo employment (2016-2023); FBI warning about Skolkovo (2014) as Russian government technology access operation; Netanyahu financial backing of CEO (March 2015)

- Response:

- First contact: Randomly hung up when reaching final details

- Second contact: Agent asked “why are you researching these people?” then rudely hung up saying “we’ll call back if we need any more info”

- Status: Dismissed; no follow-up, no active investigation known

Whistleblower Legal Counsel

- November 2025: Contacted whistleblower attorneys (Phillips & Cohen)

- Status: Pending; preparing comprehensive materials for representation

- Focus: Retaliation protection, award eligibility, coordination with federal investigations

KEY EVIDENCE: 30-Minute Response (Legal Intimidation → Federal Evidence)

6:02 PM ET: Received C&D threatening criminal prosecution

6:32 PM ET: Filed retaliation complaint (Submission #17629-039-523-592)Traditional legal intimidation relies on delay, isolation, resource asymmetry, and documentation burden to silence whistleblowers. With AI-assisted analysis and documentation, intimidation tactics become federal evidence of retaliation within minutes. The C&D threatening criminal prosecution became evidence. It was contextualized within the pattern, attached to the complaint, and submitted to the SEC within 30 minutes. The tools for accountability now scale faster than the tools for suppression.

TLDR: The Pattern

This document establishes a permanent federal record of a 13-year fraud pattern spanning five companies, comprehensive notification to all enablers, and systematic institutional failure.

The Core Pattern

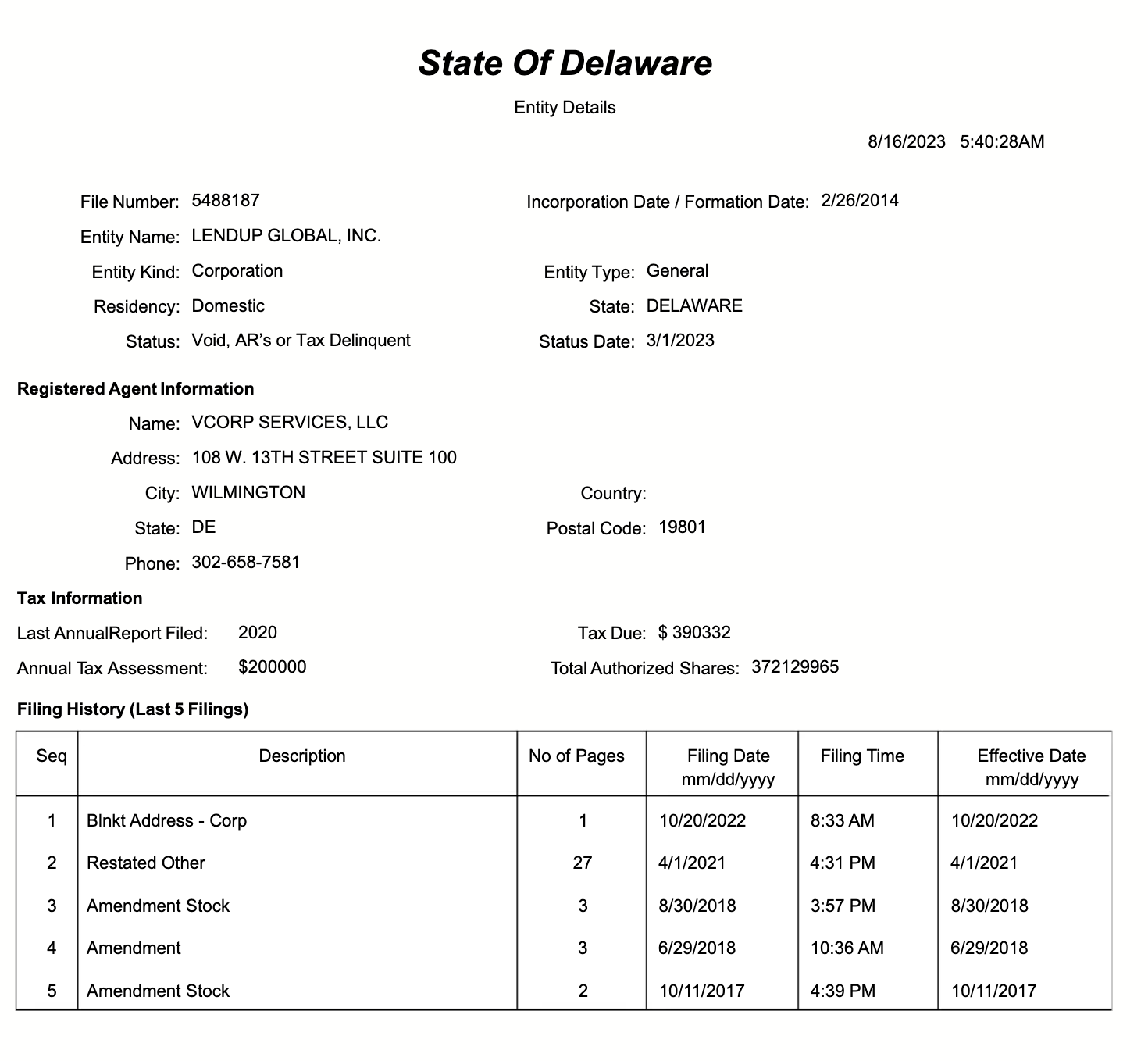

LendUp (2012-2022) — CFPB permanent shutdown for defrauding 140,000+ consumers. $40M restitution ordered. Raised $150M+ in venture capital before $29M fire sale. Shareholders received $0.

Credit Karma (2007-present; acquired by Intuit 2020) — FTC enforcement for deceptive “pre-approved” credit offers. $3M settlement; 497,425 consumers eligible for refunds. FTC complaint documents deliberate A/B testing to optimize false “certainty” claims; almost 1/3 of “pre-approved” applicants denied, damaging credit scores via hard inquiries. Currently promotes Mission Lane credit cards (4.7/5 rating, 33.99% APR) targeting same subprime demographic. Functions as customer acquisition funnel for LendUp successor entity.

Mission Lane (2018-present) — Created as acquisition vehicle for LendUp assets. CEO’s “founder” claims contradicted by corporate documents showing advisor role hired post-acquisition. Currently exhibits LendUp’s pattern: 33.99% APR cards targeting subprime demographic (average credit score 604, “Poor” to “Fair”) via Credit Karma funnel; two layoffs (2023) following Credit Karma FTC settlement (Sept 2022); Glassdoor reviews document toxic workplace, lack of transparency, favoritism, and “treated as expendable”; same QED investors profiting from LendUp → Mission Lane transition.

Puzzle Financial (2019-present) — Same CEO as LendUp. Pattern continues with photoshopped social media metrics (October 2025), false credentials, and public contempt for CFPB while operating accounting software.

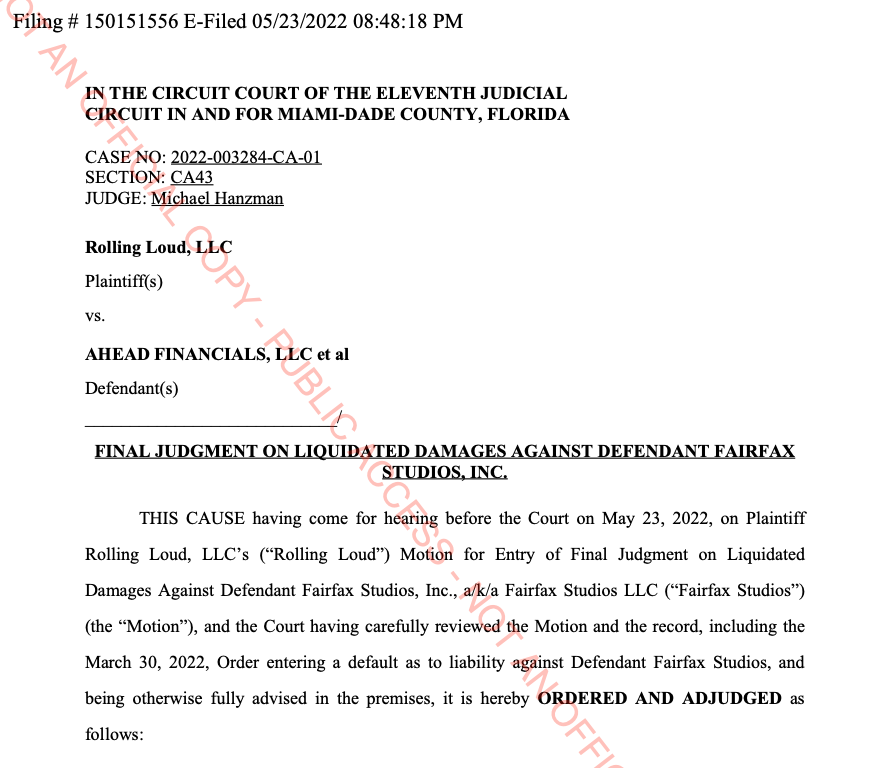

Ahead Financial (2020-2025) / DashAi (2022-present) — CEO: Anuradha Shultes (LendUp President/CEO 2015-2021). Ahead operated from LendUp address (1750 Broadway, Oakland). Rolling Loud $1.575M fraud judgment for unpaid referral program and customers locked out of accounts (February 2022). California branch entity remained registered until April 1, 2025 when it was “Forfeited Ftb” (Franchise Tax Board forfeiture for unpaid taxes) - entity continued 3 years after Rolling Loud judgment. DashFi Inc. (DBA DashAi) incorporated September 2022 (same CEO, AI-powered auto lending automation - “AiDO” AI Desking Officer, currently in Beta) and remains active. Forbes platformed CEO 16 months AFTER CFPB permanent ban. Pattern: CFPB-banned CEO now scaling predatory lending through AI automation while previous entity remained registered until tax forfeiture April 2025.

aheadmoney.com DNS timeline proves Sasha’s awareness/involvement:

Domain created September 2011, remained dormant with basic parking/nameservers through 2018. August 7, 2019: Wayback Machine archived “Coming soon” page - 7 months AFTER Sasha announced board and advisory role at LendUp (January 15, 2019) and 1 month BEFORE Puzzle incorporated (September 2019). Someone was preparing aheadmoney.com infrastructure during Sasha’s announced board tenure and simultaneous preparation of his next company.

July 22, 2020: Domain migrated to AWS nameservers (ns-1189.awsdns-20.org, ns-1983.awsdns-55.co.uk, ns-261.awsdns-32.com, ns-578.awsdns-08.net). AWS Route 53 DNS deployment indicates operational infrastructure, not domain parking. This is when Ahead Financial began operations from LendUp address.

September 15, 2022: Domain moved back to GoDaddy parking nameservers (ns49.domaincontrol.com, ns50.domaincontrol.com). Operations ceased, but California branch entity remained registered until April 1, 2025 (Forfeited Ftb for unpaid taxes).

What this proves:

- August 2019 preparation: “Coming soon” page appeared 7 months after Sasha announced board/advisory role (January 2019) and 1 month before Puzzle incorporated (September 2019) - someone was preparing Ahead infrastructure while Sasha was in announced board role and simultaneously preparing his next company

- July 2020 deployment: AWS infrastructure deployed matching Ahead Financial operational launch from LendUp address (1750 Broadway, Oakland)

- September 2022 operations ceased: Domain parked after Rolling Loud judgment, but California entity remained registered until April 1, 2025 tax forfeiture

- Timing correlation: DNS changes correlate with Ahead’s lifecycle; preparation began during Sasha’s announced board/advisory tenure (we don’t know exactly when his advisory role ended, but August 2019 prep happened 7 months after his announcement and 1 month before Puzzle incorporation)

- Board position visibility: Shell company operating from LendUp’s address while Sasha had announced board/advisory role; even if role ended between January-August 2019, the preparation timing (1 month before Puzzle launch) suggests awareness of entity being prepared from LendUp infrastructure

The “Sinking Ship” Pattern: Starting Next Operation While Previous One Collapses

A consistent pattern across all entities: executives start their next operation while the previous company is actively collapsing or facing enforcement actions. This creates plausible deniability (“I wasn’t there when it failed”) while systematically extracting value and evading accountability.

Timeline of Overlapping Operations:

- 2018: Mission Lane incorporated (December) while LendUp under CFPB consent order (May 2018, second violation)

- 2019 (January): Sasha announces “sabbatical” and “board and advisory role at LendUp” while actually preparing Mission Lane + Puzzle

- 2019 (August): aheadmoney.com “Coming soon” page archived 7 months after Sasha’s announced board/advisory role - Ahead Financial infrastructure preparation begins while Sasha on LendUp board

- 2019 (September): Puzzle incorporated during LendUp’s active CFPB violations (third violation in February 2020)

- 2020 (February): CFPB third violation ($500K penalty) while Puzzle already operating for 5 months

- 2020 (July 22): aheadmoney.com migrated to AWS nameservers - operational infrastructure deployment; Anuradha launches Ahead Financial from LendUp address (1750 Broadway, Oakland) while serving as LendUp President/CEO (Sasha’s advisory role end date unknown, but August 2019 aheadmoney.com prep occurred during his announced tenure)

- 2021 (December): LendUp shutdown; Sasha already running Puzzle for 2+ years

- 2022 (February): Rolling Loud $1.575M judgment against Ahead

- 2022 (September 15): aheadmoney.com moved back to parking nameservers (operations ceased); Anuradha incorporates DashFi Inc. (DBA DashAi) same month, same CEO now scaling predatory lending via AI

- 2025 (April 1): Ahead Financials LLC (California branch) dissolved via Franchise Tax Board forfeiture for unpaid taxes - entity remained registered 3 years after operations ceased

The Pattern Serves Multiple Purposes:

- Liability Escape: By the time enforcement actions conclude, executives have already moved to new entity with clean public record

- Investor Narrative Control: Can claim previous company “failed” due to external factors (regulation, market conditions) while already demonstrating “success” at next venture

- Customer Data Portability: Established relationships and data from failing company can be leveraged for next operation

- Network Continuity: Same investors (Kapor Capital: LendUp → Puzzle → Daylight) continue funding despite pattern

- Learning Curve: Each iteration refines tactics for avoiding detection while maintaining extraction

Why This Pattern Matters:

Traditional fraud prosecution assumes companies fail THEN executives start new ventures. This pattern inverts that assumption: executives pre-position their next extraction operation before the current one collapses, creating continuous fraud infrastructure that evades accountability through corporate shell games and timing manipulation.

The network (YC, General Catalyst, Kapor Capital, QED) enables this pattern by:

- Funding new entities despite previous failures (Puzzle after LendUp)

- Providing institutional credibility through continued platforming

- Suppressing documentation that would reveal the pattern

- Creating plausible deniability through “advisory” roles and delayed public launches

Pattern Comparison

The following table shows the repeating fraud pattern across entities.

| Entity | Founded | Status | Claims Made | Reality | Victims/Impact | Regulatory Action |

|---|---|---|---|---|---|---|

| LendUp | 2012 | Shut down 2022 | Credit building ladder | Charged higher rates despite promises | 140,000+ consumers | CFPB permanent ban, $40M restitution |

| Ahead Financial | 2020 | Collapsed 2022 | Financial inclusion | Locked accounts, unpaid vendors | Customers + Rolling Loud ($1.575M judgment) | Court judgment, customer lockouts |

| DashAi (DashFi Inc.) | 2022 | Operating (Beta) | AI automation for auto lending | Same CEO as LendUp/Ahead (CFPB-banned) | Auto dealerships, loan borrowers | Scaling predatory lending via AI (Beta) |

| Mission Lane | 2018 | Operating | Independent founding | Hired as advisor post-acquisition | Active consumer complaints, lawsuits | BBB complaints, ongoing litigation |

| Puzzle Financial | 2020 | Operating | Accounting software | $312 revenue vs $10M+ burned | Startups trusting financial data | Photoshopped metrics (Oct 2025) |

The Evidence

- 27+ months of transparent documentation and notification (August 2023 - November 2025)

- 4 SEC whistleblower complaints with supporting documents (CFPB orders, court judgments, photoshopped metrics, Asset Sale documents)

- Federal enforcement records: CFPB shutdown (LendUp), FTC settlement (Credit Karma), Rolling Loud lawsuit ($1.575M judgment)

- Corporate filings: Undisclosed related-party entities, “interested directors” with conflicts, shareholder documents proving false founder claims

- 🔑 Netanyahu financial backing: March 2015 article identifies CEO Sasha Orloff and Jacob Rosenberg as financial backers of Benjamin Netanyahu—documented one year before first CFPB violation (March 2015 vs. Sept 2016)

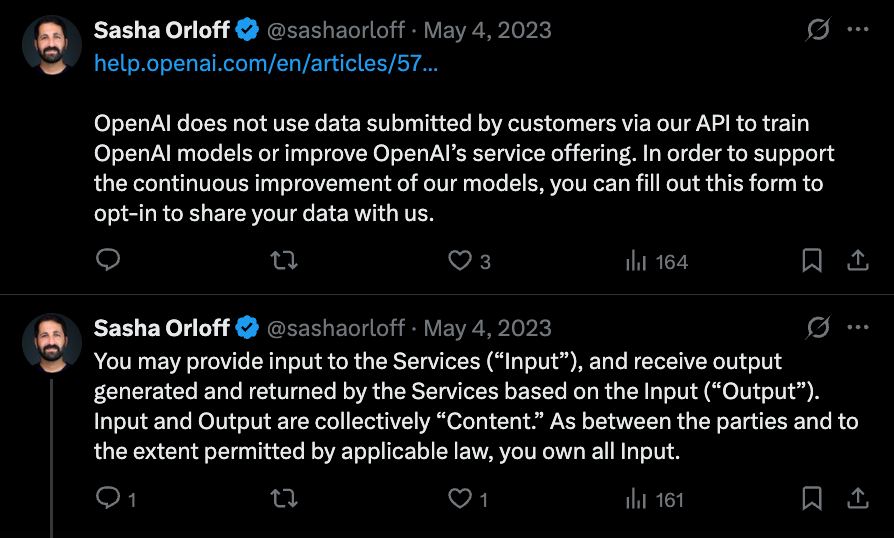

- 🔑 Co-investment with Sam Altman’s family: SEC Form F-3 Registration Statement documents Altman Family LLC, Y Combinator W2014 LLC, and Sasha Orloff as Theorem Technology stockholders (machine-learning underwriting technology that “powered billions of dollars of credit” processing consumer data at scale, 2014-2024); explains YC’s continued platforming as financial conflict, not “founder loyalty”

The Network Response

- Y Combinator: Notified August 2023; continued platforming

- On Deck: Notified January 2024; response: 22 months silence → “Top 2025 Company” designation 24 hours after SEC retaliation complaint → CEO public comment “I was just wearing my Puzzle shirt yesterday” (November 11, 2025)

- TechCrunch: Notified August 2023; 27+ months editorial silence despite initial reporter response

- Forbes: Direct conflict (contributor Dasha Shunina employed by Puzzle as GTM strategist while writing about CEO); structural conflict (lead investor #8 on Midas List 2025)

- Puzzle (LinkedIn): Warning comment posted on CPA conference announcement, deleted by Puzzle in 4 minutes

Timeline of Conscious Enablement

- August 11, 2023, 2:15:26 PM EDT: First SEC complaint filed (Submission #16917-772-564-515), establishing federal whistleblower protection under 15 U.S.C. § 78u-6

- August 11, 2023, 3:56 PM: Dual C&D letters received (Puzzle Financial + Mission Lane)—1 hour 41 minutes AFTER SEC filing (they didn’t know about SEC filing specifically, but should have been on notice: I used “fintech whistleblower” as LinkedIn tagline leading up to August 11, creating duty to investigate potential federal whistleblower protection before sending legal threats; archived evidence confirms this public designation existed before first C&D); Mission Lane threatened legal action despite never employing me, proving network coordination

- August 11-14, 2023: Email responses to Bowman with fraud documentation—NEVER mentioned SEC filing

- January 19, 2024: On Deck CEO notified with question “is this bullshit normal to you?”

- January 21, 2024: Domain registered (2 days after ODF notification)

- November 11, 2025, 3:33 AM ET: Comprehensive SEC complaint filed (Submission #17628-500-136-464)

- November 11, 2025, 6:02 PM ET: Second C&D threatening criminal prosecution (same-day retaliation)

- November 11, 2025, 6:32 PM ET: Retaliation complaint filed 30 minutes later (Submission #17629-039-523-592)

- November 12, 2025: ODF “Top 2025 Company” celebration; Julian Weisser publicly comments about wearing Puzzle shirt

What This Proves

The evidence demonstrates systematic enablement after notification, not isolated fraud. Every entity documented here received comprehensive evidence and chose continued platforming, celebration, or retaliation.

The documented pattern of conscious complicity spans:

- Venture capital (Y Combinator, General Catalyst, Google Ventures)

- Media (TechCrunch, Forbes)

- Founder networks (On Deck)

- Professional associations (CPA.com)

For critical evidence: See the 🔑 Key Evidence Index with 18 categorized pieces demonstrating consciousness, coordination, and systematic enablement.

The Central Thesis: Y Combinator as OpenAI’s Data Extraction Infrastructure

The pattern documented here extends beyond startup fraud. It reveals how the AI revolution’s competitive advantage—training data—is built on systematic extraction from vulnerable populations using Y Combinator as institutional infrastructure and progressive branding as operational camouflage.

The Financial Proof

SEC Form F-3 Registration Statement (Pagaya Technologies, November 21, 2024) documents co-investment in Theorem Technology—a machine-learning underwriting technology company that “powered billions of dollars of credit” processing consumer data at scale (2014-2024)—by:

- Altman Family LLC (Sam Altman’s personal investment vehicle)

- Y Combinator W2014 LLC (YC institutional fund)

- Sasha Orloff (CFPB-banned CEO)

YC’s 27+ months of platforming despite comprehensive fraud documentation, CFPB permanent ban, and federal whistleblower complaints stems from financial alignment, not “founder community loyalty.”

The Extraction Pattern Across Sectors

Financial Data (US Consumers & Startups):

- LendUp (YC W12): 140,000+ subprime consumer financial behavior → CFPB shutdown

- Puzzle (YC-affiliated): Startup financial operations → $312 revenue vs $10M+ burned = data infrastructure

Healthcare Data (African Patients):

- Helium Health (YC S17): Self-described “Largest healthcare data repository on Africans” (1M+ patient records) → Tencent investment (Chinese tech giant access)

Biometric Data (Global Populations):

- Worldcoin (Sam Altman co-founder): 26M+ iris scans from developing countries → a16z $135M investment (2025)

Data Colonialism: The Power Dynamic

The pattern documented here is data colonialism—the systematic appropriation of human life through data extraction, as defined by scholars Nick Couldry and Ulises Mejias. Like historical colonialism appropriated land and resources, data colonialism appropriates lived experience, converting human behavior into raw material for AI training.

The Colonial Structure:

Historical colonialism required three elements:

- Power asymmetry: Colonizers possessed military/economic advantages colonized populations could not resist

- Extraction infrastructure: Trading companies, plantations, mining operations converted local resources into metropolitan wealth

- Legitimating narratives: “Civilization,” “progress,” “development” masked exploitation as assistance

Data colonialism operates identically:

- Power asymmetry: Subprime consumers desperate for credit, undercapitalized African hospitals needing digitization, developing country residents offered “universal basic income”—populations that cannot afford to refuse

- Extraction infrastructure: Y Combinator provides institutional legitimacy, progressive branding, investor networks, and legal protection for operations converting human data into training datasets

- Legitimating narratives: “Financial inclusion” for predatory lending, “healthcare access” for patient data extraction, “proof of personhood” for biometric surveillance, “helping founders” for startup financial data collection

The Value Flow:

Like historical colonialism, value flows one direction: from vulnerable populations to powerful entities. LendUp consumers’ financial behavior patterns → OpenAI training data. African patients’ healthcare records → Tencent access. Developing country residents’ biometric data → a16z portfolio companies. Startup founders’ operational data → competitive intelligence for YC’s investment advantage.

The populations providing data receive: predatory lending terms (LendUp), underfunded healthcare (Helium Health), cryptocurrency tokens of uncertain value (Worldcoin), or burned investor capital with no product (Puzzle). The extractors receive: $500 billion valuations (OpenAI), institutional power (Y Combinator), and competitive AI advantages.

Why Progressive Branding Works:

Data colonialism requires consent that historical colonialism could obtain through force. Progressive language—“inclusion,” “access,” “empowerment”—inverts extraction into claimed assistance. This is why the documented pattern emphasizes DEI theater, LGBTQ+ ally badges, and “helping underserved populations” messaging while systematically exploiting those same populations.

The branding is not hypocrisy. It is operational necessity. Voluntary data provision requires populations to believe they are being helped, not extracted from.

The Geopolitical Dimension:

The Netanyahu-Altman call (June 5, 2023, five days after whistleblower termination for questioning OpenAI integration) documents how data extraction infrastructure serves state-level strategic interests. Israeli PM discussing AI cooperation with OpenAI CEO, while Israeli-founded companies (Pagaya acquiring Theorem) process US consumer credit data, reveals national intelligence implications of “startup” data collection.

This is not conspiracy theory. It is documented coordination between:

- State leaders (Netanyahu)

- AI infrastructure (OpenAI/Altman)

- Financial data processors (Pagaya/Theorem)

- Consumer credit operations (LendUp/Puzzle)

- Venture capital networks (YC/a16z)

The pattern shows data colonialism serving both corporate profit (AI training advantage) and geopolitical intelligence gathering (state-level data access).

The 2025 Recruitment

From YC’s official Summer 2025 Request for Startups: “YC points to a wave of new startups building AI agents that extract, structure, and re-enter data across messy systems like PDFs, faxes, or disconnected EHRs.”

After Helium Health proved the playbook (1M+ African patient records using “digitization” as cover), YC is now explicitly recruiting additional healthcare data extraction operations.

Market Implications

OpenAI’s $500 billion valuation (October 2025) rests on training data advantage. If that data is contaminated by CFPB violations, biometric consent issues, and healthcare privacy violations—the foundation collapses.

OpenAI’s competitive advantage is not superior algorithms. It is access to data that competitors cannot legally obtain.

Full documentation: The AI Bubble is Built on Legally Toxic Data →

Changelog

- Dec 26:

- Full WVRO scan now available - Complete workplace violence restraining order filing now documented including all forms, declaration pages, exhibits A-M, and title page showing “PUZZLE FINANCIAL, INC. v. PATRICK DANIEL STOICA”; full documentation reveals: (1) Corporate perjury in Paragraph 3: Sasha swears under oath on behalf of corporation that whistleblower “ultimately resigned” while company’s Separation Agreement (conspicuously omitted from exhibits) states “TERMINATION” throughout, (2) Pre-planned “mentally unstable” narrative: Paragraph 3 claims “acting erratically and posting about his drug use” - manufactured narrative dating back to August 2023 (Alice Ko warning), weaponizing mental health transparency from Sasha’s systematic abuse, (3) Systematic context-stripping: All exhibits (A-M) are surveillance screenshots from 2023-2025 with context removed to mischaracterize protected whistleblower activity as threats, (4) Mocking federal complaints: Lines 14-15 dismiss RICO notifications as “Rico-level” release characterization (putting in dismissive quotes), trivializing 18 U.S.C. § 1962 notices and 5 SEC complaints as “recent LinkedIn posts”, (5) Critical omissions proving consciousness of guilt: Excluded all employment termination documents (Separation Agreement, HR Pals letter, Termination Certificate), August 2023 compliance emails to Lisa Bowman disclaiming violence, July 2023 voicemail reinforcing “resigned” gaslighting; full scan establishes this is corporate retaliation disguised as workplace safety petition with provable false statements under oath made on behalf of PUZZLE FINANCIAL, INC. (creating Board liability, attorney liability, permanent corporate record of institutional misconduct)

- Dec 25:

- A16Z Infrastructure Analysis - Comprehensive analysis connecting Aaron Mars’s article (Nov 13, 2025, 2:40 PM) “The Metamorphosis of a16z: From Capital Allocators to Reality Architects” to documented experience; Mars describes a16z as “full-stack coordination engine for technological and political reality”; Erik Torenberg leads “New Media team” offering “timeline takeover as a service”; I sent Torenberg comprehensive fraud documentation Nov 11, 2024—he chose silence and blocking; analysis reveals: not incompetence—infrastructure working as designed; “legitimacy banking” model where deposits can’t be withdrawn with evidence; network membership > documented fraud; “hidden networks” = accountability bypass structure; explains why 27+ months notification failed to penetrate; Mars documented machinery, I documented what it feels like to be crushed by it; failed Quintenz nomination shows limits (public documentation creates friction); ODF/YC/General Catalyst weren’t protecting Sasha—they were protecting the model that makes Sashas possible; key insight: “The infrastructure that determines which questions get asked chose not to ask mine”

- Christmas cognitive biases post (9:26 AM) - Sasha posts about cognitive biases causing “misdiagnosis, unintentional IRS/tax fraud, legal” issues while actively misdiagnosing me in legal filing and potentially facing securities fraud/tax exposure himself; pure projection describing his own situation; why mention tax fraud specifically if not on his mind? Mission Lane SPV structure? Equity manipulation? Posts about systematic thinking errors while demonstrating them; consciousness of guilt processing his exposure publicly

- Christmas Day LendUp mythology posts (12:07 AM, 1:26 PM) - TWO separate posts about “Ladders not Chutes” LendUp mythology; “We turned debt trap (like payday) loans into an opportunity to build credit 💪”; cannot accept CFPB reality (140,000 victims, $51M settlements, permanent ban); still centering identity on fraudulent company; claims “founding and scaling 3 companies” (more lies); Christmas Day priorities: defending founder mythology, rewriting CFPB enforcement as success story, performing casual normalcy; 6+ days silence on restraining order while posting holiday content; midnight and afternoon posts = consumed by need to defend LendUp legacy

- General Catalyst “Familia” Christmas Eve narrative (5:13 PM Dec 24) - Peak spiritual bypassing: artisan gift box narrative about “humans trained at their craft made with love and dedication,” “gratitude,” “Familia,” “abundance we create together”; posted while ghosting restraining order victim for 5+ days; Sophia Xiao (Board Observer) continued casual engagement with Sasha during corporate perjury; “AI-driven world… physical becomes more special” while invested in AI fraud operation; “rooted in place, meant to be shared” while destroying lives; Christmas Eve gift boxes while I’m being ghosted after perjurious WVRO; this is what conscious enablement looks like with better branding

- Dec 22:

- Monday 4:30 PM ET - 4+ Days Complete Radio Silence After Institutional Escalation - No legible case number (requested Thursday), no response to corporate perjury documentation, no acknowledgment of six termination documents proving “resigned” false; institutional silence after Orrick employment department escalation (Friday Dec 20): entire employment department received emails documenting paragraph 3 perjury, “resigned” vs TERMINATION contradiction, six company documents, consciousness of guilt through omissions; Puzzle legal department also escalated same day; 2 business days of organizational silence (Fri → Mon, weekend doesn’t count); no competent legal team allows CEO to proceed after perjury documented to department level with provable contradictions in sworn declaration; silence isn’t individual attorney unavailability - it’s institutional recognition filing is indefensible; the escalation killed the case: once [email protected] and [email protected] received documentation, organizational liability exposure became clear; cannot allow client to commit perjury on stand defending paragraph 3; notable: Sasha and Puzzle both silent on social media today - complete posting silence after days of basketball TikToks (Sun 12:07 AM), Docusign GIFs (Sat 9:04 PM), philosophy posts (Sat 10:19 PM); social media silence + legal silence = consciousness of guilt; timeline: Thu Dec 19 perjury docs sent → Fri Dec 20 escalated to departments → Mon Dec 22 4:30 PM ET still no response = institutional paralysis

- Sasha posts basketball TikTok 12:07 AM - “This guy is incredible” with basketball highlight reel at 12:07 AM Sunday night/Monday morning; 4 days after filing restraining order claiming “imminent threat”; pattern of tone-deaf posting continues (Dec 18 “Amazing!!”, Dec 19 family/earthquakes, Dec 21 Docusign/Yin & Yang, Dec 22 basketball); demonstrates no genuine fear while refusing to provide legible case number or respond to corporate perjury documentation; weaponized legal process documented: file restraining order, immediately return to casual social media; 80 views = deliberate signaling of normalcy while ignoring corporate perjury documentation in inbox

- Dec 21:

- Renato Villanueva (Parallel) endorses Sasha 11:16 PM - 57 minutes after Sasha’s Yin & Yang post, Renato publicly replies: “The absolute worst days are always followed by the best”; conscious endorsement three days after Thursday email documenting corporate perjury (Renato’s last email: Dec 19, included six termination documents, perjury analysis, illegible case number); did not receive Friday-Sunday escalation but knew about perjury in legal filing; chose to publicly support during documented legal crisis; Parallel liability confirmed; 7 views = deliberate signal of support; partnership between fraud operations documented

- Sasha’s 10:19 PM Yin & Yang post (Evidence-194) - 30 minutes after receiving video of Patrick breaking down: “when something negative is happening, it means something amazing is coming soon”; doubles down “founding 3 companies”; zero empathy, complete narcissistic inversion (Patrick’s pain = Sasha’s “negative” before “amazing” comes); textbook malignant narcissism documented in real-time; final email sent: “This is what ‘malignant narcissist’ means. I expect to hear from you tomorrow”

- Video reply-all sent 9:49 PM - 1-minute unscripted video sent to full recipient list (Sasha, Lisa Bowman, Orrick, Puzzle Legal, HR Pals); humanizes “Unabomber” figure Sasha spent 2.5 years depicting; sitting at home holding restraining order document, visibly breaking down; “Why wouldn’t you even try to talk to me or verify if I’m mentally ill? Just stonewalling, just gaslighting. Why’d you do this to me?”; destroys “imminent threat” narrative; message: “This document represents nothing but emotional sadism”; transparent about AI assistance, methodical documentation approach; genuine exhaustion after 2.5 years; 45 minutes after Sasha’s 9:04 PM Docusign GIF

- Sasha posts Docusign GIF 9:04 PM (Evidence-193) - “Big announcements coming soon” celebration at 6pm PT Sunday night; 72+ hours after restraining order filing, still no case number provided; final follow-up email: “It’s the end of the weekend. I’ve asked for a legible case number since Thursday. You’re posting normalcy and GIFs. No response.”; performance of normalcy as consciousness of guilt

- Email to General Catalyst - Accountability email to Hemant Taneja, Sophia Xiao, [email protected]; “Why is your Board Observer casually engaging while he commits perjury on behalf of your entire co-created company?”; GC liability exposure

- Sophia Xiao engagement documented - General Catalyst Board Observer continues Twitter engagement with Sasha about earthquakes Dec 20; hours after perjury documentation sent; “co-created” company exposure; institutional endorsement despite documented fraud

- Sunday email: May 31, 2023 termination timeline - Comprehensive documentation of termination day: credit card cancellation as termination signal; posts deleted in seconds; Sasha gaslights employees “Patrick resigned”; Radha Shenoy reinforces false narrative; Sasha posts as “Mental Health Expert” same day; added HIRING badge night before terminating; 2.5-year pattern of narrative control established from day one

- Dec 16:

- Daily email #8 sent 1:57 PM ET - “Sasha Publishes LinkedIn Article on AI Hallucinations Hours After Partnership Post”; sent hours after Sasha’s Twitter post (12:53 PM, 30 views) and Puzzle’s redeployment of “Commitment to Accounting Firms” (comments off); comprehensive ironic commentary on every theme Sasha writes about (confidently wrong information, prompt bias, illusion of certainty, human verification, expert validation, teaching bias, auditable/traceable systems) while being CFPB-banned CEO photoshopping metrics, editing Wikipedia, intensifying resume fraud, blocking verification

- Sasha’s LinkedIn article - “What Happens When AI Gets It Wrong? The Hidden Risks of Hallucinations and Prompt Bias in Professional Services” published Dec 16; closing line: “auditable, traceable, and controllable” from CEO who deleted equity without documentation, suppresses fraud docs, photoshops metrics, edits Wikipedia, blocks whistleblowers; “the risks are too high” - consciousness of guilt; article is defensive narrative inoculation: attempting to pre-dismiss 19K+ documentation as “AI hallucinations,” simulating credibility through over-citation in minutes (Stanford HAI, Chapman U, Harvey stats, YC companies) that took 2.5 years to build, positioning as accuracy-focused while lacking oversight, framing compulsive posting as “deep research,” appropriating whistleblower’s framing and inverting it; reactive defense hours after 10-view partnership post, not thought leadership

- 7-year karmic cycle analysis - December 2018 Asset Sale (2 days before winter break, $0 to shareholders, ~$4.4M golden parachutes, dual advisory roles, coercive structure; mostly quiet on Twitter, understood narrative control; Jan 15 2019 LinkedIn announcement honest: “board and advisory role at LendUp” and “advisor at Mission Lane”) → 2020 onwards (suddenly lying, glass half-full toxic positivity, never admitting, re-engineering language, blocking repeatedly, victimizing self) → December 2025 (5 SEC complaints, State Bar/Board complaints, 19K+ lines docs, Wikipedia decompensation, compulsive posting, partnership announcements to empty rooms, LinkedIn article on hallucinations, 49-minute panic blocks, complete mental decompensation); 7-year cycle completes, what was done in shadows now fully illuminated

- Corrections from last email - Photoshopped post was LinkedIn not Forbes; AI usage admission (expanding notes, doing best to proofread, minor errors/hallucinations possible, more tokens = higher conflation, none invalidate mountain of evidence); photoshop sequence: kept Sasha blocked, unblocked to comment, Sasha blocked immediately, didn’t delete until entire ActualQuickbooks campaign removed; spending money on this (Sasha likely knows); treated like “literal dirt” for 2.5 years, now just LinkedIn avatars and untaggable names, becoming numb, meaningless fake interactions

- To Puzzle employees - This isn’t normal startup hardship; Sasha let it go on 3 months first time (May-Aug 2023), over a month this time (Nov 2025 restart); why keep supporting (“love,” “celebrate”) when Puzzle can’t refute, keeps posting with comments disabled; “Sasha, why did you send C&D in 2023 literally accusing me of accusing you of ‘fraud and conspiracy’? I barely used ‘conspiracy’ then, had no idea it was massive RICO, you gave it away in subtext”; 2023 responses “almost cute and innocent,” didn’t know would get to this point, “all worse than imagined”; emotional cruelty = pure sadism, narrative control, dictatorship, totalitarianism, hasbara

- Neither could AI make this up - “Illusion of certainty” is one Sasha maintaining for himself; evidence real, federal complaints real, CFPB ban real, photoshopped metrics real, Wikipedia edit war real; karmic reckoning real

- Brex email distribution changes - After blocking [email protected], [email protected] (Dec 15 “Message rejected”), [email protected] (suspected); Brex executives now receive separately in small batches, eventually needing email relays; if automatic (doubtful given C-suite/co-founder coordination), will find out; more likely: institutional suppression at highest levels

- Simone Tega permanently added - Puzzle Software Engineer; ignored direct warnings, continues engaging with Puzzle posts

- 8+ blocks on Parallel post - “That’s not business as usual”

- 364 LinkedIn views - Post from 18 hours ago detailing Sasha’s 49-minute block when presented with own 2019 announcement

- Puzzle redeploys “Commitment to Accounting Firms” - No new content, no substance, just distraction; comments immediately turned off; “Why are you posting?”

- Followup email sent - Brief reminder: “Sasha Orloff is very obviously an actively manipulative, unhinged security and legal hazard. Act like it. Nobody cares about his pre-holiday break drivel.”

- Dec 19:

- Documentation correction regarding restraining order exhibits - Clarified throughout document that Sasha’s restraining order exhibits (labeled A through M) are ALL surveillance screenshots spanning 2023-2025 (tweets, LinkedIn posts, emails he saved while monitoring); NOT the Separation Agreement or Termination Certificate; those documents were conspicuously OMITTED from his exhibits because they prove perjury; previous references to “Exhibit A” and “Exhibit C” were corrected to clarify these are internal references within the HR Pals exit paperwork (Separation Agreement references “Exhibit C - Termination Certificate” as attachment to that document), not Sasha’s restraining order exhibits; ironic self-own: Sasha’s actual restraining order Exhibit F (Evidence-180 - team photo) includes my LinkedIn caption stating “Patrick Stoica (me: wrongfully terminated; suffering 2.5+ years of abuse)” - he submitted evidence to the court saying “wrongfully terminated” while swearing under oath in paragraph 3 that I “resigned”; his own surveillance screenshot contradicts his sworn declaration

- Case number request email sent (12:29 PM ET) to Sasha Orloff ([email protected]), Lisa Bowman ([email protected]), and HR Pals ([email protected]) - Subject: “Case Number Request - Corporate Perjury in Paragraph 3”; requested illegible case number for Monday legal consultation; documented provable corporate perjury in paragraph 3 of Declaration (swears “resigned” while Separation Agreement states “TERMINATION” throughout, includes severance, wrongful discharge waivers); presented company’s own documents proving perjury: 1) Separation Agreement (conspicuously omitted as exhibit despite being referenced), 2) HR Pals Letter of Termination (May 31, 2023 - uses “terminated” twice, completely omitted from filing), 3) Termination Certificate (omitted), 4) NY State Record of Employment (omitted), 5) Insurance Termination Notice (omitted), 6) HR Pals May 31 correspondence (only source of “resignation” language, contradicted by legal docs); 2.5-year gaslighting pattern documented: July 26, 2023 voicemail (reinforced “even though you resigned,” offered transition costs), August 11-14, 2023 compliance emails to Lisa Bowman (already noting Sasha “insisting i resigned”), August 2023-December 2025 surveillance and evidence curation, December 16, 2025 filing with perjury under oath; direct questions to Lisa Bowman: reminded her of August 2023 compliance emails where I apologized profusely, stated “no intention of escalating into violence,” was exhausted/apologetic/seeking to comply, and already called out Sasha’s “resigned” gaslighting - questioned what Sasha told her during preparation, whether she received termination documents or only curated narrative; HR Pals accountability: their termination letter conspicuously omitted, will be presented as evidence of perjury, implicates HR Pals in potential exposure as professional documentation suppressed to manufacture false narrative; consciousness of guilt through omissions: included surveillance screenshots from 2023-2025, omitted all termination documents, July 26 voicemail, August 2023 compliance emails; judge’s recognition: “FACTS ALLEGED DO NOT SUPPORT ALL THE ORDERS REQUESTED” even without seeing full evidence; Sasha’s post-filing behavior: Dec 18 tweets “Amazing!!,” launches podcast, posts 2026 predictions, monitors/deletes LinkedIn perjury comments, Dec 19 retweets podcast (noted “not stalking, just trying to understand this bizarre headspace for my own safety”); federal supplement notice: will present to legal counsel Monday, supplement 5 SEC complaints, State Bar complaint #25-O-30894, Board of Accountancy complaint #A-2026-1047, CFPB (potential contempt of consent decree); closing: “If this was a simple error, withdraw the petition. If this was deliberate perjury, you’ve created permanent legal exposure for PUZZLE FINANCIAL, INC., its Board, Orrick, and HR Pals”; EOB Friday deadline; attached August 2023 compliance email chain, six termination documents, full restraining order analysis link

- Lisa Bowman out-of-office auto-reply received (2:12 PM ET) - “Hi there! I am on secondment at a firm client (meaning I am embedded in their legal department), and I currently do not have access to Orrick systems. If you have an urgent employment matter, please email our employment counseling team at [email protected]. Thanks!”; suspicious timing: Lisa Bowman filed perjurious restraining order on behalf of PUZZLE FINANCIAL, INC. on December 16, 2025 with provable false statements in paragraph 3 (swears “resigned” while company’s own Separation Agreement states “TERMINATION”); now unavailable/inaccessible when called out for enabling perjury December 19, 2025; secondment context: “embedded in their legal department” = working at firm client’s offices without access to Orrick systems; raises questions: 1) When did secondment begin? (before or after filing restraining order?), 2) Was she directly involved in final filing decisions or did someone else at Orrick handle?, 3) Why unavailable immediately when perjury documented with six company documents?, 4) Does “no access to Orrick systems” mean genuinely unreachable or strategic unavailability?; timing implications: filed restraining order Monday December 16 → partly denied Wednesday December 18 → perjury called out Friday December 19 → auto-reply reveals unavailability; either coincidental timing (unlikely) or strategic positioning to avoid accountability for catastrophic legal malpractice

- Reply-all escalation to Orrick Employment Department and Puzzle Legal (2:32 PM ET) - Added [email protected] (Orrick’s employment counseling team per Lisa’s auto-reply) and [email protected] (Puzzle’s in-house legal department); full email: “Adding [email protected] because Lisa has auto-reply on, apparently having no access to Orrick systems. [email protected] too, why not. Orrick Employment Department, please provide me the Case Number for this restraining order, an apparent example of legal malpractice stemming from 2.5 years of Sasha Orloff’s narrative control and misrepresentation across all professional relationships. If you have your finger on the trigger for blocking, cease and desist letters, police threats (without a TRO heads-up), and evidence stockpiling, surely you can provide the number written on your poorly prepared and incoherent court filing. Patrick”; escalation significance: 1) Wider Orrick organizational awareness - No longer individual attorney (Lisa Bowman), now Orrick’s employment counseling team/department level, 2) Puzzle’s in-house legal directly notified - [email protected] means Puzzle’s general counsel/legal department sees everything (corporate perjury, Lisa’s unavailability, malpractice accusation), 3) “Legal malpractice” accusation on record - Direct characterization to Orrick employment department, not just individual attorney, 4) “Poorly prepared and incoherent court filing” - Professional criticism of work product quality, 5) Pattern references - “Blocking, cease and desist letters, police threats (without a TRO heads-up), and evidence stockpiling” establishes 2.5-year retaliation timeline (August 2023 first C&D, August 14 2023 Mission Lane police threat, November 2023 second C&D, December 2025 restraining order), 6) Case escalated beyond individual attorney to organizational liability - Orrick employment department now aware of malpractice claim related to restraining order with corporate perjury, 7) Puzzle’s legal team aware of in-house crisis - Their CEO’s company committed perjury under oath via Orrick attorney who’s now unavailable, 8) Creates institutional pressure - Both Orrick (employment department) and Puzzle (legal department) now have organizational awareness and potential liability exposure

- Comment deletion consciousness of guilt - Late evening December 19, 2025 (hours after judge partly denied restraining order on December 18), Sasha deleted LinkedIn comments calling out his corporate perjury; deleted both an old comment and recent December 18/19 comment calling out perjury; LinkedIn post context: Charles Crabtree promotion - “Accounting firms… have you met Charles Crabtree? He has spend over a decade devoted to accounting firm success. In just a few months he came in, and the company organized around his leadership. Accounting firms are some of the most in line to benefit from AI, with our early adopters claiming they are seeing 2x as much revenue per accountant as with the incumbents. I am calling it. 2026 is the year accountants make more money than ever before. More clients. Happier clients. More time back. It’s going to be a great year”; consciousness of guilt through deletion pattern: if restraining order legitimate and my accusations false, why delete comments pointing out perjury? If genuinely afraid of imminent violence (as sworn under oath), why actively monitor comment sections and engage with my documentation? Why post promotional content about “2026” business optimism hours after judge found “facts alleged do not support all orders requested”?; what deletion proves: awareness perjury callouts are accurate (otherwise would leave up as “evidence” of my “baseless harassment”), actively monitoring my responses (contradicts “imminent threat” narrative - someone genuinely afraid doesn’t engage), continuing narrative control (can’t refute substance, so deletes accountability), performing normalcy (business promotions) while simultaneously suppressing documentation

- Pattern analysis: Sasha swears under oath I’m dangerous → hours after judge’s skepticism, tweets “Amazing!!” at Julian’s programs → launches podcast about VC funding → posts about 2026 accounting predictions → monitors and deletes my perjury callouts → continues business-as-usual; this is not behavior of someone genuinely afraid; this is consciousness of guilt: knows restraining order based on perjury, knows I’m documenting it, can’t refute (because it’s true), so deletes evidence of being called out; LinkedIn comment moderation as narrative control: Sasha’s using restraining order as legal weapon while actively engaging with/monitoring my speech, deleting specific accountability callouts, maintaining “thought leader” persona; if I’m “imminent threat,” why engage? If claims false, why delete?

- Establishes ongoing consciousness of retaliation purpose - Restraining order filed December 16 (after 5 SEC complaints, not after alleged threats), partly denied December 18 with judicial skepticism, Sasha immediately returns to normal posting/comment moderation December 18-19; timeline proves: not genuine fear response (would maintain low profile if actually afraid), strategic reputation management (suppress documentation, maintain business image), retaliation against federal whistleblower (filed after SEC complaints, operates normally after filing), abuse of legal process for narrative control (uses court order to claim victimhood while actively monitoring/suppressing accountability)

- YouTube comment removal - cross-platform suppression pattern - Turpentine Finance YouTube channel removed comment “sasha orloff committed perjury” from Sasha’s OWN PODCAST SHOW (posted night of December 18/19); critical context: Sasha HOSTS his own ongoing podcast series on Turpentine network (not guest appearances - he is the HOST with hosting contract, production support, distribution infrastructure); Turpentine/Erik Torenberg conscious enablement: Erik Torenberg (Turpentine founder) received explicit fraud documentation November 2025 (CFPB ban, $51M+ enforcement, Asset Sale, SEC complaints, Wikipedia meltdown), yet continued hosting Sasha’s show with 3-4 episodes released post-warning (December 8-10, 2025 documented); establishes systematic cross-platform suppression: LinkedIn comments deleted December 18-19 (detailed criminal enterprise documentation, HR Pals investigation references, corporate perjury callouts) + YouTube factual statement removed December 19 from Sasha’s own podcast show; pattern demonstrates: 1) Active monitoring across multiple platforms (LinkedIn, YouTube, likely others), 2) Systematic suppression of any perjury mentions regardless of platform, 3) Coordinated narrative control (Sasha’s team AND Turpentine moderating comments), 4) Consciousness of guilt (if perjury claims false, why suppress across all platforms?), 5) Not genuine fear (someone afraid of “imminent violence” doesn’t monitor YouTube comment sections on their own podcast show episodes and request removal of “committed perjury” comments); simple factual statement was removed - “sasha orloff committed perjury” is documentably true (paragraph 3 swears “resigned” while Separation Agreement states “TERMINATION”); not harassment, not threats, just statement of documented fact on Sasha’s own podcast show; if I’m wrong, why not leave it up as evidence of my “baseless harassment”? Suppression across platforms proves accuracy and consciousness of perjury; Turpentine liability escalation: Erik Torenberg/Turpentine continues hosting Sasha’s show (formal business relationship) AND participates in comment moderation to suppress perjury callouts = ongoing conscious enablement + active suppression of accountability + RICO exposure (18 U.S.C. § 1962 - each episode post-warning = predicate act in criminal enterprise pattern); demonstrates reach of narrative control extends beyond Sasha’s direct platforms to network ecosystem actively protecting CFPB-banned CEO through hosting contract and comment moderation

- QED network awareness signal (~10:48 AM ET - Evidence-186) - Brandon Arvanaghi (Meow CEO, QED-backed company, Forbes 30 Under 30, received 27+ months of daily emails documenting fraud) posts on LinkedIn: “I’ve worked at startups where my equity went to 0. More than once. I’m furious about it. In those scenarios — the founders still win. They get connections, accolades, and when there’s an acquihire, the ‘(1x exit)’ in their bio. The team gets nothing. I won’t let that happen to the team at Meow. They know that. We win big or I die trying.”; timing significance: posted same day as perjury documentation, hours BEFORE perjury email sent (12:29 PM ET) specifically highlighting Sasha’s equity deletion in termination agreement; same day as restraining order perjury analysis circulating publicly documenting Sasha deleted all equity while swearing under oath I “resigned”; network context: Brandon is part of QED investor network (Nigel Morris, Frank Rotman), received explicit daily emails for 27+ months, called out in Forbes analysis for platform complicity, formally notified of RICO liability; public response: I commented “Funny, I experienced just this at Puzzle Financial”; Kyle Avery (recruiter) responded “Damn, what a CEO should look like. Good job Brandon Arvanaghi”; demonstrates: QED network figure publicly signals ethical stance on founder equity theft on same day as Sasha’s equity deletion perjury documentation circulating, implicit distancing from Sasha’s behavior (deleted equity + corporate perjury), consciousness of network awareness (Brandon knows about Sasha’s specific misconduct, posts about founder equity theft on same day perjury goes public), validates whistleblower’s documentation through network silence/contrast (no one defends Sasha, QED figures signal ethics); “we win big or I die trying” echoes language Sasha weaponized from my “nothing left to lose” posts; Brandon using similar determination language in POSITIVE ethical context (protecting team) vs. Sasha’s mischaracterization of my language as violence threat; establishes QED network is watching, aware of specific details (equity theft), and choosing how to position themselves relative to Sasha’s documented corporate perjury

- Dec 18:

- PUZZLE FINANCIAL, INC. files workplace violence restraining order (WV-109) - CORPORATE RETALIATION + CORPORATE PERJURY: Declaration cover reads “DECLARATION OF SASHA ORLOFF IN SUPPORT OF PUZZLE FINANCIAL, INC.‘S PETITION FOR WORKPLACE VIOLENCE RESTRAINING ORDER” with “PUZZLE FINANCIAL, INC. Petitioner v. PATRICK DANIEL STOICA Respondent”; CORPORATION using workplace violence statute to suppress FORMER EMPLOYEE’S federal whistleblower documentation; CATASTROPHIC LEGAL ERROR: By filing as PUZZLE FINANCIAL, INC. instead of Sasha personally, Sasha’s provable perjury becomes CORPORATE PERJURY - the company itself committed false statements to court under penalty of perjury; creates Board liability, attorney/Orrick liability, permanent corporate record of institutional misconduct, securities implications; filed Dec 16, 2025; decided Dec 18, 2025 by Judge Michelle Tong, Superior Court of California, County of San Francisco; PARTLY GRANTED and PARTLY DENIED; judge explicitly stated: “FACTS ALLEGED DO NOT SUPPORT ALL THE ORDERS REQUESTED”; Petitioner: PUZZLE FINANCIAL, INC. (not Sasha personally); Protected Persons: Sasha Orloff, Jennifer Orloff, “all current Puzzle employees” (transforms conscious enablers explicitly warned about RICO liability into “victims”); Attorney: Lisa M. Bowman (State Bar #253843), Orrick, Herrington & Sutcliffe LLP; Respondent: Patrick Daniel Stoica; Court hearing: January 8, 2026, 8:30 AM, Department 505, Room 505

- CORPORATE PERJURY IN PARAGRAPH 3 - Sasha swears under penalty of perjury on behalf of PUZZLE FINANCIAL, INC. that whistleblower “resigned” while ADMITTING whistleblower “declined Puzzle’s standard separation agreement”; “STANDARD” is itself damning - by calling predatory terms “standard,” Sasha admits this is how they routinely operate (not special case), normalizes equity theft/fraud waivers/whistleblower suppression as default practice, minimizes contents to sound innocuous when agreement actually included severance ($7,115.38) requiring wrongful discharge waivers + equity forfeiture + non-disparagement (proving this was TERMINATION not resignation—resignations don’t need releases); company’s termination documents (conspicuously OMITTED from exhibits) use “TERMINATION” throughout: HR Pals Letter of Termination (“your employment is terminated” - uses word twice), offered Separation Agreement draft referencing “termination of employment relationship”; Termination Certificate; NY State Record of Employment; Sasha’s admission I “declined” the agreement proves: (1) it was termination not resignation (resignations don’t need releases), (2) I never signed away equity or claims, (3) company took equity anyway when I tried to exercise post-C&D (theft without signed agreement), (4) calling predatory terms “standard” admits systematic exploitation by design; only “resignation” mention: HR Pals email contradicted by their own legal documents; this is not individual error - this is PUZZLE FINANCIAL, INC. admitting terminated employee declined to sign release, then making provably false “resigned” claim to court while stealing equity under “standard” predatory practices